Hey there! My name is Jordan and I write about trading for the WOLF Financial newsletter. If you are looking for more trading tips and tricks, I guarantee you’ll enjoy my content on 𝕏, @AcetheKidTA.

Thanks for reading!

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more here.

It was another uneventful week in the market where we saw the S&P 500 gain 0.26% on the week. The only better thing about this week than last week is the fact that we had some extra volatility with the VIX trading over 20 for the majority of the time.

This means we had a wider range to play with which made it easier to capitalize on the moves at hand. We were still trading in a range, but that range had much more opportunity than the range the week prior.

Myself and the crew on X Spaces did a phenomenal job of identifying the range and trading between it, even though we were waiting for a trend day the past 2 weeks.

Keep reading to get a tip on how we identify whether it’s going to be a range day or a trend day!

30 Minute ORB (Opening Range Breakout)

The 30m ORB has been a part of my system for a while now. Thanks to @MapleStax for showing me this, he also introduced me to the CBC Method.

Simple but effective.

To get the 30m ORB for each day, simply wait for the first 30 minute candle of the day to close. (from 9:30-10:00)

After that candle closes, all you do is mark the high and low of that first 30 minute candle.

That is now your ORB for the day.

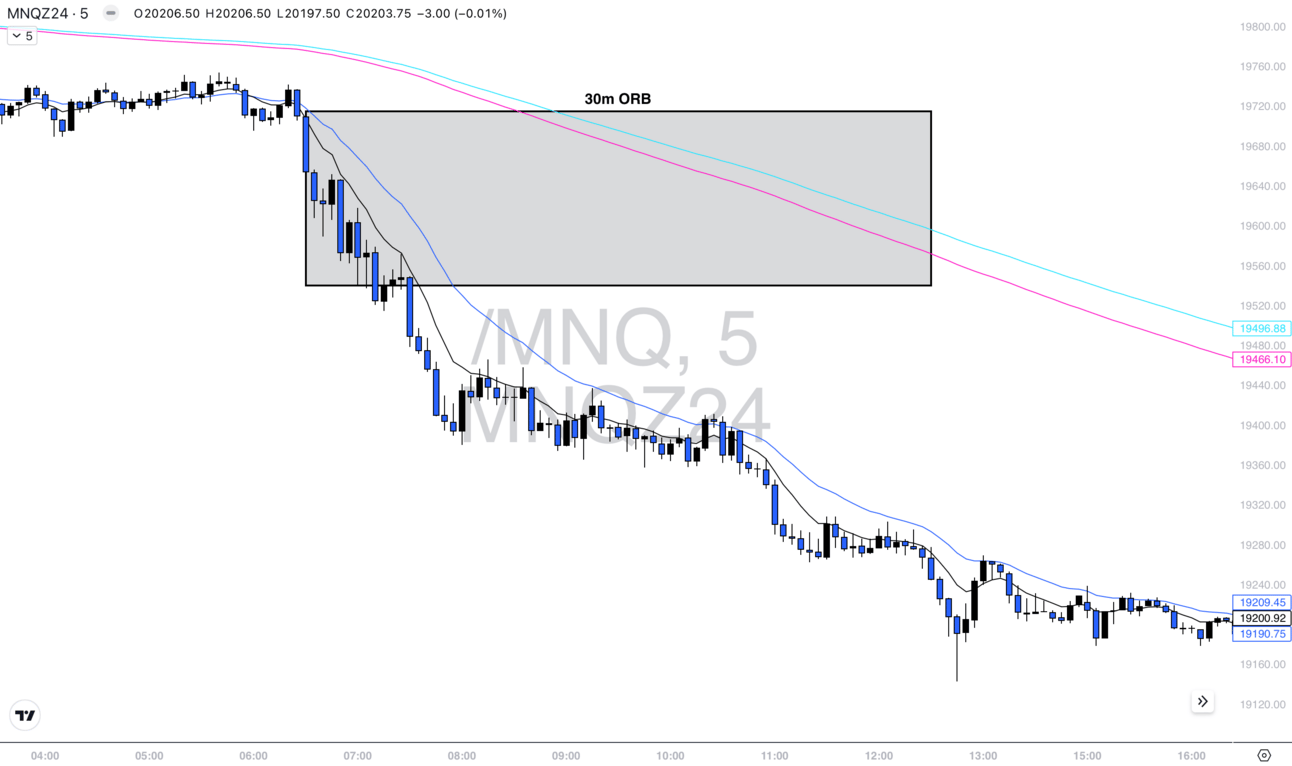

On range days you will see price action stay within the ORB making the high and low potentially great entries if we range the rest of the day.

$MNQ 5 Minute Range Day

On trend days, you will see us breakout of ORB (to the upside or downside) and backtest it.

The backtest is where I like to position myself for further continuation to make it a trend day.

$MNQ 5 Minute Trend Day

Obviously we haven’t seen that in 2 weeks, but I’m sure we will soon. Markets don’t rest forever, just as they don’t trend forever.

If you have been play the range of the 30m ORB the past 2 weeks, you have been tearing up this choppy market.

Using ORB low as potential long entries and using ORB high for potential short entries.

Until ORB breaks you have no reason to believe that this market is trending.

When we get that trend day we will play ORB differently.

Until then it is playing within the ORB range for myself and the crew.

This is such a simple yet effective way to get a good understanding of the market environment for the day and be able to position yourself accordingly.

I hoped this helped everybody.

Thanks for reading and have a great week!

Jordan