Hey there!

Welcome to the WOLF Financial Newsletter.

Join over 13,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

Fannie Mae & Freddie Mac are the reason why 30-year fixed mortgages exist.

They nearly collapsed in 2008 but were saved by the government.

Trump wants to cut their government safety net in his next term.

Here’s what that means for 30-year fixed mortgages in the US:

On January 15th, Bill Ackman gave a presentation on Fannie Mae & Freddie Mac.

I found the presentation so insightful I decided to summarize it here + give my own thoughts.

Few investors realize just how important this is.

Let’s dive in 👇

First, let’s take a short trip through history to highlight the importance of these 2 institutions.

Fannie Mae was created in 1938 to provide liquidity in the mortgage market during the Great Depression.

Before Fannie Mae, mortgages had 5 to 10-year terms with floating interest rates.

Thanks to Fannie and their FHA-insured loans, the 30-year mortgage was born.

Fannie Mae started as a fully government-owned entity.

In 1968, it became a for-profit and shareholder-owned enterprise.

In 1970, Freddie Mac was founded to compete with Fannie Mae and prevent it from being a monopoly.

Together, Fannie and Freddie are considered Government-Sponsored Enterprises (GSE)

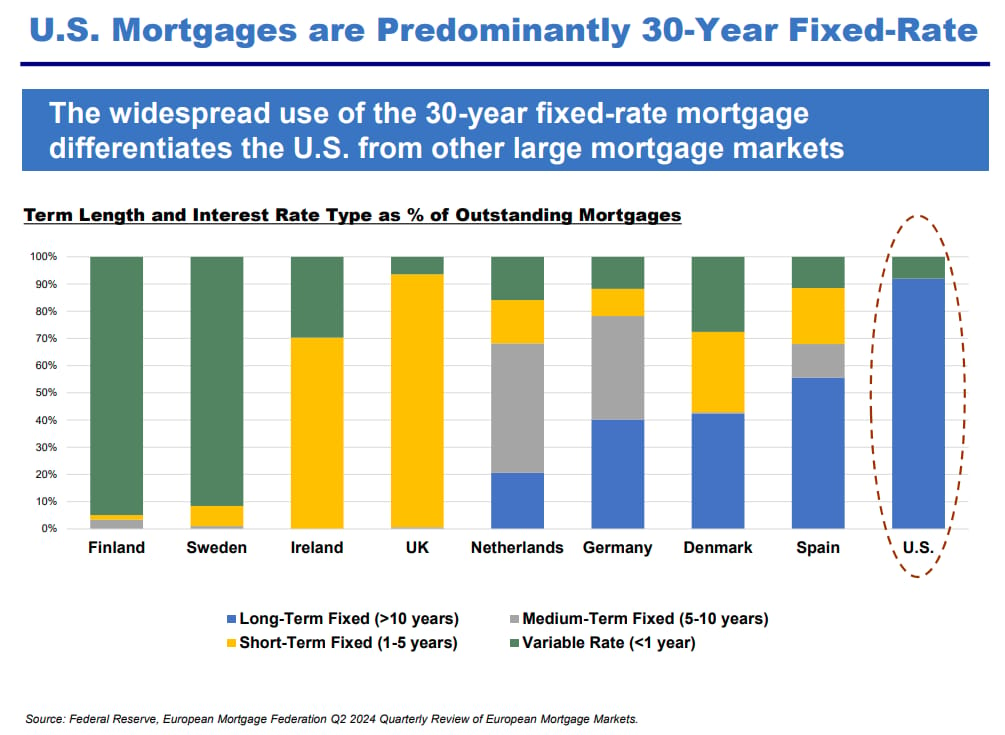

The GSE’s impact on the mortgage market in the U.S. is staggering.

Look at the percentage of Americas > 10-year fixed mortgages compared to other countries.

Thanks to the GSE, we have 30-year mortgages with smaller monthly payments.

Unfortunately, Fannie and Freddie played a big role in the 2008 collapse.

These GSEs expanded their portfolios to include riskier loans like subprime and Alt-A mortgages.

Too much leverage from the GSEs and private sector resulted in the GFC.

The government saved the GSEs by pumping them with liquidity and restoring their balance sheets.

However, they were placed under conservatorship in exchange.

Conservatorship essentially means the government has oversight of BoD and financial decisions with the GSEs.

Including capital management, risk management, and compensation.

17 years later, conservatorship with Fannie and Freddie is still ongoing.

Once the GSEs are ready, fully privatizing them would be extremely bullish for their stocks thanks to:

Ending conservatorship undervaluations

Solving legal uncertainty

Return to private ownership

Their stocks never returned to their pre-2008 prices.

Ending conservatorship could change that.

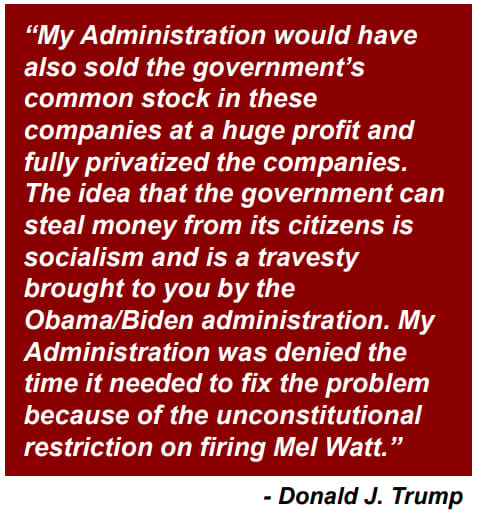

Trump wanted to make this a reality during his first term.

