Hey there! My name is Nate and I write about trading for the WOLF Financial newsletter. If you are looking for more trading tips and tricks, I guarantee you’ll enjoy my content on 𝕏, @tradernatehere. Thanks for reading!

This service is for general informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice. These are my opinions and observations only. I am not a financial advisor.

Trading options is a great way to build your account and outperform the market.

There are multiple strategies to choose from, each with different characteristics that have their own strengths and weaknesses.

You can buy calls or puts, keeping things simple. Or you can create more complex positions using multiple options across varying expiration dates and strike prices.

The key is to not only understand how to utilize these options strategies successfully, but also being able to identify the pitfalls to avoid.

You will undoubtedly have missteps as a trader, but you can accelerate your learning curve by identifying errors commonly made by traders and avoiding them from the start.

Here is a list of the five top mistakes made by options traders and how to avoid them.

Strategy and Market Outlook Do Not Align

Sometimes the most obvious sounding statement still needs to be said and that is how I feel about this first of five mistakes traders make.

Avoid having a bias and sticking to it regardless of what markets are doing.

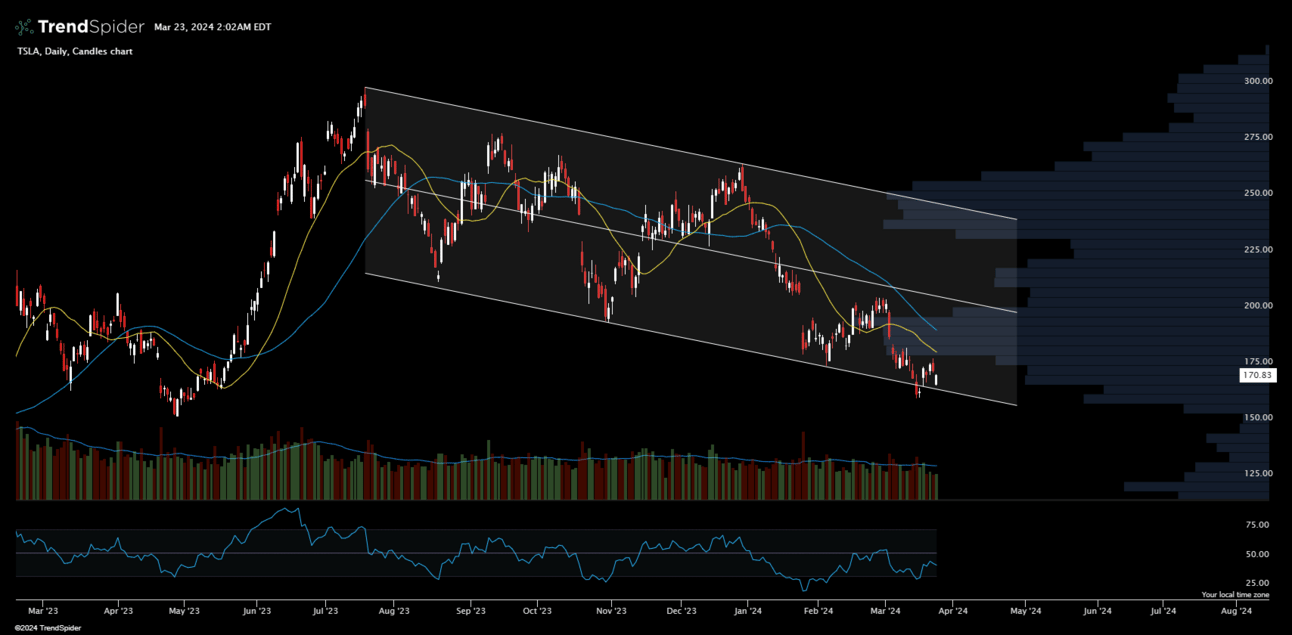

If you are bullish on TSLA long term this does not mean you always need to trade TSLA for upside in the near term.

This is especially true when all EV companies are struggling and in a downtrend. Why would you decide to fight the trend with a short term, upside trade?

There is no reason to think you know better than everyone else.

You might actually be correct, but if nobody is aligned with you they won’t be in the trade and the odds of it working out will remain low.

TSLA daily candles.

Pay attention to the trend and do not fight it. This might be the market’s overall trend, an industry trend, or a stock specific trend.

All three should be respected.

Expiration Date and Liquidity

Selecting the right expiration date and ensuring there is enough liquidity for the options you select are two more very important decisions options traders must make.

You do not want to end up in a trade that is expiring too soon and has such little interest it becomes hard to exit. This can lead to losses for a trade idea that may ultimately be a winner.

