Welcome to the WOLF Financial Newsletter.

Join over 18,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

From AI and EV breakouts to Powell’s guidance and a relentless melt up, markets are rewriting the playbook in real time.

Tesla & IonQ Massive Run

$TSLA ( ▼ 2.91% ) and $IONQ ( ▼ 3.51% ) have ripped higher, and Vista Shares $WILD ( ▲ 0.98% ) caught the entire move. The fund is having a monster YTD, rebalancing at the right time to capture gains in the AI and EV cycle.

Today we’ll be sitting down with Adam Patti, CEO of Vista Shares 12 PM EDT for a full discussion on how WILD has positioned itself to capitalize on these trends on our YouTube channel. You can tune in here!

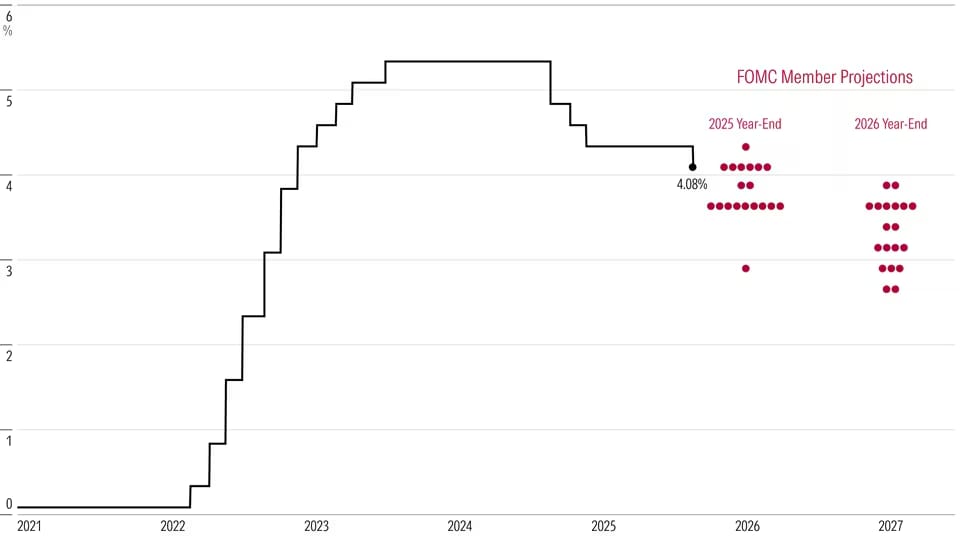

FOMC Cuts, More on Deck

The Fed cut rates by 25 bps, as expected. The bigger headline came from the September SEP, which now projects two more cuts by year-end. Powell also reminded markets there are still two meetings left in 2025, leaving plenty of room for flexibility.

Source: MorningStar

This is dovish guidance with a steady hand. The Fed is telling us it wants to ease, but without sparking another runaway risk cycle. Investors are hanging on every word from Powell’s commentary to gauge how aggressive this path might get.

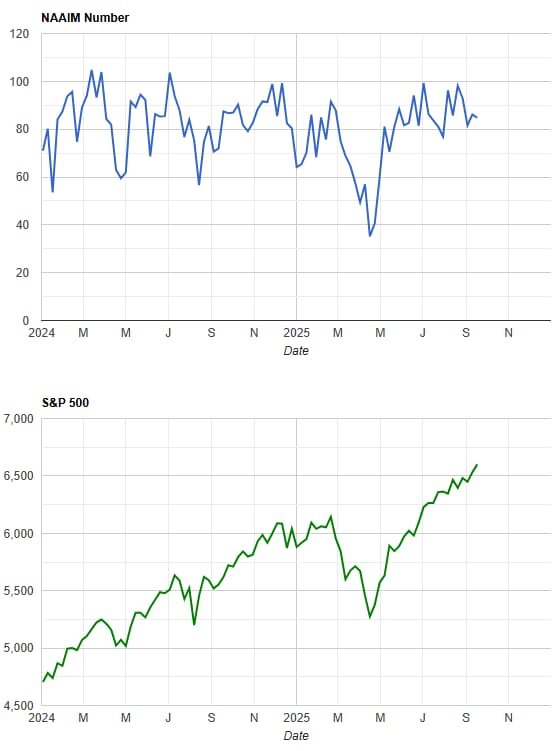

Melt Up Continues Against All Odds

Markets keep grinding higher against expectations of a correction. The S&P 500 is pushing new highs, and the positioning data explains why: NAAIM exposure sits at 84, well below the fully invested zone of 95-100. Institutions are still underweight, and that means forced buying whenever the market squeezes.

This is the fuel behind the melt up. It doesn’t mean risk has vanished, but it does mean sidelined capital is still being dragged into equities… whether managers like it or not.

Thanks for reading! Check out more content like this over on my X account.

Have a safe weekend!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.