Hey there! My name is Nate and I write for WOLF Financial. If you enjoy learning about trading, I guarantee you’ll also enjoy my newsletter A Trader’s Education, and more of my content on 𝕏 @tradernatehere. Thanks for reading!

This service is for general informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice. These are my opinions and observations only. I am not a financial advisor.

Stocks are making moves and after a couple months of being patient we are getting some great opportunities.

My favorite kind of opportunity are trades to the upside. It is just more fun when everyone is making money and markets are rising.

After a couple of selling months, “seasonal” activity, I am ready for a strong Q4 and with that comes the potential for breakout trades.

Regardless of your trading time frame, the same principles apply for trading a breakout and that is this week’s focus.

Minimizing pain and maximizing gain is how this works and there are a few basic steps I like to take to ensure I’m giving myself the best chance to be a profitable trader.

There are really three key components to a solid trading plan:

Finding and taking a quality entry

Setting loss levels and sticking to them

Taking profits and letting runners run

Each of these components are critical to understand for trading a breakout.

You are going to get that understanding this week!

Plus, a look at why large accounts have a built-in advantage. If they actually take advantage of it.

Taking a Quality Entry

The difference between a high-quality entry and just a decent buy point might not make a huge difference with long term investments.

With short duration trading, the difference could change a profitable trade into a flat or even negative one.

This is why finding multiple reasons for taking an entry is important.

For trading a breakout, I look for the following:

Break through resistance with strength, volume

Retest of prior resistance

Aligning data points - moving averages, VWAP, volume shelf

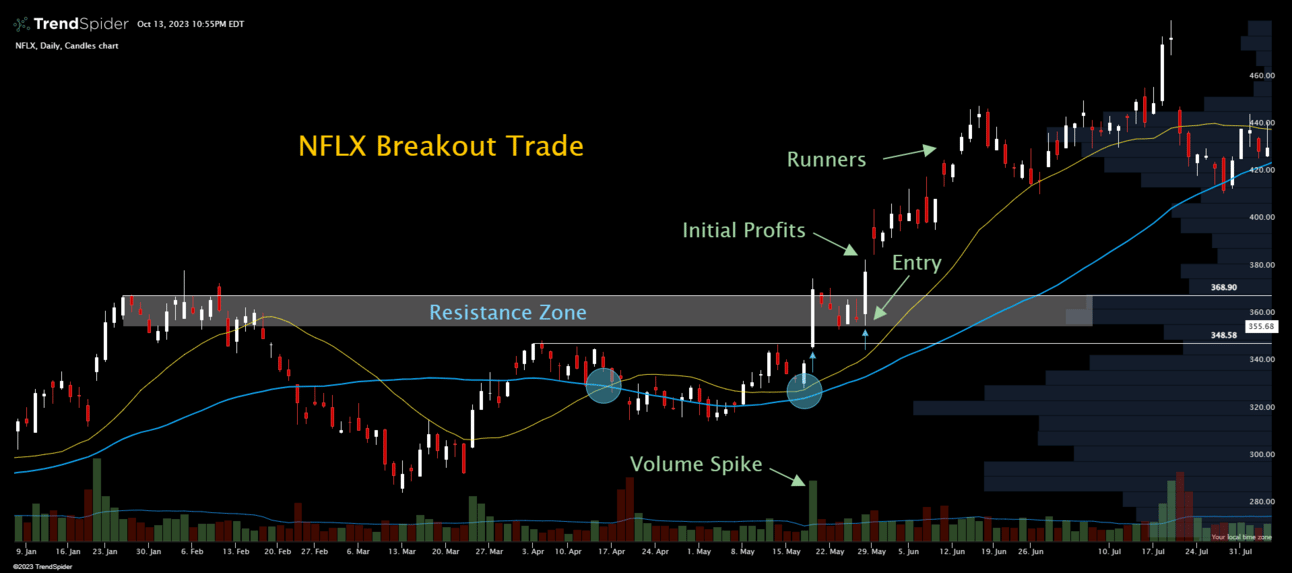

Here’s an example of a breakout for NFLX, which broke through $370 in May and continued higher to north of $480 in July before cooling off.

Daily candles for NFLX

That was a 30% move in two months!

All of the signs were there.

First, the 20-day simple moving average (SMA) crossed above the 50-day SMA. A bullish signal.

Shares then bounced off of the 20-day SMA a few weeks later and had a huge volume spike up and through resistance.

The following days then saw profit taking but the resistance zone held up as support which gave the buy signal.

Additionally, the volume shelf to the right of the chart also showed the large number of trades in this zone between $355-$370.

This was a key level and there were no signs of dropping back below making the retest an optimal entry point.

