Welcome to the WOLF Financial Newsletter.

Join over 18,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

All eyes turn to the Fed, $NVDA ( ▼ 4.17% ) global reach gets sharper, and China continues to surprise as the narrative shifts to growth and deal-making.

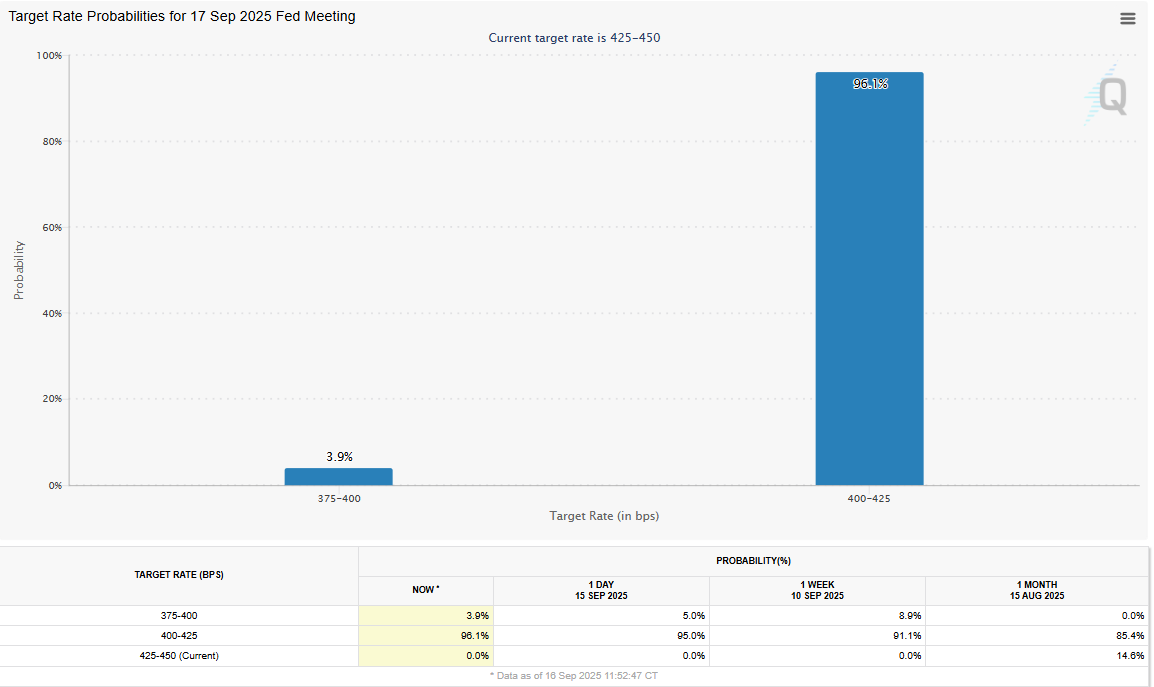

FOMC Tomorrow… Cut Is Baked, Guidance Is Everything

The Fed meets tomorrow with markets pricing in a 96% chance of a 25 bps cut. The decision itself isn’t the drama, it’s the commentary. Investors want to know whether September marks the start of a 3-cut year or a 4-cut year, and Powell’s tone will set the table.

Inflation has been sticky, but the momentum of dovish policy is strong. The biggest risk for the Fed is overpromising a path of easing while data still sits uneven. Expect volatility around Powell’s Q&A more than the announcement itself.

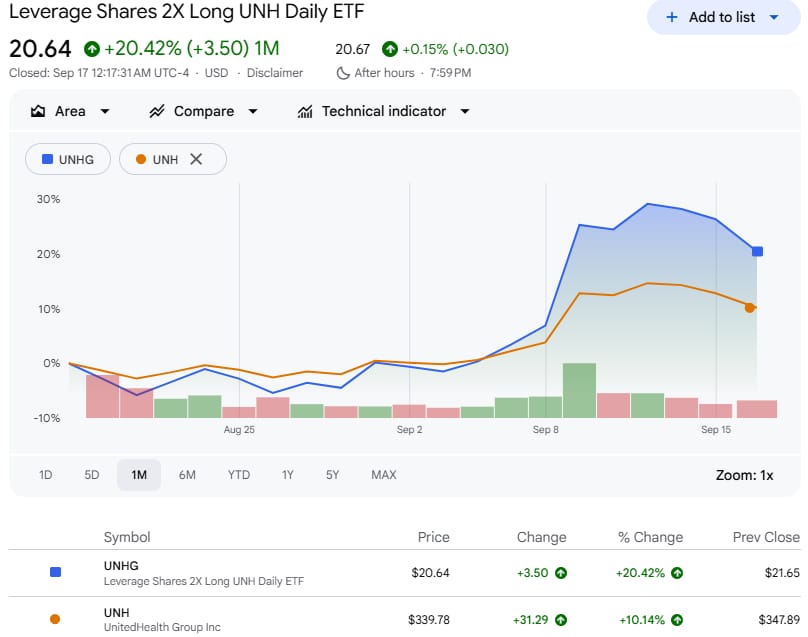

$UNH ( ▲ 2.31% ) is up a solid 10% over the past month… but the Leverage Shares 2x Long UNH ETF $UNHG ( ▲ 4.44% ) doubled that move, ripping +20.4% in the same stretch.

NVIDIA’s UK Expansion Deal

NVIDIA $NVDA ( ▼ 4.17% ) announced a major partnership with the UK government, part of a $15B OpenAI Stargate expansion. The plan includes scaling 300,000 Grace Blackwell GPUs globally, with 60,000 deployed directly in the UK. Partners include CoreWeave $CRWV ( ▼ 18.51% ), which will manage 120,000 B200s, and Nscale as a domestic AI infrastructure backbone.

Thematic takeaway: This is less about one deal and more about NVIDIA embedding itself as the default compute layer in Western AI strategy. It reinforces the role of hyperscalers $MSFT ( ▼ 2.24% ), $BLK ( ▼ 2.48% ) and suppliers $ALAB ( ▼ 4.68% ), $MU ( ▼ 0.77% ), $ASML ( ▼ 0.9% ), $TSM ( ▼ 0.59% ) in capturing downstream benefits of the AI datacenter buildout.

Premium Moves and Trade Journaling with TradePath.ai

While the headlines dominate around chips, execution in our own trades matters just as much.

That’s why I use TradePath, a platform that makes it simple to track positions, journal trades, and analyze results… the same way we manage entries and exits here.

If you want to sharpen your own process, check them out.

China Narrative Running Hot

China is back in the headlines. The market is running hard on the compute buildout theme and optimism around a potential tariff deal. That combination has fueled a surge in Chinese tech, with big names like $BABA ( ▼ 2.66% ) and $KWEB ( ▼ 1.27% ) catching strong momentum.

This is good news for global risk appetite. A stronger China trade provides oxygen to emerging markets, supports commodity demand, and shows that investors are willing to buy into growth narratives beyond the U.S. For now, it’s a trend worth respecting… and possibly leaning into.

Thanks for reading! Check out more content like this over on my X account.

Have a safe weekend!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.