Hey there!

Welcome to the WOLF Financial Newsletter.

Join over 13,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

Earnings season is almost here.

This is when investors make pivotal decisions about their portfolios.

Give me 1 minute to explain how you can capitalize:

IN PARTNERSHIP WITH NEOS INVESTMENTS

Seeking Income From Market Volatility

What if you could aim to turn market volatility into income opportunities...?

ETFs from NEOS Investments aim to harness volatility to seek tax-efficient monthly income for investors through data-driven options strategies, like covered calls.

Their ETF lineup offers exposure to both equities and fixed income:

• SPYI – NEOS S&P 500 High Income ETF

• QQQI – NEOS Nasdaq-100 High Income ETF

• CSHI – NEOS Enhanced Income 1-3 Month T-Bill ETF

• BNDI – NEOS Enhanced Income Aggregate Bond ETF

• IWMI – NEOS Russell 2000 High Income ETF

And... income generated from NEOS options strategies may be less sensitive to future interest rate changes compared to traditional income-oriented investments... Food for thought🤔

To learn more about how you can seek monthly income within your investment portfolio, visit

Each quarter, publicly traded companies release their financial results.

Companies disclose financial data that typically leads to stock price corrections.

Around mid-October is when most companies' Q4 quarterly reports are out.

If you’re an active investor, you NEED to read quarterly reports.

It’s the driving indicator regarding whether you should sell any given stock.

If you’re not researching your investments, you’re not investing; you’re gambling.

Yes…reading quarterly reports is as boring as it sounds.

However, there’s a better way to analyze and digest this information.

Let me introduce you to Earnings Hub (@earningshub24)

Earnings Hub offers a real-time financial events calendar.

It tracks important dates related to publicly traded companies like:

IPOs

Real-time stock news

Quarterly earning reports

And so much more.

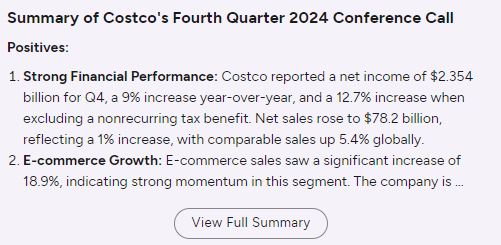

Once quarterly reports are out, Earnings Hub provides earnings calls.

With complete summaries of each public stock’s quarterly earnings on their calendar.

They read the fine print, and you get a digestible summary in return.

They even have data, full reports, and summaries of prior quarterly reports.

With a quick glance, you can get a full perspective of a company's quarterly health.

This will help you spot trends in ways you never could before.

Don’t waste your time scrolling through SEC databases during earnings season.

Check out Earnings Hub instead.

But don’t take it from me; their calendar is free, so there’s no risk on your behalf.

Check them out at earningshub.com

The crew at Wolf Financial loves working with Earnings Hub.

If you’ve read this far, give their tools a shot.

Your portfolio’s health will thank you.

Which Edition of our Newsletter has been your Favorite to Read?

Disclaimers:

Investors should carefully consider the investment objectives, risks, charges, and expenses of exchange-traded funds (ETFs) before investing. To obtain an ETF's prospectus containing this and other important information, please call (866) 498-5677 or view/download a prospectus here: SPYI | QQQI | | CSHI | BNDI | IWMI. Please read the prospectus carefully before you invest.

An investment in NEOS ETFs involves risk, including possible loss of principal. The equity securities purchased by the Funds may involve large price swings and potential for loss.

The use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include (i) the risk that the counterparty to a derivative transaction may not fulfill its contractual obligations; (ii) the risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate, or index. Derivative prices are highly volatile and may fluctuate substantially during a short period. The use of leverage by the Fund, such as borrowing money to purchase securities or the use of options, will cause the Fund to incur additional expenses and magnify the Fund’s gains or losses. The earnings and prospects of small and medium-sized companies are more volatile than larger companies and may experience higher failure rates than larger companies. Small and medium-sized companies normally have a lower trading volume than larger companies, which may tend to make their market price fall more disproportionately than larger companies in response to selling pressures and may have limited markets, product lines, or financial resources and lack management experience. The funds are new with a limited operating history.

Investments in smaller companies typically exhibit higher volatility. Investors in NEOS ETFs should be willing to accept a high degree of volatility in the price of each fund’s shares and the possibility of significant losses. Income distributions from NEOS ETFs have been classified as a return on capital. Distributions may be comprised of option premiums, dividends, interest payments, and capital gains. There is no guarantee the ETFs will make a distribution and amounts may fluctuate from month to month.

Covered Call: A covered call is an options trading strategy that involves selling a call option on a stock that the investor already owns. The investor, or "seller", gives the buyer the right to purchase the stock at a specific price (strike price) and before a specific date (expiration date). The seller receives a premium for the option and then waits to see if the buyer exercises the option or if the option expires.

NEOS ETFs are distributed by Foreside Fund Services, LLC.