Minimal Losses and Max Gains

Minimizing losses actually comes in two parts.

The first is setting a stop loss. This is simple but yet rarely followed.

When you hear about “bag holding” you are really hearing about not having a sell discipline.

Setting a stop loss and respecting it is the easiest way to avoid being a bag holder.

I like using levels of support/resistance to determine my stop loss levels.

For the NFLX example, the $348.58 prior resistance level looks about right.

The second part of minimizing losses is to take profits on the initial move.

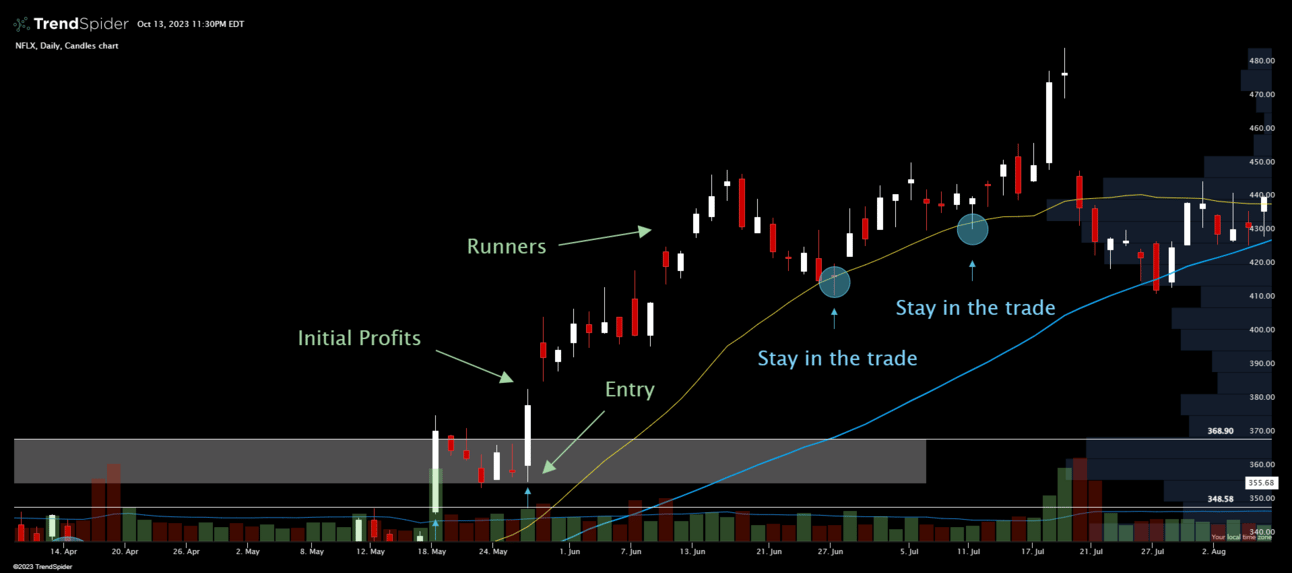

Using the NFLX example again, keeping it simple, let’s assume you bought 20 shares at $357 per share.

Not right on support, but just a few dollars above.

On the initial move higher is where I like to take half of my position off.

For NFLX, the ideal timing was when shares started to slow down after crossing above $380.

This means that the remaining 10 shares would need to drop to $334 before you would start taking losses in the trade.

You can now also move up your stop loss to your buy point and ensure you at least lock in some profits for the day.

This is how you keep your account green and growing.

You could consider selling even more on the initial move. It might make sense to sell 75% of your position, securing those profits and letting a smaller percent run for more upside.

When you’ve taken initial profits, you will find that “letting runners run” becomes much easier.

You are no longer stressing about your entry because you’ve lowered the point at which you would start taking losses.

And moving up your stop loss above this level prevents taking a loss on the trade altogether.

Now your runners can pull back and you can stay in them with more conviction.

Looking back to the NFLX example one more time, there was a draw down after the initial push to $450 but that pullback bounced on the 20-day SMA.

The 20-day SMA keeping the NFLX bulls in the trade.

That bounce should have kept you in the trade. Easier said than done but also much easier to do when you’ve already taken profits.

This highlights the big advantage that large accounts have.

If you’re a small account you may not have enough cash to buy multiple shares for every trade you enter. A stock like NFLX might take up 10% of your account with just one share.

When you are able to buy multiple shares for a trade, it gives you the power to “scale out” and take those initial profits.

This strategy of taking initial profits coupled with using and respecting a stop loss is the best way I know of to keep you in the trading game.

Add in taking an optimal entry and you’re giving yourself great odds.

I hope you found this week’s newsletter helpful. Have a great week of trading!

And one last note…

-Nate