Before we dive in, here’s what’s driving sentiment: the market extends its multi-month winning streak, mega-caps reaffirm massive spending plans for 2025-2026, and the next phase of earnings season could decide how long the rally lasts.

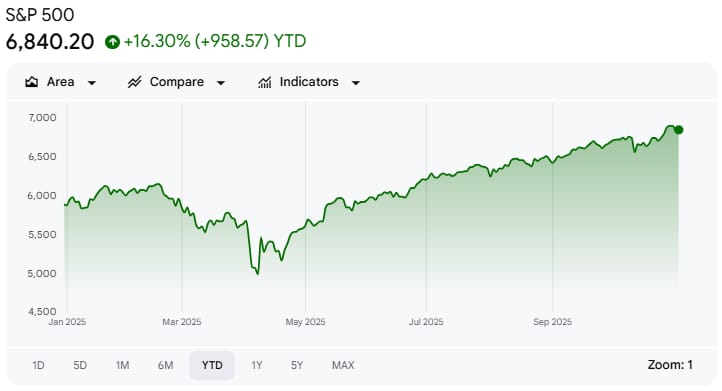

Sixth Consecutive Green Month

The S&P 500 just notched its sixth straight green month, the longest run since 2021. October is up 2.27%, adding to what’s now a 16%+ YTD gain.

Volatility remains elevated, but the trend is intact… investors keep buying dips as liquidity expectations rise. The shortage of AI compute capacity has been a quiet driver too, lifting valuations for hyperscalers. That shortage is bullish for AWS, Google Cloud, and Azure, which can charge more for every incremental unit of compute.

It also spills over into tokenized asset platforms, where real-world assets and digital infrastructure are converging. One emerging player, Jarsy, tokenizes private-company equity and opens pre-IPO access to retail investors… bridging traditional finance and blockchain rails. Download their app here.