When choosing the expiration date for the options you are trading, be certain to allow enough time for the trade to play out.

It is tempting to buy near term expiration dates because the prices are lower and any big moves in the stock will see drastic moves by the option held.

There are two mistakes made here. The first is not recognizing that short-dated options can also move against you just as quickly as they can for you.

The second is assuming the move will happen immediately when it may take more time than expected.

You also want to be aware of earnings reports and any economic news being reported. The expiration date you choose should consider these potential impacts.

Also take note of your ability to close an option after you have entered it.

If there is not enough open interest, you may have a hard time finding someone to buy your option from you, which will have a negative impact on your returns.

Paying attention to open interest and the spread between the bid and the ask prices for the options you are considering will help you avoid making a costly mistake up front.

Position Size & Exit Plan

When a mistake is made with respect to position size it is usually immediately felt.

Position sizing matters because it impacts both your risk as well as your mentality towards a trade.

And this can have a negative impact on your exit plan.

Sometimes increasing size is a good thing but sometimes it is the worst idea for a trader.

And when you make a mistake with sizing it can wipe out your entire account.

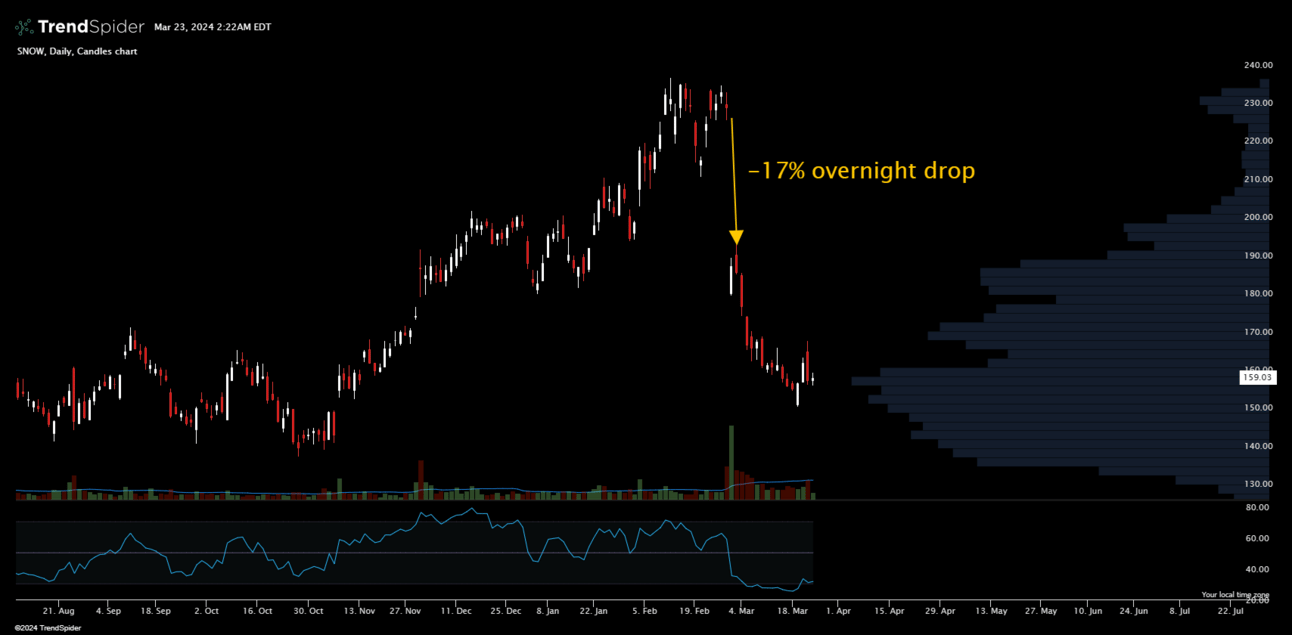

Consider the recent earnings report for SNOW, which saw shares drop roughly 17% overnight.

SNOW daily candles

Heading into this event you might have been very confident in the company’s future prospects and therefore bullish on the stock price.

Using options to trade a name like SNOW is definitely worth considering, but if you had taken too large of a position prior to earnings you would have been helpless to stop the overnight damage.

And now your exit strategy is also more difficult to execute.

Do you stay in the trade and hope shares recover some of the drop?

What if your exit plan intended to prevent these steep losses? Do you throw it out now that the losses have been realized?

Ignoring the impacts of position sizing and changing or ignoring your exit strategy are quick ways to implode your account.

Avoid making these mistakes and improve your odds at becoming consistently successful as a trader.

There is no way to trade perfectly at all times but recognizing common mistakes and taking steps to avoid them is a key part of collecting profits week after week.

-Nate