Hey there! My name is Nate and I write for WOLF Financial. If you enjoy learning about trading, I guarantee you’ll also enjoy my newsletter A Trader’s Education, and more of my content on 𝕏 @tradernatehere. Thanks for reading!

This service is for general informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice. These are my opinions and observations only. I am not a financial advisor.

If you are an options trader, Average True Range (ATR) is an indicator you want to pay attention to.

I use it any time I consider entering a trade, but I pay even closer attention when I am trading options.

You can save yourself a lot of wasted time and money by understanding this simple and underutilized piece of information before you start trading.

Traditional methods of measuring volatility only use the closing prices of the underlying stock, which can overlook opening gaps or intra-day price swings.

Perhaps this is why the Average True Range indicator was derived.

What is certain is this indicator captures the price swings that are needed to understand how much a stock has been moving, on average.

This is critical information!

Without getting too much into the math, it is important to understand that ATR is a moving average that reflects the average price range, typically over the prior 14 periods.

I usually use ATR on a daily chart, so the average would be based on the prior 14 days of trading.

Using ATR in Trading

So, how can we use ATR in our trading strategies?

Let’s start with an example. If a stock has an ATR of $1, it means that's the average daily range for that stock.

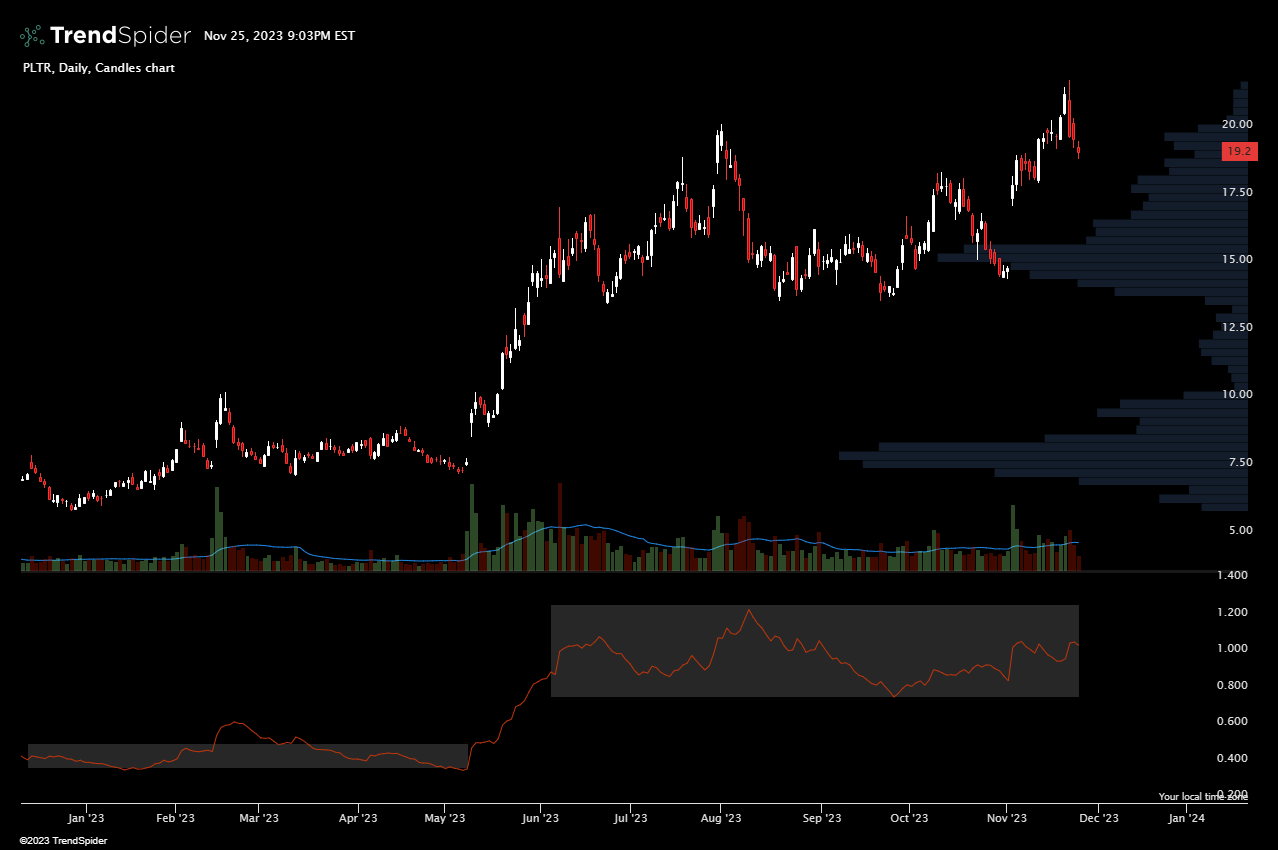

PLTR fits this description perfectly. A $19 stock with a $1 ATR.

That equates to an average range of more than 5% per day.

Now you know what to expect, based on recent history, for the price action of PLTR on a given day.

Daily candles for PLTR

This information can be incredibly useful for setting stop-loss and take-profit levels.

Keeping with the PLTR example. As of Friday’s close, the stock traded at $19.20. Assuming that is the entry price, you can set a stop loss at or just below $18.20 for Monday.

This way, you're giving the stock enough room to move based on its average volatility, reducing the chance of being stopped out prematurely.

This is overly simplistic, but hopefully illustrates the point. In reality, you will take more factors into consideration.

You wouldn’t allow a stock to drop $1 per day, reset your stop lower and lower based on ATR, and not consider support levels, trendlines, and other indicators.

That said, ATR is a data point that can help you determine whether or not a trade is worth taking.

When you start trading options, this becomes even more evident.

Why ATR is Important for Options Traders

For options traders, understanding volatility, and therefore ATR, is crucial.

