Hey there! My name is Nate and I write for WOLF Financial. If you enjoy learning about trading, I guarantee you’ll also enjoy my content on 𝕏 @tradernatehere. Thanks for reading!

This service is for general informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice. These are my opinions and observations only. I am not a financial advisor.

The news cycle is never ending and full of surprises that can impact the charts you have come to know and trust.

News events can blow up a chart with complete disregard for support and resistance levels, RSI, or moving averages.

And we have a lot of news coming in 2024. A whole lot.

This week I thought it would be a good idea to touch on what you can expect next year and a few tips on how to navigate these events as a trader.

Here’s a few charts to keep an eye on and what to look for:

Interest Rates

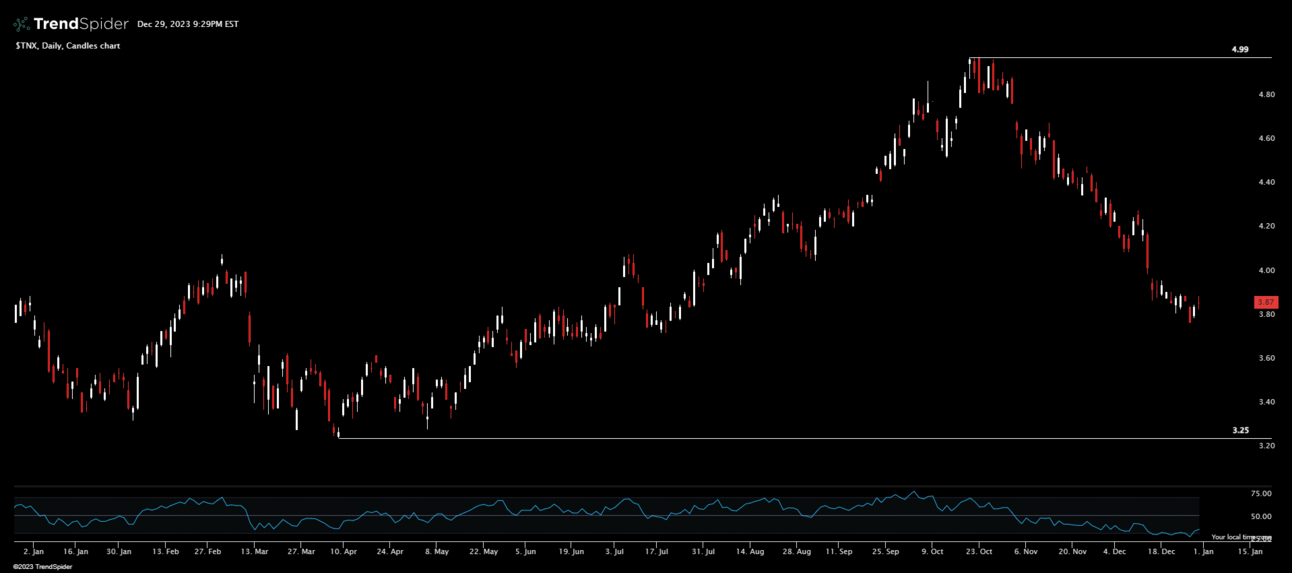

TNX (10-year Treasury Note) daily candles for 2023.

When central banks, like the Federal Reserve in the U.S., cut interest rates, it's generally to stimulate the economy.

Lower interest rates make borrowing cheaper, encouraging businesses to invest and consumers to spend.

For traders, this can often lead to bullish market sentiment. However, it's important to watch out for the underlying reasons for the rate cut.

If it's due to economic weakness, the positive effects might be short-lived and charts will quickly reflect that.

