Welcome to the WOLF Financial Newsletter.

Join over 20,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

The markets are snapping back after Trump walked back tariff threats, crypto made a sharp weekend recovery, and earnings season is about to set the tone for Q4.

The 2nd Trump dip… and the reversal

Friday’s escalation of China tariffs triggered the largest single-day drawdown since April, with the S&P 500 falling nearly 3%. But over the weekend, Trump completely de-escalated the situation, reversing course and saying “all will be fine.”

Futures opened with a big gap up as traders unwind defensive positioning. It’s the second Trump dip of the year… and once again, markets treated it as a buying opportunity rather than a macro shift.

It’s a trend that also extends into tokenized asset platforms, where real-world assets and digital infrastructure are beginning to merge. One example is Jarsy, which tokenizes private-company equity to give retail investors access to pre-IPO shares, effectively bridging traditional finance with blockchain-based markets. Download their app here.

Bitcoin and Ethereum bounce back

Crypto snapped back strong over the weekend. Bitcoin $BTC dropped as low as $102,000, briefly breaking the 20MA, before reclaiming it in a sharp reversal. Ethereum $ETH also dipped to $3,510 but quickly rebounded, now trading well above $4,000.

Both moves signal resilience across digital assets… the 200MA holds remain a bullish signal as traders rotate back into risk following the macro pullback.

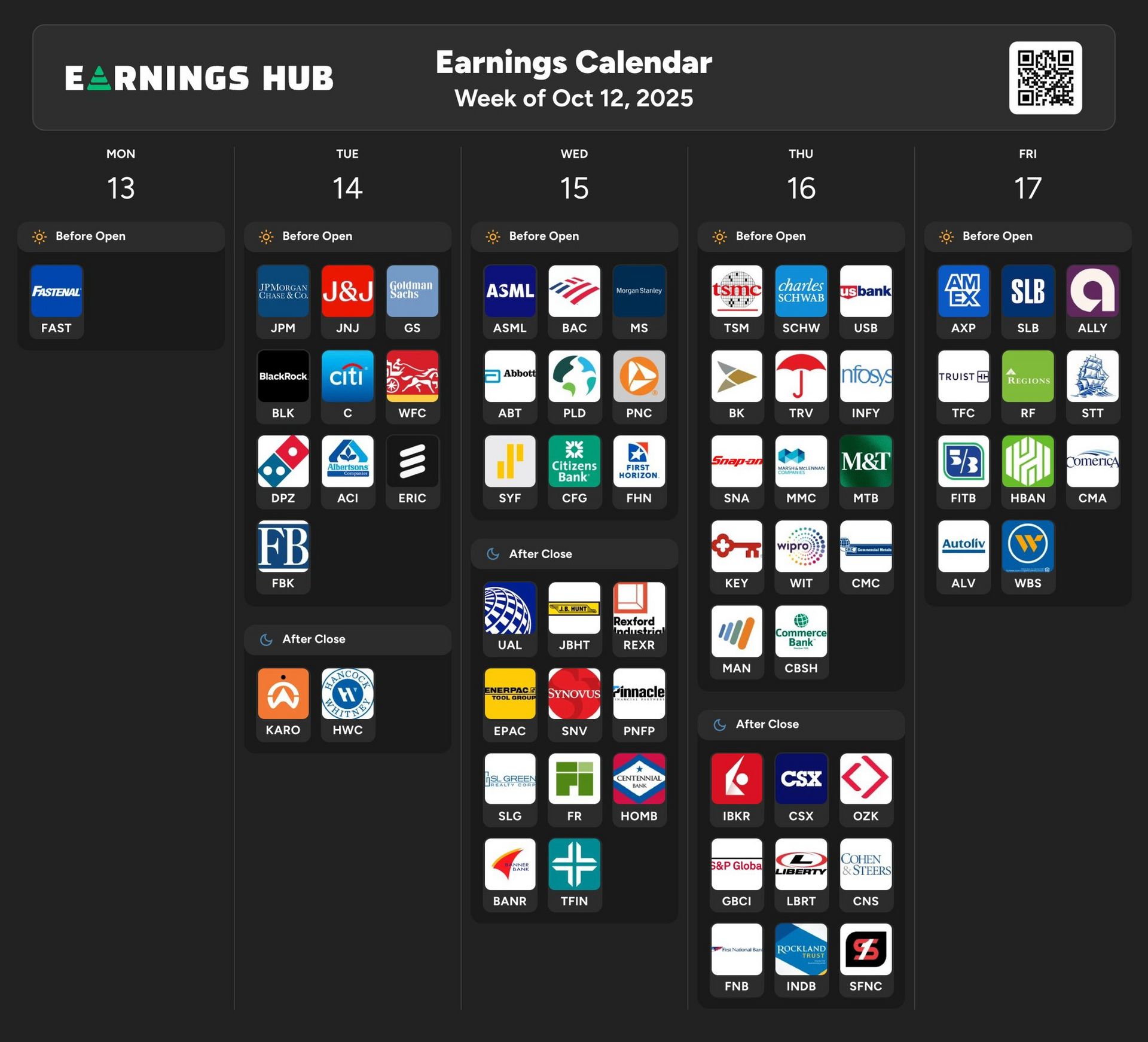

Bank earnings season begins

Earnings season kicks off this week with the big banks. JPMorgan ($JPM), Citigroup ($C), Wells Fargo ($WFC), and Bank of America ($BAC) are all set to report.

Consensus estimates call for 5-7% YoY profit growth, driven by steady net interest income and easing credit loss provisions.

Analysts will be watching loan demand, consumer spending trends, and deposit costs for signs of economic cooling or resilience.

Given the uncertainty around the shutdown and data delays, these earnings will be the first real pulse check on the U.S. economy heading into Q4.

Thanks for reading! Check out more content like this over on my X account.

Have a profitable rest of the week!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.