Hey everyone! Sam here (AKA @SamSolid57 on X)

I drop into your inbox a few times a week, breaking down the biggest stories in finance and the moves that matter most.

Let’s get into it

Amazon Tranium Chips

Amazon announced Tranium 4 and Tranium3 Ultra, confirming what the industry has been hinting at for months… ASICs are the game now. Purpose-built silicon is taking share from general-purpose GPUs, and the hyperscalers are racing to cut cost per compute while scaling model training capacity.

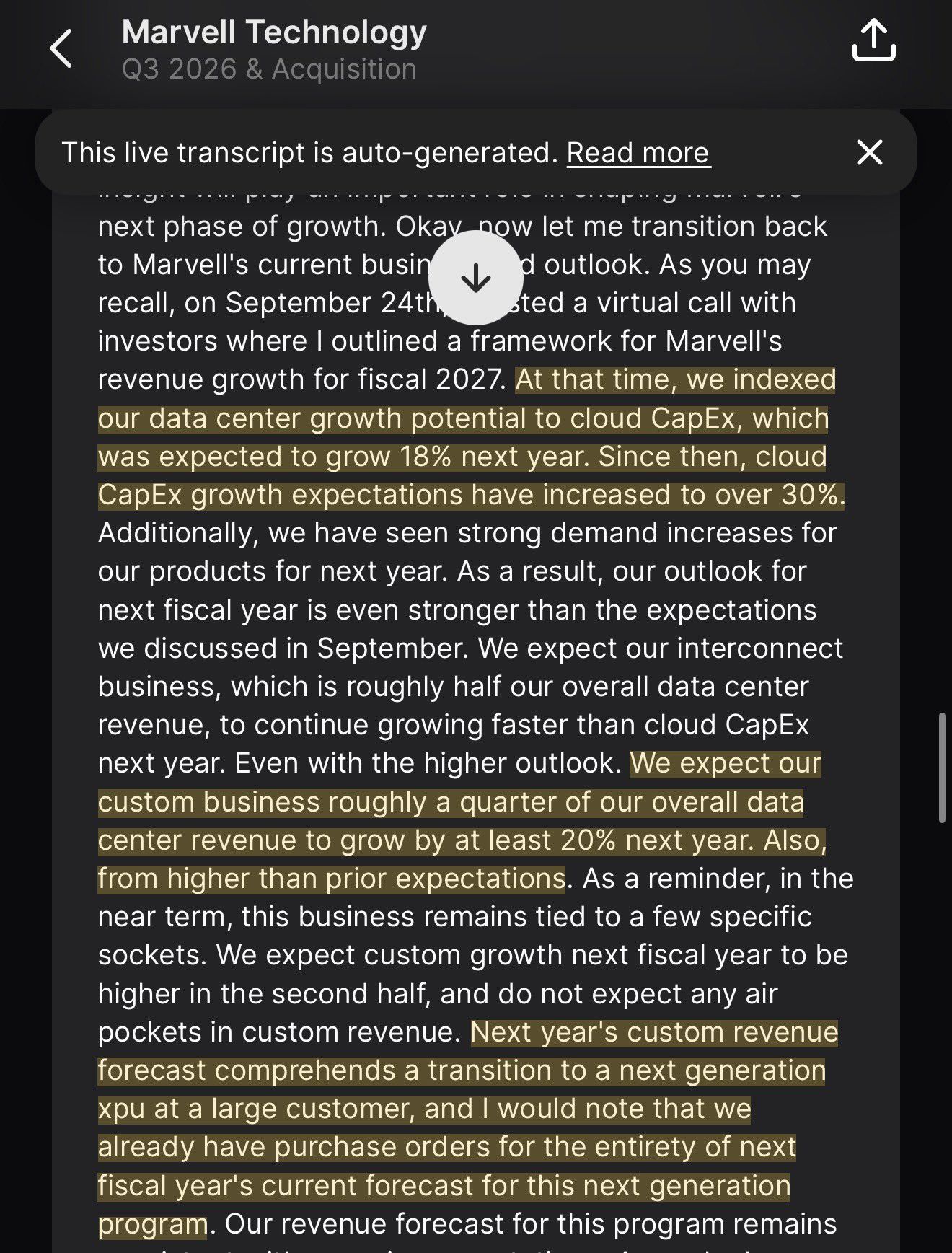

The shock came from Marvell ($MRVL). After sliding nearly 8% on earnings, the stock ripped more than 12% higher once executives announced that custom chip revenue is expected to grow 20%+ next year. The message is clear: AI silicon is diversifying, and companies that can build custom accelerators for hyperscalers are just getting started.

Sponsored by NEOS Investments

Seek Monthly Income. Aim to Navigate Uncertainty. Stay Invested.

Markets remain unpredictable, rate expectations keep shifting, equity volatility persists, and questions around tariffs and the AI trade continue to drive uncertainty.

As investors consider portfolio positioning for 2026, NEOS ETFs may offer a way to stay invested across equities, fixed income, and alternative asset classes while seeking outcomes like monthly income, enhanced tax efficiency, upside potential or in some cases, a measure of downside protection.

The award-winning firm behind the ETF.com “Best New Active ETF” and ETF Express “Best Options Strategies ETF Issuer ($1–10bn)” offers a suite of options- based ETFs that aim to harness volatility for monthly income, enhance after-tax outcomes, and potentially complement core allocations.