Unemployment Numbers

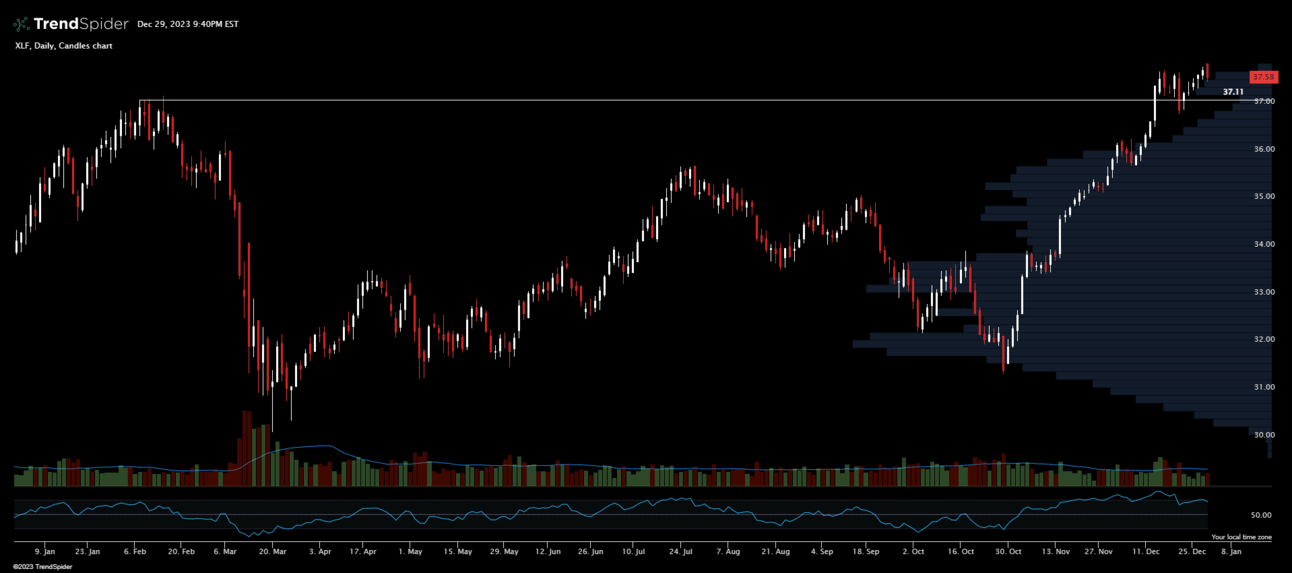

XLF (Financials) daily candles making new highs to close 2023.

Unemployment figures are a key indicator of economic health.

A decrease in unemployment often signals a strengthening economy, which can boost market sentiment.

Conversely, an increase can indicate economic slowdown, potentially leading to bearish sentiment.

Throughout 2023 the talk of a looming recession was persistent but it never came. That was in large part due to the strength of the labor market.

A strong labor market creates credit worthy borrowers. Banks do better when the economy does better and the financial sector just made new recent highs.

