Hey everyone! Sam here (AKA @SamSolid57 on X)

I drop into your inbox a few times a week, breaking down the biggest stories in finance and the moves that matter most.

Let’s get into it

Fed Cut Odds Surge After Williams’ Flip

Williams, the head of the Federal Reserve Bank of New York, said policy is “modestly restrictive” and there’s “room for a further adjustment in the near term,” which kicked the odds of a December rate cut from under 29% to about 71%.

Markets responded fast… Treasury yields dipped, stocks perked up, and the vibe shifted from “stay cautious” to “maybe go all-in.” This kind of mindset change matters: if rates do come down, that could turbocharge risk assets.

Prospero AI gives you real time trading insights, lightning fast news, and the kind of clean data that makes decision making feel effortless. If you want an edge without the noise, download their app here.

Crypto: Bottom In Sight?

Bitcoin briefly hit around $80k (the seven-month low) before bouncing toward $86k today, and Ethereum dropped toward $2,620 then bounced back to $2,850.

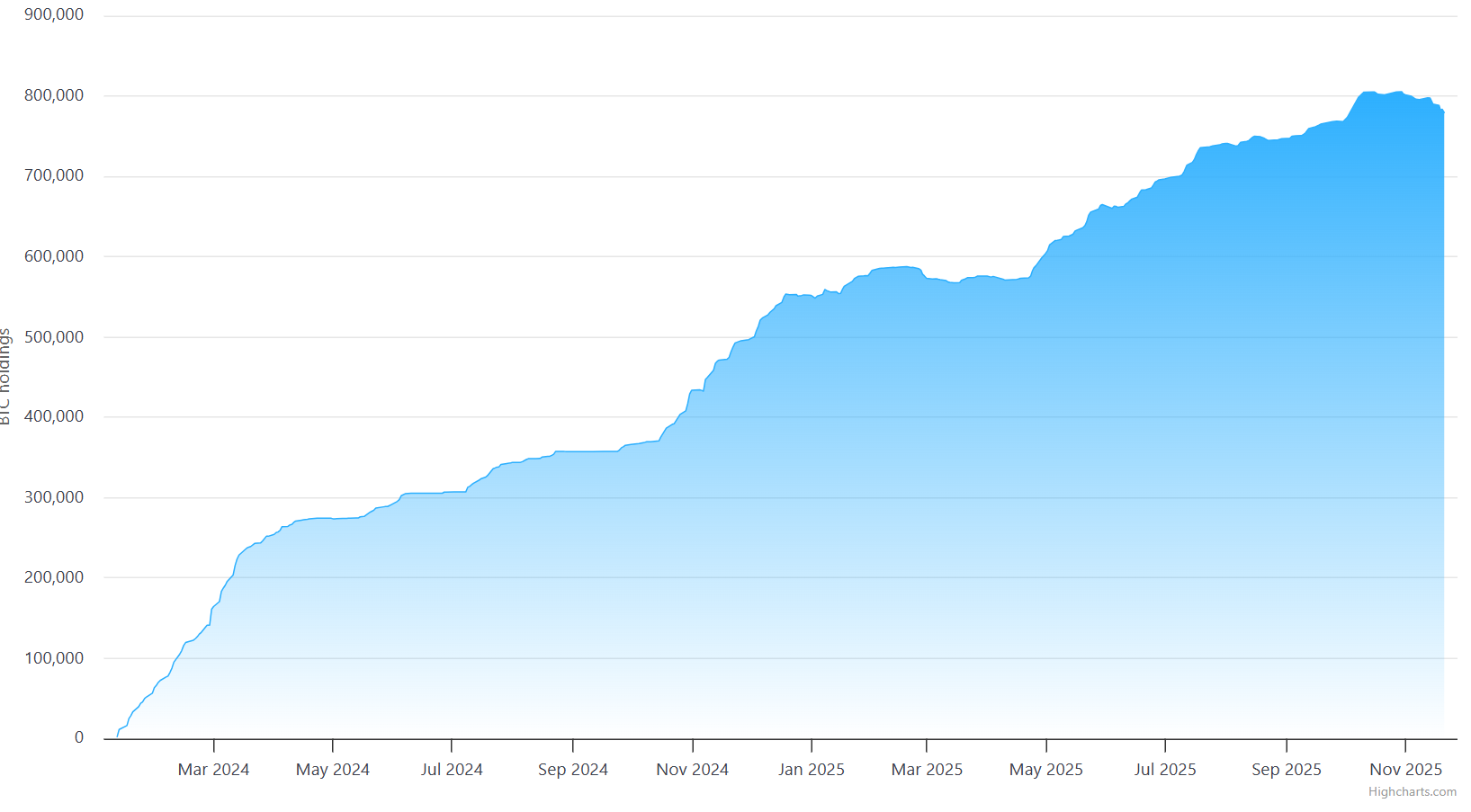

Amount of Bitcoin in Blackrock’s $IBIT Trust

I’m staying hopeful this is a near-term bottom and added to my long-term HODL crypto portfolio. The coins that I am favorable on If rates come down are Bitcoin, Ethereum, Chainlink, Solana, and Ripple.

Nvidia’s China Door May Be Cracking Open

The Trump team is considering letting Nvidia sell its H200 AI chips to China... a move that, if approved, would open access to one of the largest underserved markets for high-end AI hardware.

That means that even after Nvidia just delivered a blow-out quarter, this policy shift could add a whole new growth vector. If you believe Nvidia’s story isn’t over (and I do), this is the kind of upside surprise that keeps it in the “uncapped” category.

Thanks for reading! Catch you in the next one!

For more updates throughout the week, follow @WOLF_Financial and @SamSolid57 on X.