Welcome to the WOLF Financial Newsletter.

Join over 20,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

Bitcoin pushed into uncharted territory, the Fed returns to the spotlight midweek, and the government shutdown threatens to mute key macro signals.

Bitcoin Back at All-Time Highs

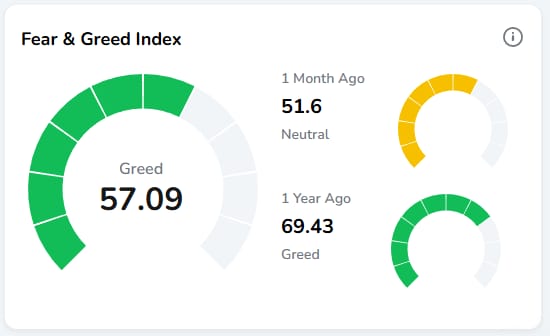

$BTC.X ( ▲ 0.05% ) broke through its previous all-time high from August 13 ($124,533) last night, setting a new record at $125,750. The breakout highlights growing optimism around digital assets as the stablecoin market is projected to 7x by 2030, paving the way for real-world crypto use cases in payments, settlement, and tokenized assets.

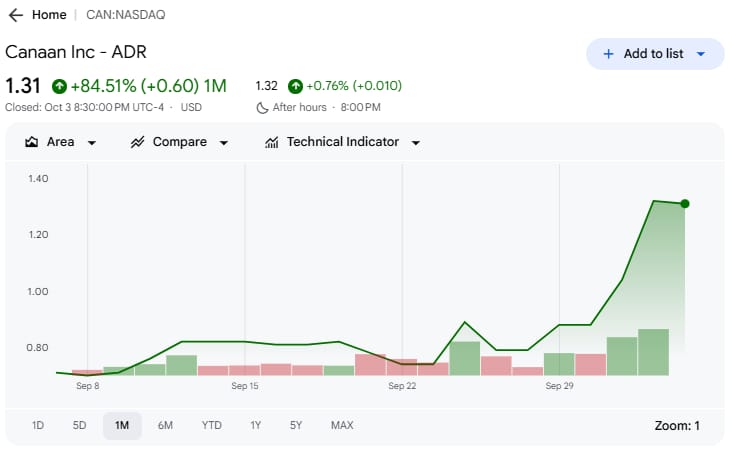

The move also lifted mining-related names… the largest miners continue to rely on ASIC chips from Canaan, which saw its stock $CAN ( ▼ 1.37% ) jump 65% last week and 85% in 1M as demand surged. Canaan’s hardware sits at the heart of many high-efficiency rigs powering the current Bitcoin cycle. Investor relations here.

Fed Update & Powell at the Podium, Again

The Fed minutes arrive Wednesday, October 8 at 2:00 p.m. ET, giving traders another read on the central bank’s internal debate over rates and inflation. Markets typically treat these as tone checks rather than catalysts, so volatility should stay contained unless the language hints at faster cuts or a stronger “higher for longer” bias. Jerome Powell follows on Thursday with welcome remarks at the Community Bank Conference, a scripted event unlikely to carry surprises… unless he slips in commentary on inflation or financial stress.

Shutdown & Data Watch

Friday’s jobs report (non-farm payrolls and unemployment) is in jeopardy as the government shutdown suspends BLS operations. With data collection paused, the official release won’t drop unless funding resumes.

That leaves markets without their usual labor signal, forcing traders to rely on ADP and private proxies instead. The absence of official data could cool short-term volatility but raises uncertainty heading into the weekend.

Thanks for reading! Check out more content like this over on my X account.

Have a safe weekend!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.