Hey everyone! Sam here (AKA @SamSolid57 on X)

I drop into your inbox a few times a week, breaking down the biggest stories in finance and the moves that matter most.

Let’s get into it

January 2023: Relief Rally After a Brutal Year

The S&P 500 started 2023 strong as investors repositioned after the 2022 bear market, driven by falling inflation expectations and short covering.

Gold moved modestly higher as rate pressure eased and real assets regained appeal.

Bitcoin surged early, marking the start of a recovery phase following forced deleveraging and extreme pessimism across crypto markets.

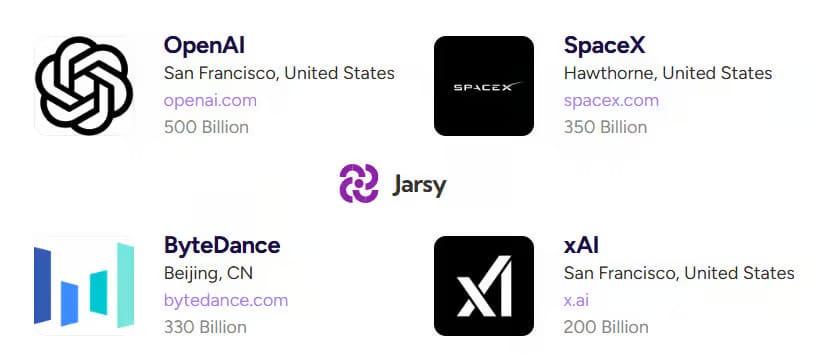

Sponsored by Jarsy

One emerging player, Jarsy, tokenizes private-company equity and opens pre-IPO access to retail investors… bridging traditional finance and blockchain rails. Download their app here.

January 2024: Liquidity Returns

The S&P 500 was slightly positive but choppy, reflecting digestion of strong 2023 gains and uncertainty around rate cuts.

Gold was flat to modestly higher, supported by geopolitical risk and continued central bank buying.

Bitcoin continued higher, benefiting from renewed institutional interest and early-cycle momentum.

January 2025: Rotation and Consolidation

The S&P 500 saw mixed to slightly lower performance as investors took profits after a strong prior year and rebalanced portfolios.

Gold rose as defensive positioning picked up amid fiscal and geopolitical uncertainty.

Bitcoin remained volatile but generally positive, showing early leadership even as equities paused.

The Takeaway

January tends to reward assets coming off extreme positioning rather than those that simply performed best the year before. Liquidity returns first, conviction comes later.

Thanks for reading! Catch you in the next one!

For more updates throughout the week, follow @WOLF_Financial and @SamSolid57 on X.