From equity and alternative high income strategies, to enhanced fixed income strategies, NEOS aims to deliver Next Evolution Options Strategies for today’s uncertain markets. Explore their award-winning lineup at https://neosfunds.com.

Bitcoin Snaps Back With a 14k Round Trip

Bitcoin bounced sharply to 92k, pulling off a nearly 14k round trip after tagging cycle lows. The volatility has been brutal, but bulls are pointing to liquidity pockets forming around multi-month support and rising open interest as signs the sell-off may be stabilizing.

Still, BTC remains well below major moving averages, so traders are treating this as a reflexive bounce rather than a confirmed trend reversal.

Fed Enters Quiet Period Ahead of Next Week’s FOMC

The Federal Reserve is officially in its quiet period heading into next week’s FOMC meeting, where markets are pricing in a 91% chance of a rate cut.

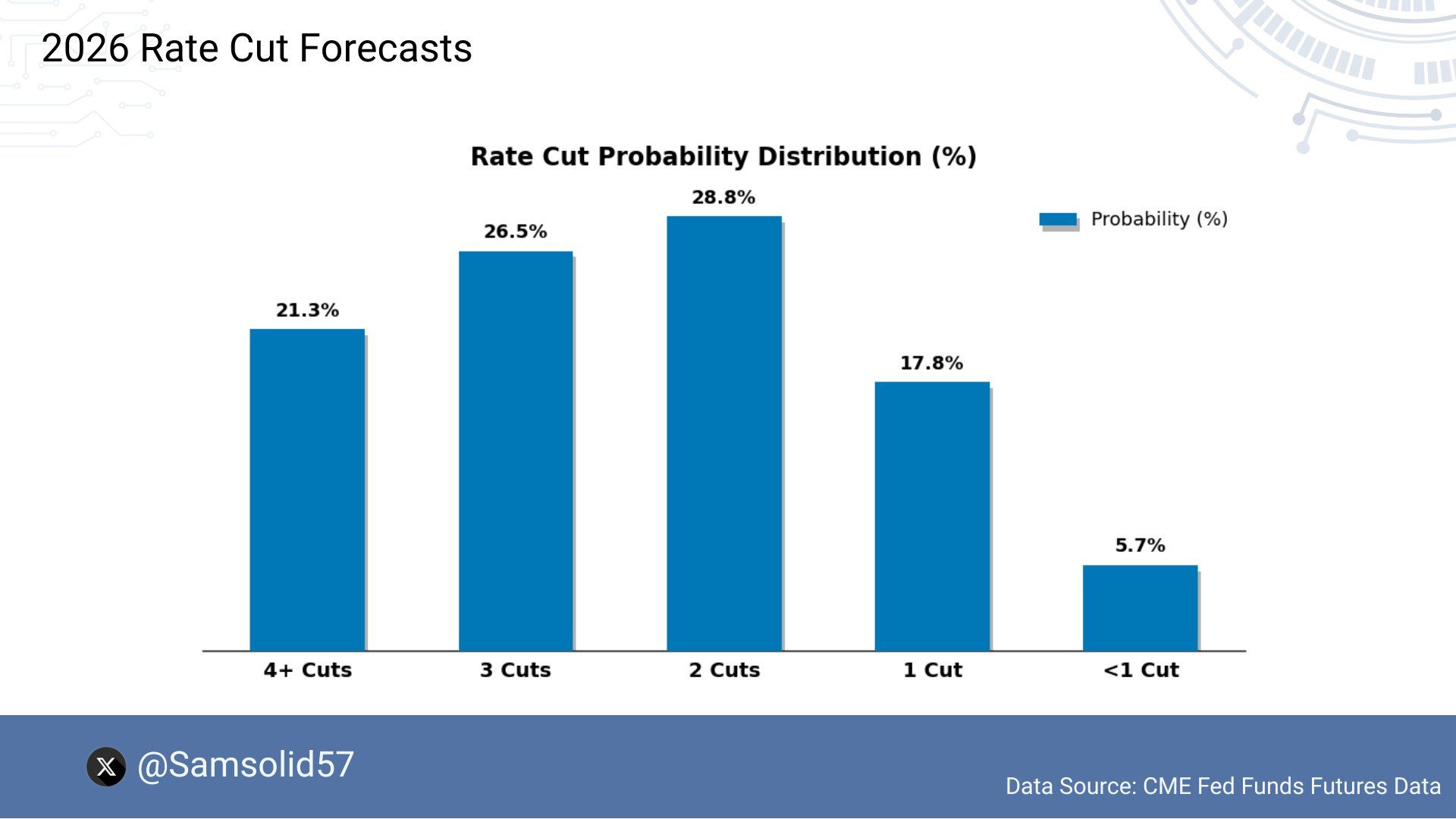

Bank of America expects only two cuts in 2026, while futures imply a 50%+ probability of three or more cuts. That gap reflects how uncertain the macro backdrop still is… and how sensitive risk assets will be once Powell steps up to the podium.

Thanks for reading! Catch you in the next one!

For more updates throughout the week, follow @WOLF_Financial and @SamSolid57 on X.

Disclaimers:

Important Disclosures: Investors should carefully consider the investment objectives, risks, charges and expenses of Exchange Traded Funds (ETFs) before investing. To obtain an ETF's prospectus containing this and other important information, please call (866) 498-5677 or view/download a prospectus at https://neosfunds.com. Please read the prospectus carefully before you invest. An investment in NEOS ETFs involve risk, including possible loss of principal. NEOS ETFs are distributed by Foreside Fund Services, LLC.