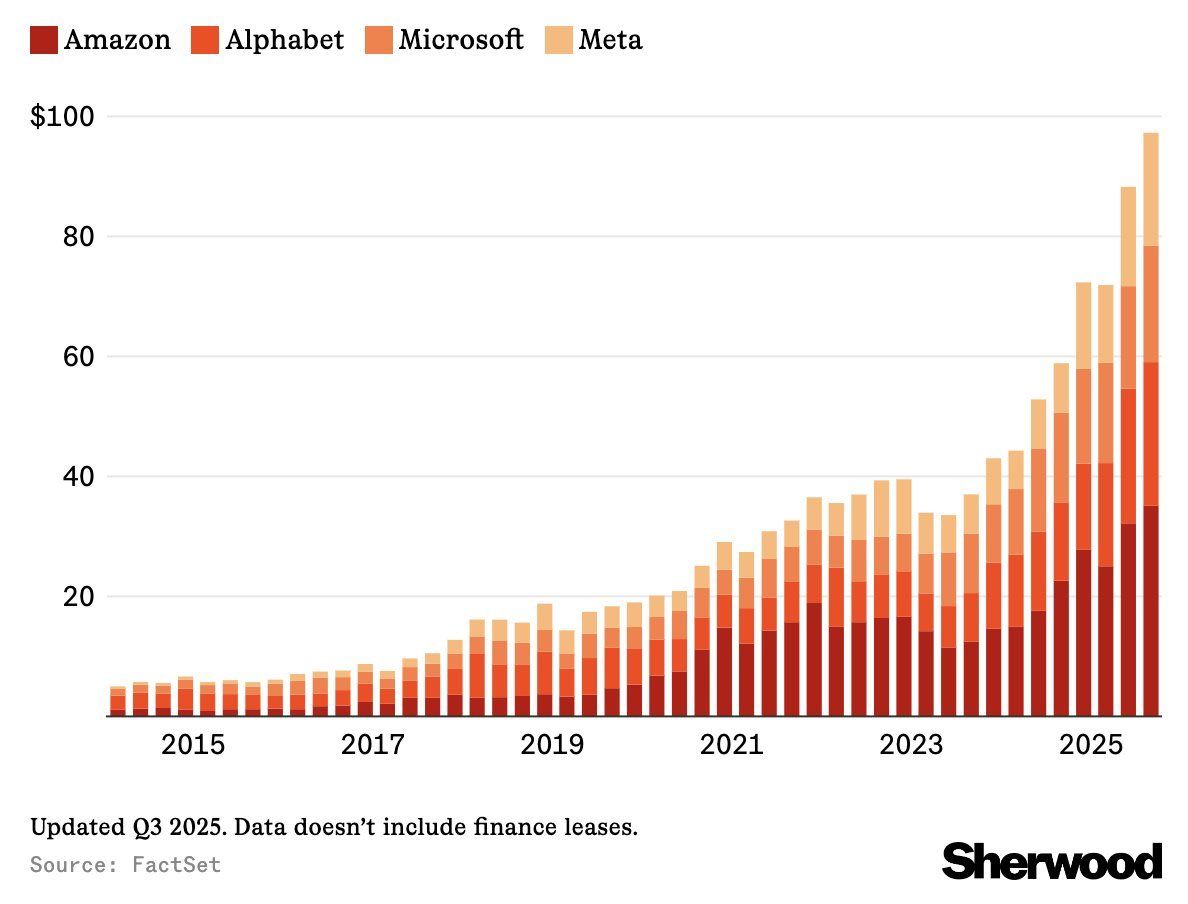

Mega-cap CapEx Guidance

The hyperscalers made one thing clear: 2025 will be another record year for AI infrastructure spend. Here’s what each is expected to invest:

Amazon $AMZN: $125B, led by AWS expansion and fulfillment automation.

Google $GOOGL: $93B, heavily weighted toward technical infrastructure and data centers.

Microsoft $MSFT: $85B, focused on scaling Azure and AI compute.

Meta $META: $72B, as it ramps Reality Labs and generative AI capabilities.

That’s over $370B in expected combined CapEx… a historic figure that reaffirms the scale of the AI build-out. The second wave of hyperscaler investment isn’t about starting new projects; it’s about deepening infrastructure dominance.

