Welcome to the WOLF Financial Newsletter.

Join over 18,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

Before we dive in, a quick update on our weekly trade for Premium Subscribers… our $BTCL ( ▼ 5.44% ) swing position is off to a strong start. We outlined our entry, stop-loss, and target levels in last week’s setup, and you can find the latest progress in the premium section below. Now, let’s get into today’s story.

Hims just suffered the biggest single-day drop in its trading history… a HISTORIC 34.53% pull back. And CEO Andrew Dudum isn’t backing down.

IN PARTNERSHIP WITH NEOS INVESTMENTS

Seeking Monthly Income During Volatility?

Perhaps it’s time to consider covered call ETFs – a market segment that’s become increasingly popular with those who desire steady income in their portfolios.

NEOS ETFs seek monthly income, tax efficiency, and the potential for upside capture in rising markets for their investors. NEOS has set out to enhance investment portfolios with the next evolution of options-based income solutions.

NEOS ETFs serve as a compelling income-focused alternative or complement to many of the core holdings already in investor portfolios. Investment categories include the S&P 500, Nasdaq-100, Russell 2000, Bitcoin, Bonds, Treasuries, Real Estate, and more. Their diversified ETF suite includes:

SPYI – S&P 500 High Income ETF

QQQI – Nasdaq-100 High Income ETF

IWMI – Russell 2000 High Income ETF

BTCI – Bitcoin High Income ETF

CSHI – Enhanced Income 1-3 Month T-Bill ETF

BNDI – Enhanced Income Aggregate Bond ETF

IYRI – Real Estate High Income ETF

If volatile market conditions leave you desiring passive income in your portfolio, consider learning more about NEOS ETFs at neosfunds.com.

And give them a follow on X while you’re at it, linked here!

After $NVO Novo Nordisk abruptly terminated their partnership, citing “deceptive marketing,” $HIMS Hims & Hers fired back with confidence… saying they’ll continue offering compounded GLP-1 meds for weight loss at accessible prices.

In interviews and public posts, Dudum called the termination “misleading” and pulled back the curtain on months of rising tension behind the scenes. According to him, Novo had been pressuring Hims to direct more patients toward Wegovy instead of compounded options, which Hims believes remain FDA-compliant for personalized medical use.

“They were pushing us to a degree that was uncomfortable. They’ve been losing a tremendous amount of market share… and I think they’re just under real financial strain to try to drive sales.”

This isn’t just a licensing dispute… it’s a glimpse into the power struggle between upstarts and Big Pharma. Dudum framed it as part of a broader trend: legacy giants trying to retain control over pricing, distribution, and exclusivity, even if it means cutting ties with companies offering cheaper, legal alternatives.

The timing is also interesting. GLP-1s are Novo Nordisk’s biggest and fastest-growing revenue stream, and competition is heating up. Eli Lilly’s Zepbound is gaining traction, compounded access is expanding, and supply issues are easing. In that context, this move feels more like margin protection than public safety.

Was Novo looking for an exit all along? Or is this a calculated strike against a fast-growing competitor? Either way, Hims isn’t backing off. And with a proven track record of affordability, tech-driven care, and massive demand for GLP-1s… this drop may turn into opportunity.

Now, onto the $BTCL ( ▼ 5.44% ) update!

If you’re enjoying the article so far (and we know you are), here’s your chance to see exactly what paid subscribers get.

Most Americans are buried in debt, yet over 60 billionaires were minted during COVID.

What separates them? Financial literacy.

Our CEO is a former Goldman Sachs analyst who’s spent 8,000+ hours teaching real-world money strategy.

Each week, subscribers get:

Deep dives into stocks and sectors

Step-by-step guides to building wealth

Simple breakdowns of complex market trends

This week’s issue is free, so you can see for yourself.

In a world of rising debt, inflation, and geopolitical instability, learning how to protect and grow your money isn’t optional anymore.

👇 Preview today’s premium edition, then decide if $9/month is worth it.