Consumer Strength

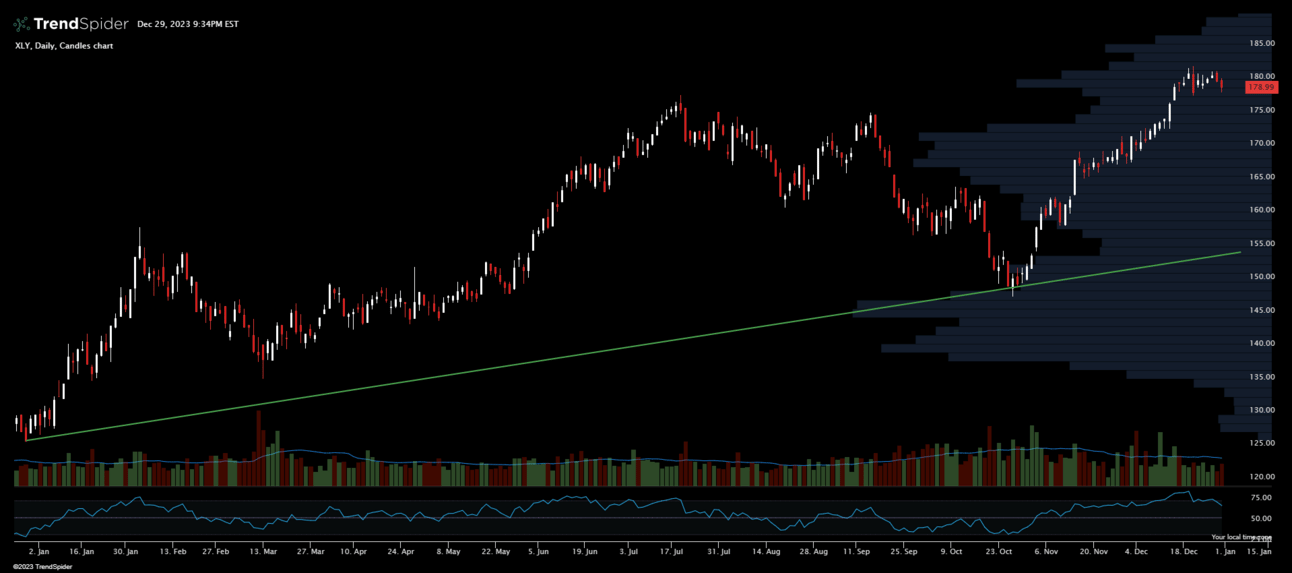

XLY (Consumer Discretionary) daily candles for 2023.

Consumer strength can be gauged through various indicators like consumer confidence, retail sales, and personal spending.

Strong consumer spending can signal a healthy economy, as it makes up a significant portion of GDP.

If these indicators show weakness, it could be a sign of economic slowdown or even recession.

As long as the consumer continues to buy items that are a “want” and not necessarily a “need” there is some indication of strength.

Keep close watch on spending patterns in 2024.

United States Elections

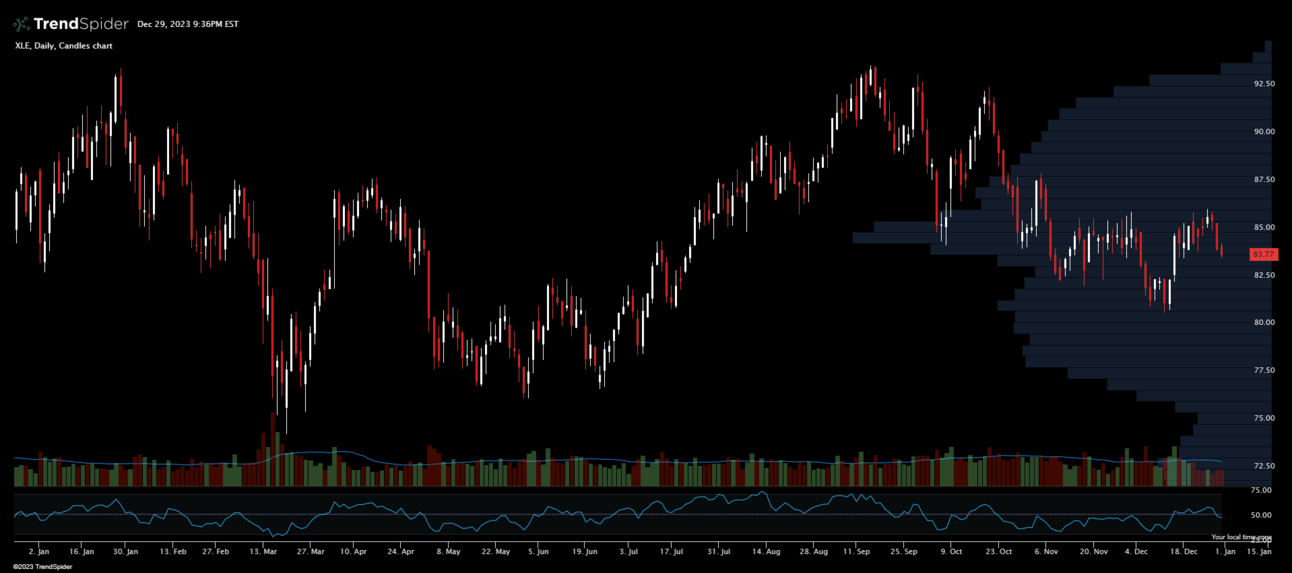

XLE (Energy Sector) daily candles for 2023.

Elections can bring uncertainty, which markets generally don't like.

Policy changes, potential regulatory shifts, and economic plans of candidates can all impact different sectors in different ways.

As things become clear and the winners are obvious, markets will react accordingly. This is almost always a move up as certainty for markets is always a good thing.

Traders should stay informed about the positions of candidates and consider how they could impact the sectors they're trading in.

Thank You!

Thank you all for reading and continuing to support the newsletter. We hope you find these Sunday posts full of helpful trading information.

If you know someone that would enjoy the newsletter, use the link below to share and get in on our monthly trade ideas.

Have a great week of trading ahead and a safe start to the new year.

-Nate