The price of an option is largely determined by the expected volatility of the underlying asset over the life of the option.

In other words, the price of an option reflects the expected big or small size moves for the underlying stock.

ATR provides a way to gauge this volatility, helping you to more accurately price your options and make better informed trading decisions.

Look back at the PLTR chart and note the low ATR at the beginning of the year. It never really gets above $0.40 and the chart reflects that.

Options were cheaper then as volatility was lower.

If you were a buyer of call options then and held through the summer, you not only would have benefited from the increased share price but also the increased volatility that drives the options prices even higher.

ATR moved from $0.40 to $1.00 and has remained elevated.

At times, this can be an indication of when to be a seller of options as premiums are elevated which allows you to bring in a higher percentage yield.

Something to keep in mind.

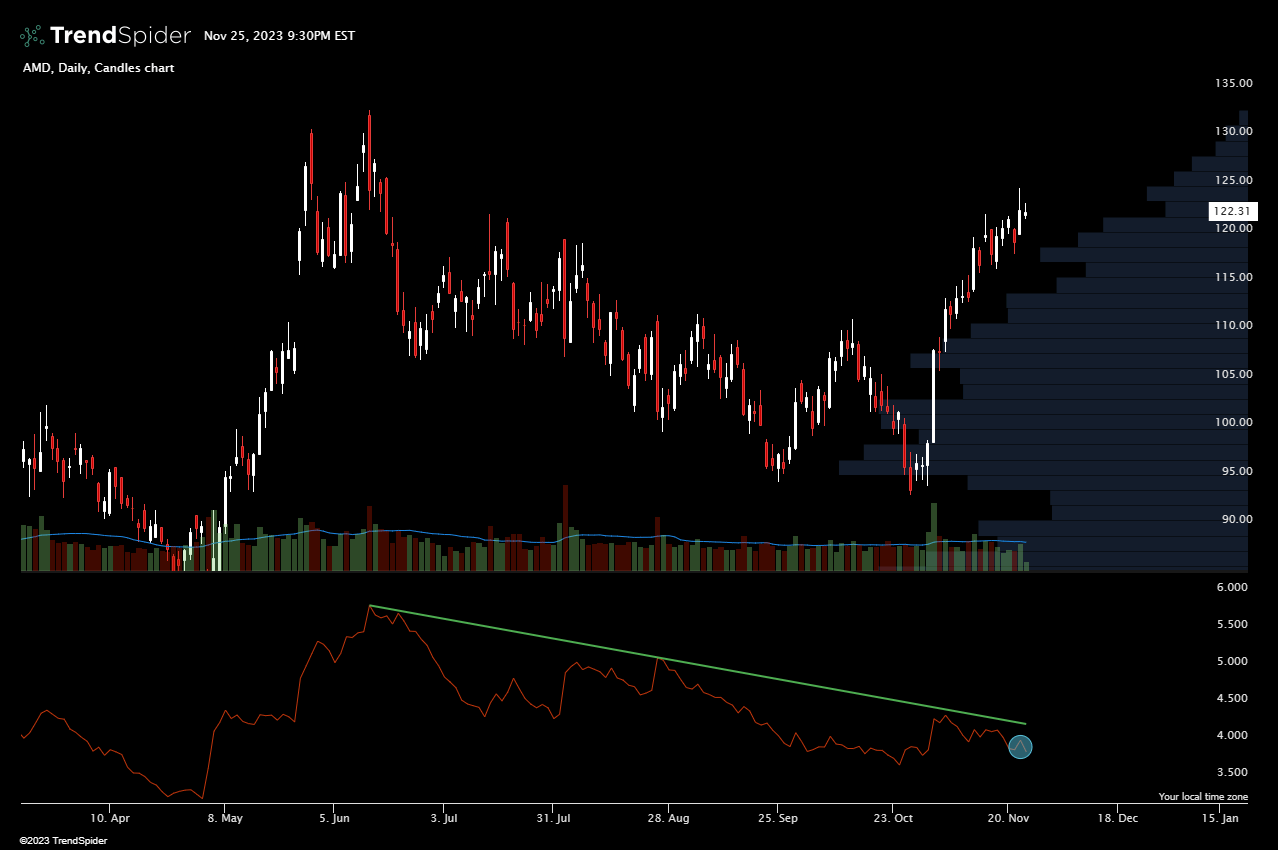

Looking at another example, AMD has a lower ATR which is shown with the tighter trading range and lower recent volatility.

Daily candles for AMD

The options for AMD will reflect the tighter trading range with cheaper options prices.

Let’s compare the two.

Using the December 1st expiration, the at-the-money (ATM) calls for AMD and PLTR look very different.

PLTR $19.50 strike calls have a premium of 2.4% relative to the Friday’s closing stock price.

AMD $123 strike calls have a premium of 1.5% relative to Friday’s closing stock price.

In other words, PLTR stock needs to make a bigger percentage move than AMD stock does for their respective ATM call options to break even at expiration.

Do you expect AMD to see an increase in volatility? Do you expect PLTR’s ATR to remain elevated, keeping options prices higher?

These are the questions you can ask when looking at ATR for the various stocks you are considering trades for.

However, it's important to remember that ATR isn't a percentage like the traditional volatility calculation.

You can't compare the ATR of one stock to another because ATR is not a relative measure.

It's also non-directional, meaning it only measures the size of price moves, not the direction.

Keep these things in mind and ATR can be very useful.

Average True Range is a powerful tool for understanding market volatility and informing your trading decision and it is important to understand how it works and how to interpret it.

So, next time you're analyzing a stock or an option, consider checking out its ATR. It might just give you the edge you need.

That is all for this week’s newsletter!

If you found this information helpful, consider sharing it with others and have a great week ahead!

-Nate