Hey there!

Welcome to the WOLF Financial Newsletter.

Join over 13,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

Tariffs will force certain manufacturing jobs to return to the US.

But will everything be more expensive as a result?

Here are compelling arguments for and against prices rising:

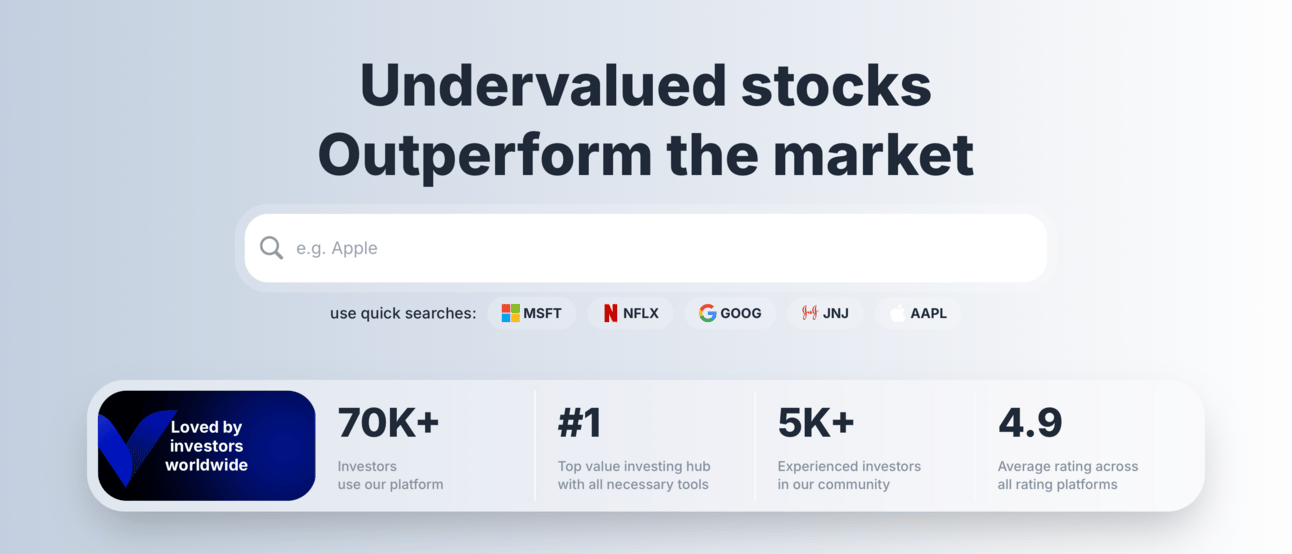

I hate spending every waking moment researching stocks.

That’s why I use Value Sense, they do a lot of the research for me.

Check this out:

Value Sense has every relevant metric for every relevant stock on the market.

All bundled up in one spot for you to analyze.

Gone are the days of multiple monitors, Bloomberg Terminal, or anything else.

You can just type in the name of a stock, analyze it, and make a decision.

I’ll start by arguing that prices won’t rise.

The standard argument is that labor is cheaper overseas.

Which is why products manufactured in China, Vietnam, etc, are less expensive.

But here’s the problem.

Labor is indeed cheaper overseas.

But labor is only one aspect of the equation.

You also need to factor in:

• Inventory

• Shipping

• Quality

• Energy

• Waste

• Time

And so much more.

In China, shipping is expensive. In the US, it’s local.

In China, everything takes longer because products need to travel to the US.

In China, quality is inconsistent (sometimes it’s great, sometimes it isn’t)

In China, there’s geopolitical risk that can disrupt supply chains.

In China, inventory holding costs are higher because production and shipping delays require more stock on hand.

You can cherry-pick countries, products, and situations where this applies.

But the point is that labor costs are only one variable.

There are dozens, perhaps hundreds, of other factors to account for.

If the US improves in these factors, it could offset its disadvantageous labor costs.

Now I’ll make the argument why prices WILL rise 👇

The labor cost discrepancy compared to Asian countries is too high.

And the US also can’t lower its labor costs thanks to:

• Cost of living

• Smaller US labor force

• Unions and employee benefits

• Minimum wage exceeding China’s factory wages

But it gets worse: the Chinese yuan is weaker than the U.S. dollar.

So even if a Chinese worker earns less on paper, their wages go further at home.

This makes labor even cheaper for global companies paying in dollars.

So…what do you think?

Can the US make up for its labor costs in other avenues?

Or is it perpetually screwed when it comes to reshoring operations?

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.