Welcome to the WOLF Financial Newsletter.

Join over 18,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

THE FOURTH INDUSTRIAL REVOLUTION IS HERE!

My name is Sam. I write articles on growth stocks and macro for the WOLF Financial newsletter.

For more of my content, follow me on X @samsolid57

Friday gave us two signals worth watching.

First, buyers keep showing up. Every dip, every small pull back… buyers are stepping in. That’s been the trend for weeks.

Second, the after-hours sell-off was sharp. $SPY dropped nearly 1% in just a few hours, wiping out all the day’s gains. Why? Moody’s downgraded U.S. debt.

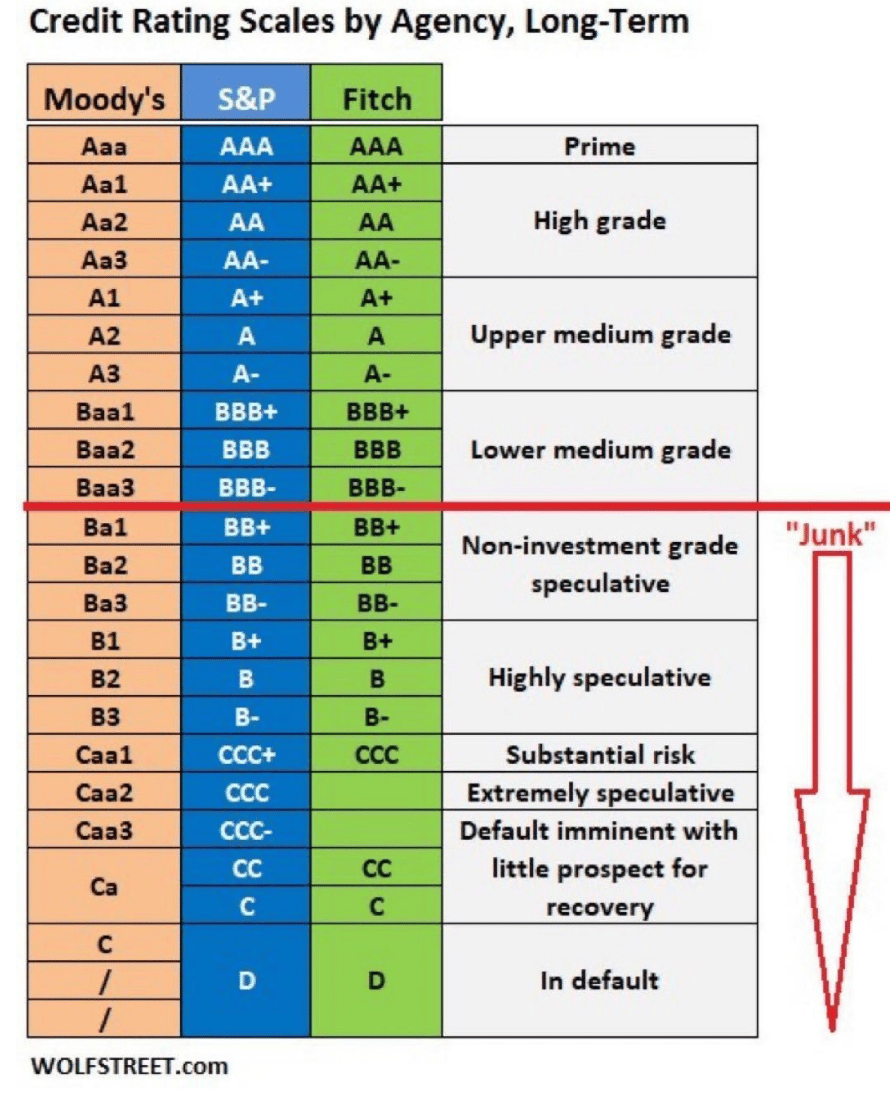

They cut America’s credit rating from AAA to AA1, matching the stance already taken by S&P and Fitch.

Now all three major credit rating agencies agree: the U.S. sits at AA+, not the pristine AAA it held for decades.

Moody’s pointed to rising fiscal risk, the recent tariff escalation, and long-term uncertainty… not a lack of ability to pay, but growing concerns about sustainability.

Naturally, people panicked.

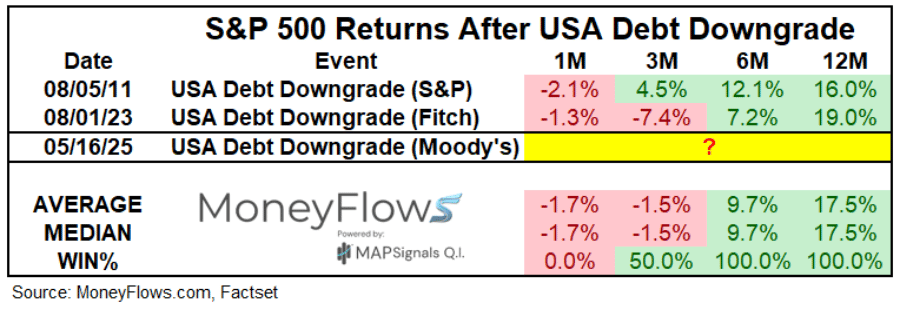

Social media lit up with 2011 flashbacks. S&P’s downgrade back then led to a massive correction. Others pointed to 2023, when Fitch downgraded and stocks followed with a multi-day slide.

But here’s the key, this time is different.

Back in 2011, the downgrade broke things.

Contracts, especially those tied to collateral and treasury holdings, were written to allow only AAA-rated securities. So when the U.S. lost that label, institutions were forced to sell Treasuries, creating a mechanical and sudden drop.

But after that, the system adjusted. Contracts were rewritten to say “U.S. government securities” instead of requiring a specific AAA rating. The market evolved.

By 2023, when Fitch downgraded, there was no structural fallout. The 1-1.5% selloff was more about recession fears and profit-taking after a huge rally. Not credit panic.

Now it’s 2025. Moody’s is just catching up. There’s no new information. The downgrade was widely expected. It doesn’t change the status of Treasuries. It doesn’t force institutions to sell. It just makes headlines.

Yes, we saw a 1% dip. But by Sunday, the market had already retraced half of that. Bonds sold off briefly, but found support. If yields remain stable, this story dies out. If yields spike, we’ll reassess… but the downgrade alone isn’t the trigger.

Let’s zoom out.

We just rebounded from one of the fastest bear markets since 2020. That drop wasn’t about earnings, balance sheets, or credit events. It was front-running tariff fears. And those fears proved overblown. The rebound since has been aggressive.

So did this downgrade reintroduce real uncertainty?

Maybe for a minute. But the market reaction looks like headline whiplash, not a fundamental shift.

If you’re bearish now, ask yourself, what’s your edge?

Are you trading a structural change… or just reacting to the news cycle?

Selling after a 1% drop, at the tail end of a 25% rally, on expected news, isn’t strategy. It’s emotion.

And if that’s your thesis? It’s weak.

I’m still long. Trimmed risk where it made sense, but I’m not flipping bearish on Moody’s.

The downgrade didn’t surprise me. It didn’t change the data. And it sure didn’t break the system.

If this market rolls over, it won’t be because of a recycled headline. It’ll be because of rates, liquidity, or a macro curveball we haven’t seen yet.

Until then, I’m sticking with the trend, and tuning out the noise.

Do you know what provides the alpha in my portfolio? My weekly swing trading setups and stock market analysis…

Check out my SubStack: Hidden Edge Capital - See link below for my latest analysis on $NBIS Nebius!

Have a Blessed Weekend!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.