Hey there! My name is Jordan and I write about trading for the WOLF Financial newsletter. If you are looking for more trading tips and tricks I guarantee you’ll enjoy my content on 𝕏, @AceTheKidTA. Thanks for reading!

This service is for general informational and educational purposes only and is not intended to constitute legal, tax, accounting, or investment advice. These are my opinions and observations only. I am not a financial advisor.

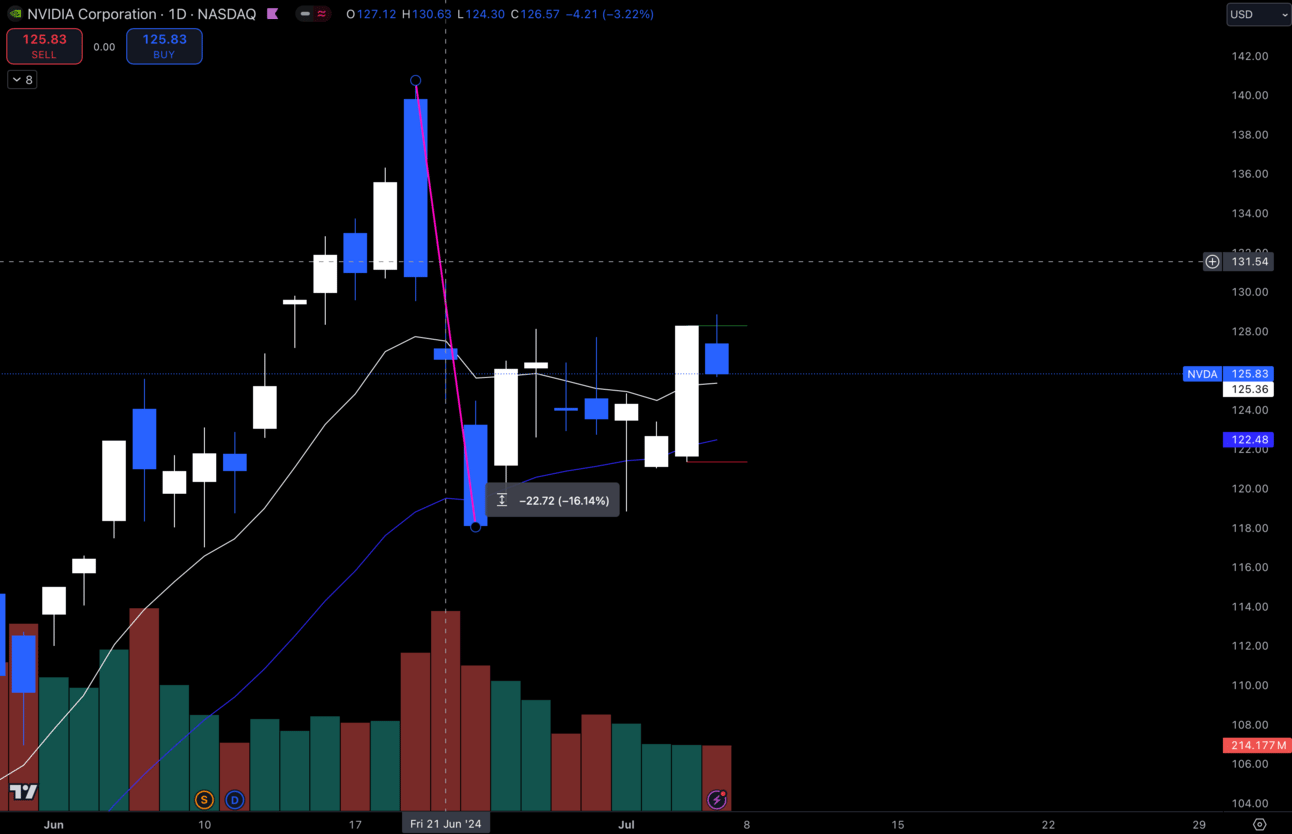

$NVDA has made massive moves this year, but since the split, I feel things have been quieter in this area.

We’ve seen this pullback of 16.14% from the highs which isn’t a big dip for $NVDA, but in my opinion, it is not as enticing to big investors anymore.

$NVDA Daily

I think that big investors have slowly started to rotate some money out of $NVDA and into other stocks that they think are more interesting.

The top stock I think they would pick is…

$TSLA

$TSLA Daily

Why?

$TSLA is the only AI & Technology company left that has been down over 25% YTD.

Now it’s green at 1.22% YTD.

In my opinion, this is the most enticing stock to any big investor who has been holding $NVDA and wants to reallocate some of those funds to a new opportunity.

