Hey there! My name is Jordan and I write about trading for the WOLF Financial newsletter. If you are looking for more trading tips and tricks, I guarantee you’ll enjoy my content on 𝕏, @AcetheKidTA.

Thanks for reading!

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more here.

A very interesting market this past week to say the least. The days everybody thought would be the worst were arguably the best trading days of the week.

Most of the week was pretty quiet, but Wednesday and Friday had some pretty killer price action. This goes to show that the best thing we can do as traders is show up and see what the market has to offer.

Rather than saying, “I’m not going to trade, today will be terrible.” I like to approach it with a let’s see what happens kind of mindset. If I see opportunities that I like, I don’t care if it’s OPEX, the day before Thanksgiving, or any other kind of holiday.

These things lie to you. Seasonality makes you expect a certain outcome for a month which inherently puts a bias in your head. Instead of just following price action and letting the language of the market speak to you.

Price Action Never Lies

Many people on social media will mention things like seasonality, economic data points, and any other events and will say it should go in a certain direction.

The problem with that is the market does what it wants and it doesn’t care about any of us. If you followed what many of these people said you likely lost money.

What I’m getting at here is those things will lie to you and not always be correct. Whereas price action never lies. Sometimes we have bad data and the market still rips, that’s the market telling us that it doesn’t care about that right now just focus on my and what’s happening on the screen right now.

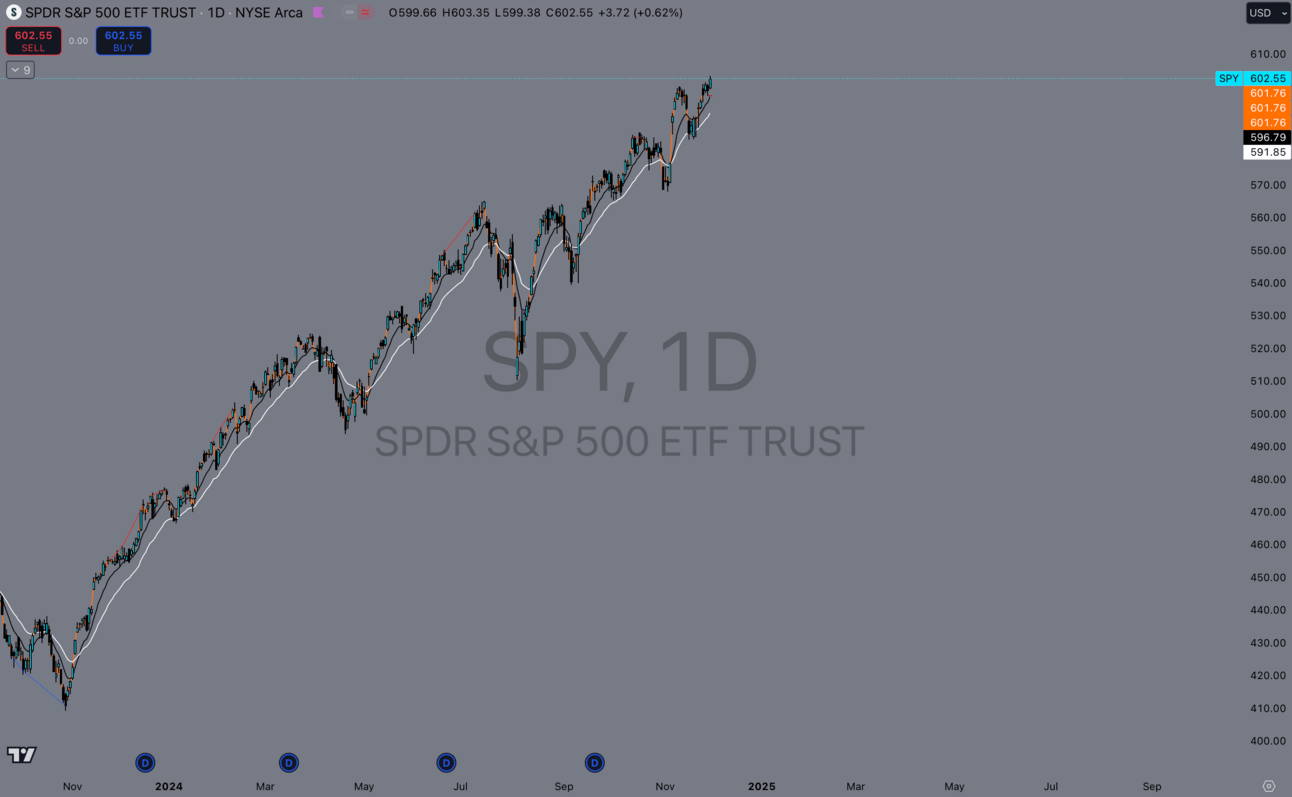

$SPY Daily

This is where the Bears lost the fight this year. They continued shorting a market that had strong price action with no indications of it reversing just because of outside theories and thoughts instead of focusing on what was happening right in front of them.

Forcing an idea out of thin air and praying for it to happen on the chart instead of riding the wave of the chart and just following price action.'

On this thought, I want to say it is good to be aware of data coming out and seasonality and things like this, but at the end of the day, it should NOT be deciding trades for you. I’m always aware of seasonality for certain months, but that does not mean I’m going to take trades just because the seasonality of September is bearish.

NO!

If price action lines up with that thesis then great, I have multiple points of confluence. Otherwise, it is irrelevant to me.

I hope this helped people and maybe gets you more prepared for what’s to come in the market ahead.

Thanks for reading and have a great week!

-Jordan