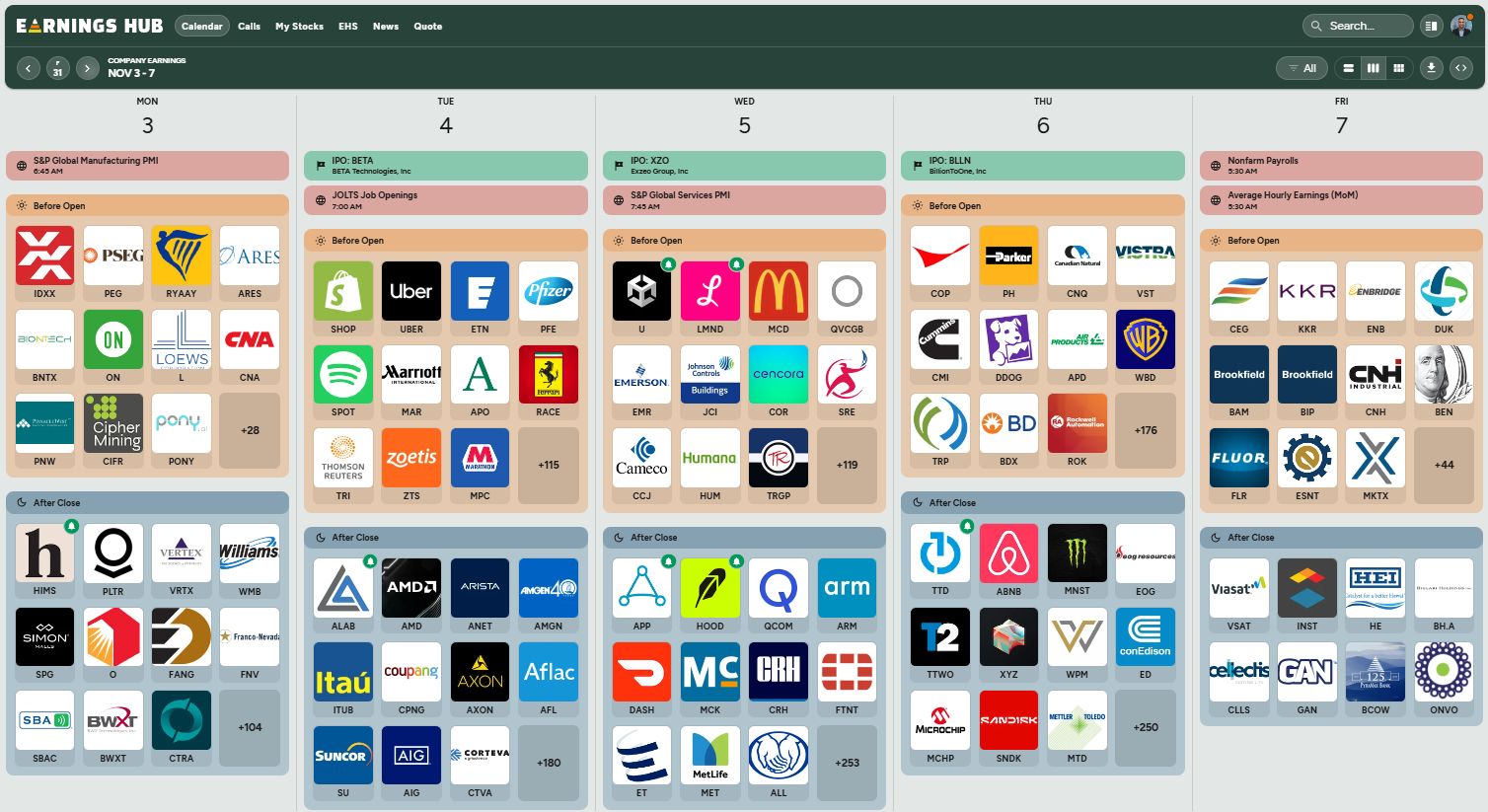

Earnings Season: One Chapter Ends, Another Begins

Mega-cap earnings may be behind us, but the story isn’t over. Next week brings reports from Palantir, Robinhood, Hims & Hers, and Applovin a mix that will test whether strength broadens beyond the leaders.

Tech has carried the market to record highs, but this next stretch decides if the rally becomes more inclusive, or if the mega-cap era continues to dominate.

Thanks for reading! Check out more content like this over on my X account.

Have a great weekend!

Which Edition of our Newsletter has been your Favorite to Read?

Disclaimer:

Investors should carefully consider the investment objectives, risks, charges and expenses of Exchange Traded Funds (ETFs) before investing. To obtain an ETF's prospectus containing this and other important information, please call (866)498-5677 or view/download a prospectus here: SPYI | QQQI | | CSHI | BNDI | IWMI | BTCI | IYRI. Please read the prospectus carefully before you invest.

An investment in NEOS ETFs involves risk, including possible loss of principal. The equity securities purchased by the Funds may involve large price swings and potential for loss.

The use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include (i) the risk that the counterparty to a derivative transaction may not fulfill its contractual obligations; (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. Derivative prices are highly volatile and may fluctuate substantially during a short period of time. The use of leverage by the Fund, such as borrowing money to purchase securities or the use of options, will cause the Fund to incur additional expenses and magnify the Fund’s gains or losses. The earnings and prospects of small and medium sized companies are more volatile than larger companies and may experience higher failure rates than larger companies. Small and medium sized companies normally have a lower trading volume than larger companies, which may tend to make their market price fall more disproportionately than larger companies in response to selling pressures and may have limited markets, product lines, or financial resources and lack management experience. The funds are new with a limited operating history.

Investments in smaller companies typically exhibit higher volatility. Investors in NEOS ETFs should be willing to accept a high degree of volatility in the price of each fund’s shares and the possibility of significant losses.

Bitcoin Risk: Bitcoin is a relatively new innovation and the market for bitcoin is subject to rapid price swings, changes and uncertainty. The further development of the Bitcoin network and the acceptance and use of bitcoin are subject to a variety of factors that are difficult to evaluate. The slowing, stopping or reversing of the development of the Bitcoin network or the acceptance of bitcoin may adversely affect the price of bitcoin. Bitcoin is subject to the risk of fraud, theft, manipulation or security failures, operational or other problems that impact the digital asset trading venues on which bitcoin trades. The Bitcoin blockchain may contain flaws that can be exploited by hackers. A significant portion of bitcoin is held by a small number of holders sometimes referred to as “whales.” Transactions of these holders may influence the price of bitcoin. NEOS ETFs are distributed by Foreside Fund Services, LLC.