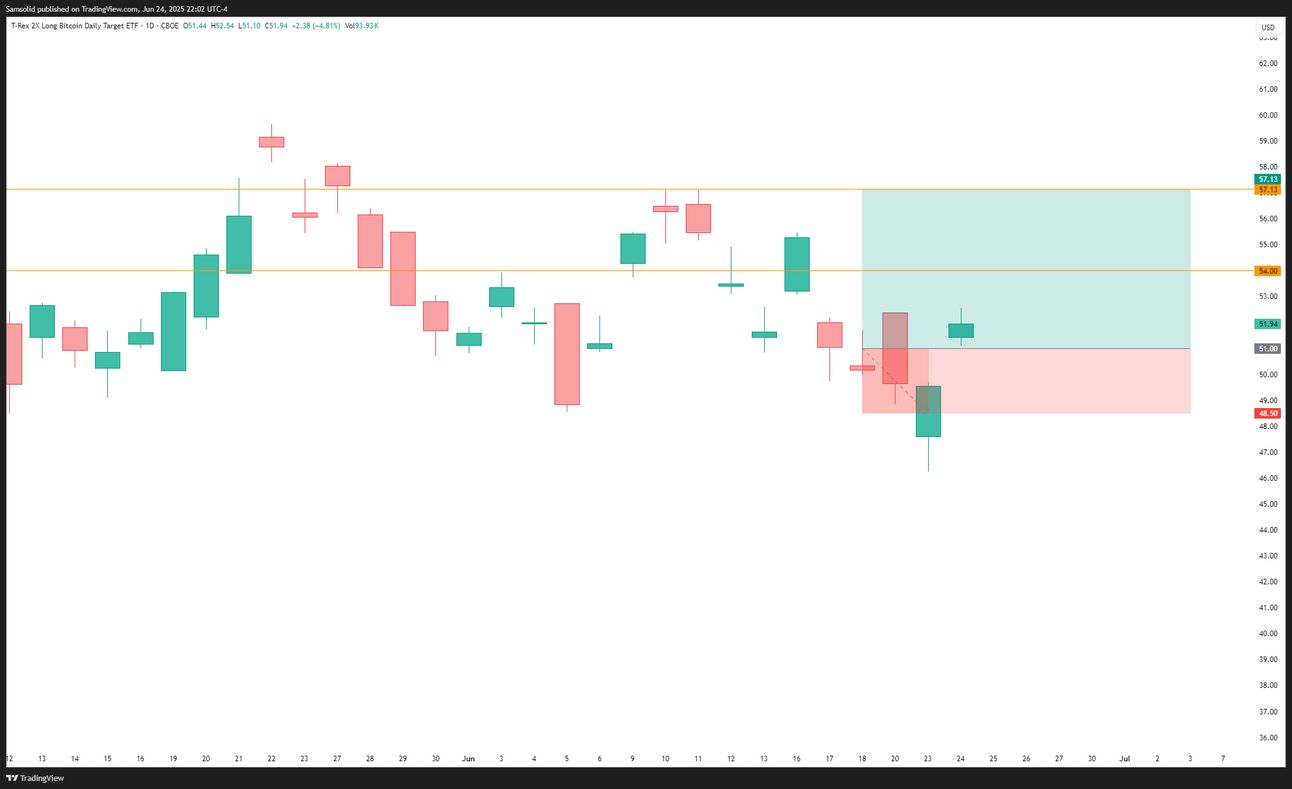

BTCL Swing Trade Update

Our $BTCL ( ▼ 5.44% ) swing trade is performing nicely following the recent escalation in the Middle East. We entered at $51.00, and with the price now around $52.45, we’re currently up +2.84% on the position.

Here’s the current plan:

First target: $54.50 → Take off 50% of the position

Second target: $57.13 → Take off another 35%

Runners: Leave the remaining 15% to ride momentum

And if things pull back?

We don’t let green turn red… if price retraces back to $51.00, we’ll close the position at breakeven.

Momentum is building. Bitcoin is setting up well while $QQQ ( ▼ 0.32% ) just made a new closing ATH. We believe $BTC ( ▼ 2.72% ) could be next, which would put this trade in a very strong spot.

Stay tuned for updates… and make sure to manage risk in case we hit targets before Friday’s newsletter.

Thanks for reading! Check out more content like this over on my X account.

Have a profitable week!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.

Which Edition of our Newsletter has been your Favorite to Read?

Disclaimers:

Investors should carefully consider the investment objectives, risks, charges and expenses of Exchange Traded Funds (ETFs) before investing. To obtain an ETF's prospectus containing this and other important information, please call (866)498-5677 or view/download a prospectus here: SPYI | QQQI | | CSHI | BNDI | IWMI | BTCI | IYRI. Please read the prospectus carefully before you invest.

An investment in NEOS ETFs involves risk, including possible loss of principal. The equity securities purchased by the Funds may involve large price swings and potential for loss.

The use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include (i) the risk that the counterparty to a derivative transaction may not fulfill its contractual obligations; (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. Derivative prices are highly volatile and may fluctuate substantially during a short period of time. The use of leverage by the Fund, such as borrowing money to purchase securities or the use of options, will cause the Fund to incur additional expenses and magnify the Fund’s gains or losses. The earnings and prospects of small and medium sized companies are more volatile than larger companies and may experience higher failure rates than larger companies. Small and medium sized companies normally have a lower trading volume than larger companies, which may tend to make their market price fall more disproportionately than larger companies in response to selling pressures and may have limited markets, product lines, or financial resources and lack management experience. The funds are new with a limited operating history.

Investments in smaller companies typically exhibit higher volatility. Investors in NEOS ETFs should be willing to accept a high degree of volatility in the price of each fund’s shares and the possibility of significant losses.

Bitcoin Risk: Bitcoin is a relatively new innovation and the market for bitcoin is subject to rapid price swings, changes and uncertainty. The further development of the Bitcoin network and the acceptance and use of bitcoin are subject to a variety of factors that are difficult to evaluate. The slowing, stopping or reversing of the development of the Bitcoin network or the acceptance of bitcoin may adversely affect the price of bitcoin. Bitcoin is subject to the risk of fraud, theft, manipulation or security failures, operational or other problems that impact the digital asset trading venues on which bitcoin trades. The Bitcoin blockchain may contain flaws that can be exploited by hackers. A significant portion of bitcoin is held by a small number of holders sometimes referred to as “whales.” Transactions of these holders may influence the price of bitcoin. NEOS ETFs are distributed by Foreside Fund Services, LLC.