However, he was stopped short.

It’s likely Trump will end conservatorship this term.

However, before doing so, he needs to make sure that:

GSEs maintain the availability of 30-year fixed-rate mortgages

GSEs can protect taxpayers from another housing downturn

Government involvement in the housing finance system is minimized

GSEs can maximize profitability from successful private capital raises

Taxpayer profits are maximized on Treasury investment in the GSE

Here are the 4 ways Trump can make it happen:

1 - Set Appropriate Capital Requirements

GSEs currently have 4% capital requirements of their total assets and guarantees.

That’s too high for the GSEs to attract sustainable private investment.

The solution is a 2.5% capital requirement.

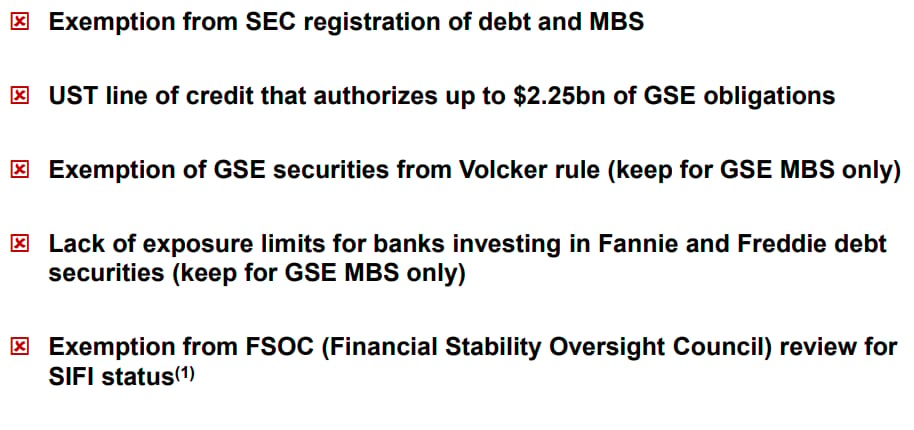

2 - Limit Government-Granted Benefits

Conservatorship benefits that don’t benefit the mortgage market should be eliminated.

The following should change:

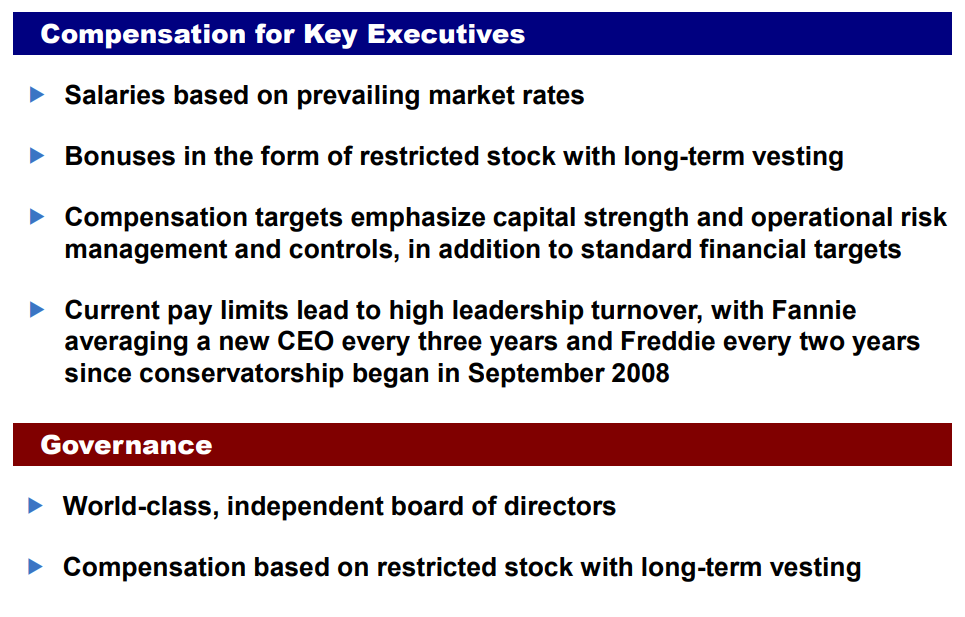

3 - Develop Market-Based Compensation & Governance

Re-privatized GSEs need to be aligned with public interests.

4 - Clarify the Nature of the Government Backstop

A direct government guarantee for these GSEs isn’t necessary.

Instead, existing Preferred Stock Purchase Agreements should be modified to act as a government backstop.

They’ll provide the same benefits as an explicit government guarantee without the negatives.

If Trump plays this correctly, we can have a fully privatized Fannie Mae & Freddie Mac once again.

This could be a massive opportunity for investors.

Keep your eyes peeled on what the Trump administration does going forward.

Interesting times ahead.

Looking to take your investing game to the next level?

Download the Blossom investing app to converse with 100k+ investors.

Plus, you’ll get a peak at my investment portfolio.

It’s free — give it a try: https://www.blossomsocial.com/wolffinancial