Hey everyone! Sam here (AKA @SamSolid57 on X)

I drop into your inbox a few times a week, breaking down the biggest stories in finance and the moves that matter most.

Let’s get into it

Markets Bounce Yesterday

Markets bounced strongly yesterday as broad indices regained key technical ground following recent pressure. The $SPY climbed about 0.76%, while the $QQQ held was up 1.46% with cyclical and tech sectors leading the rebound… signaling buyers stepped in at support after oversold conditions.

Tech and high-momentum ETFs lagged modestly, but the overall move showed a rotation into value and yield-sensitive areas as traders interpreted softer inflation data as supportive for easing monetary policy.

Sponsored by Jarsy

One emerging player, Jarsy, tokenizes private-company equity and opens pre-IPO access to retail investors… bridging traditional finance and blockchain rails. Download their app here.

CPI Report Comes in Cool

The November CPI headline came in at 2.7%, below the 3.1% expected and down from ~3.0% previously, indicating inflation pressures are easing more quickly than anticipated.

Core inflation (excluding food and energy) also softened, with shelter and other key categories rising more slowly than forecast, pointing to broader moderation. Combined with mixed labor market signals, these figures reinforce the case that price pressures are moving closer to the Fed’s target — tightening the path for future rate decisions.

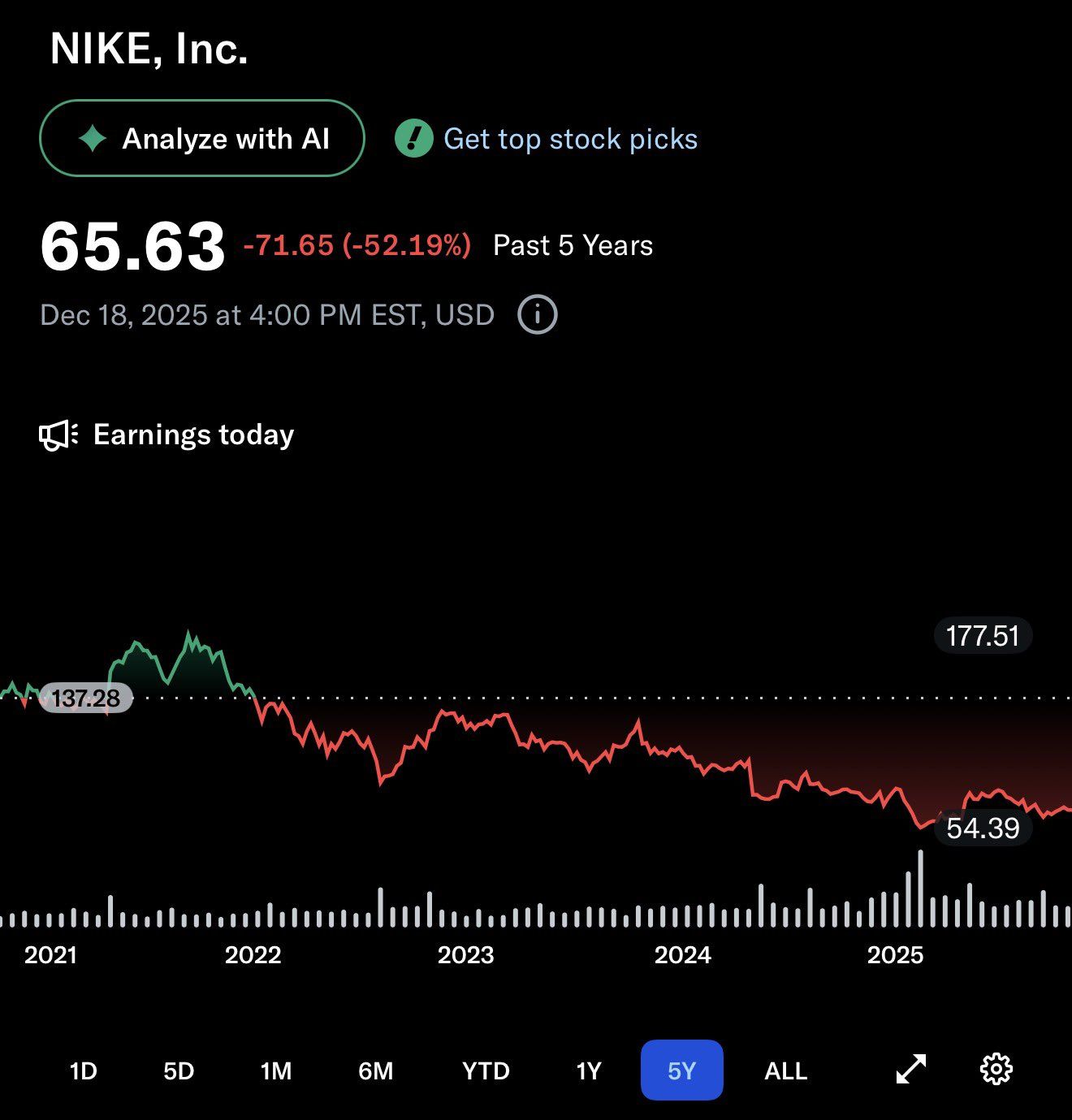

Nike Earnings Disappoint, China Weakness Weighs

Nike reported earnings that beat modestly but shares fell more than 10% after hours, reflecting deep concerns about growth and profitability. Revenue came in at about $12.4 billion with earnings of $0.53 per share, above expectations, but the China business saw a roughly 17% sales decline YoY significantly dragging on results.

Management described the turnaround as still in the “middle innings,” with inventory challenges and weak store traffic in Greater China adding pressure. Margins also contracted as tariffs and promotional activity weighed on profitability, reinforcing investor caution as global demand outside North America remains uneven.

Thanks for reading! Catch you in the next one!

For more updates throughout the week, follow @WOLF_Financial and @SamSolid57 on X.