Another big week, but let’s talk micro.

I’ll be real… I don’t want to dive into the broad markets again. Feels like we’ve been chalking up the same $SPY ( ▲ 0.72% ) and $QQQ ( ▲ 0.89% ) narratives for the past three months. So let’s zoom in.

Still macro… but let’s make it specific.

Today’s focus: S&P 500 inclusion.

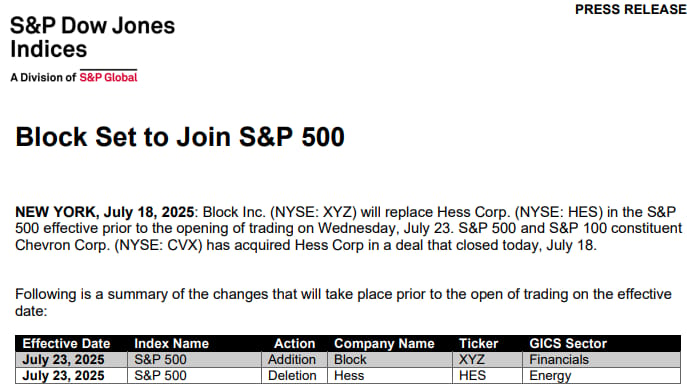

We just had a surprise entry… $XYZ ( ▲ 0.62% ) Block is officially joining the $SPX ( ▲ 0.69% ) S&P 500.

This came in after the acquisition of $HES ( ▲ 0.96% ) Hess by Chevron $CVX ( ▼ 0.46% ) finally went through. The timing caught some people off guard since the deal wrapped faster than expected. But that’s not what got most folks talking. The real buzz? Who didn’t make it in.

A lot of eyes were on $HOOD ( ▲ 0.61% ) Robinhood and $APP ( ▲ 1.62% ) AppLovin. For several rounds now, people thought they had a real shot at getting the nod. This reminds me of when $PLTR ( ▲ 0.26% ) Palantir was the retail favorite that everyone thought had to be added... and yet it got snubbed repeatedly.

People argued, “It’s the best stock!”

“It’s profitable!”

“It’s better than half the S&P already!”

Even our Prospero.ai indicator is VERY bullish the stock short-term!

But S&P inclusion doesn’t care about your favorite stock. It’s not about what we think. It’s not even necessarily about profitability or fundamentals in comparison. It’s a board decision… one made behind closed doors, with criteria no one fully understands.

That said… Palantir eventually made it. And I promise you, one day, Robinhood probably will too.

It meets the criteria. So does AppLovin. But it wasn’t their time.

Instead, Block got the seat at the table. Another FinTech. Not expected by most. But here we are.

The lesson? Stay patient. Stay in the game. Own high-conviction names with solid long-term risk/reward. And while you’re waiting, there’s always room for tactical trading… which brings us to this week’s action.

Weekly stock deep dives, market breakdowns, and financial tips, just $9/month.

Join hundreds of subscribers leveling up in 2025.

I want to be Financially Literate.