To understand sector rotation in depth, keep reading below.

What is Sector Rotation?

In a bull market, there is money constantly flowing into different sectors in the market.

For example, this year semiconductors have outperformed the market significantly and have been a market leader.

Other sectors in the market did well too, but some sectors performed horribly, so it’s very important to understand rotation and put yourself where the money is as much as possible.

How to Identify Sector Rotation

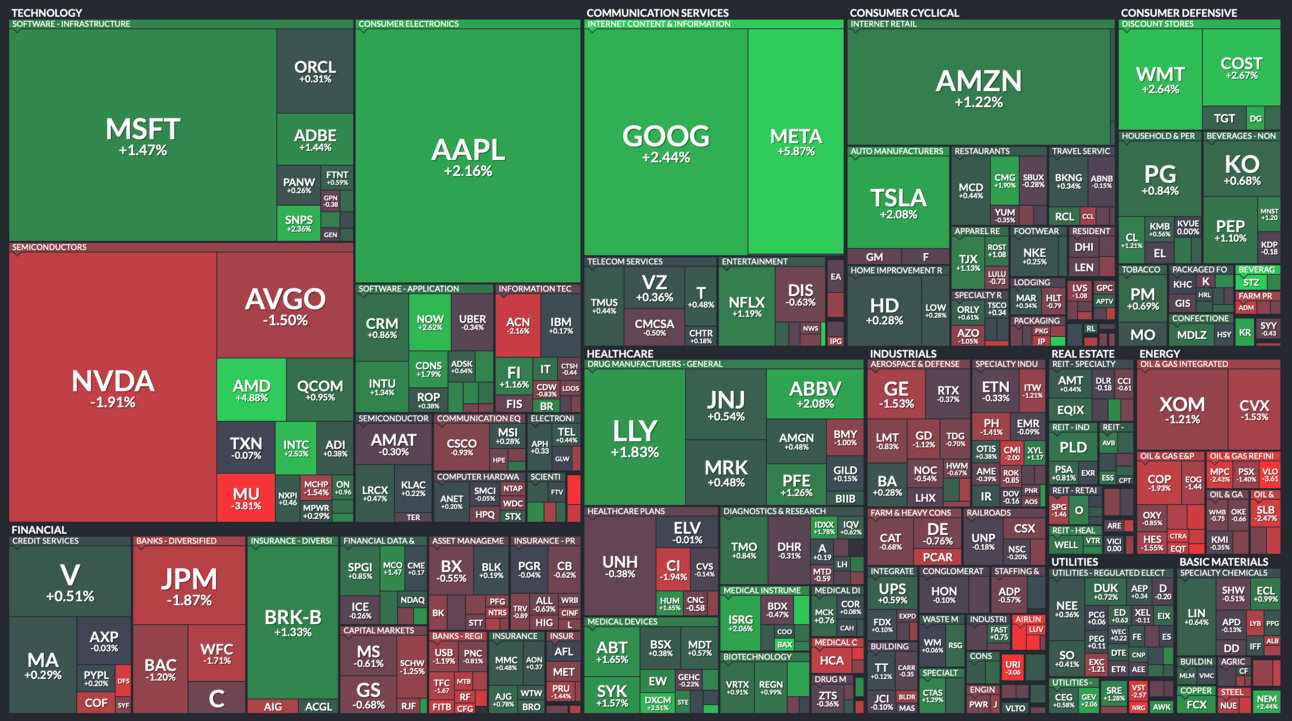

One tool that helps me identify sector rotation easily is FINVIZ.

Finviz Heat Map

This is a website that will show you every sector in the S&P 500 and how it’s performing depending on your time frame.

This is a great way to get an idea of where big money is flooding into over a day, week, month, or year.

Sector rotation is very simple, but it can be the deciding factor on whether you make any money or not.

It also just makes sense to always be putting yourself in the best positions when trading. Why try and buy up a certain sector if all the money is flowing elsewhere?

Use sector rotation to your advantage and watch your trading drastically change for the better.

I’m still personally looking for $NVDA to dip more, but as long as it’s holding that daily 21 EMA it will likely get sent back to highs.

I still think there is more money to rotate into $TSLA and that this is only the beginning of this move, but we will see how things play out.

I hope this helped you guys get a better understanding of sector rotation and hopefully you can use this skill to further your trading!

Thanks for reading.

-Jordan

Share WOLF Financial

Want access to my exclusive top trade ideas? Share the WOLF Financial Newsletter just once, and I'll immediately send you our current top trade ideas. Keep referring and unlock ongoing access to top trade ideas every month!

You currently have 0 referrals, only 1 away from receiving WOLF Top Trade Ideas.