Welcome to the WOLF Financial Newsletter.

Join over 18,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

The market just got hit afterhours with a curveball as $NVDA ( ▼ 4.17% ) told suppliers to pause H20 chip production for China, raising questions about ripple effects across the supply chain. With Powell’s Jackson Hole speech tomorrow and memories of past 10% corrections, investors are on edge to see if this is the spark for a pullback or just noise in an ongoing trend.

NVIDIA HALTS H20 PRODUCTION

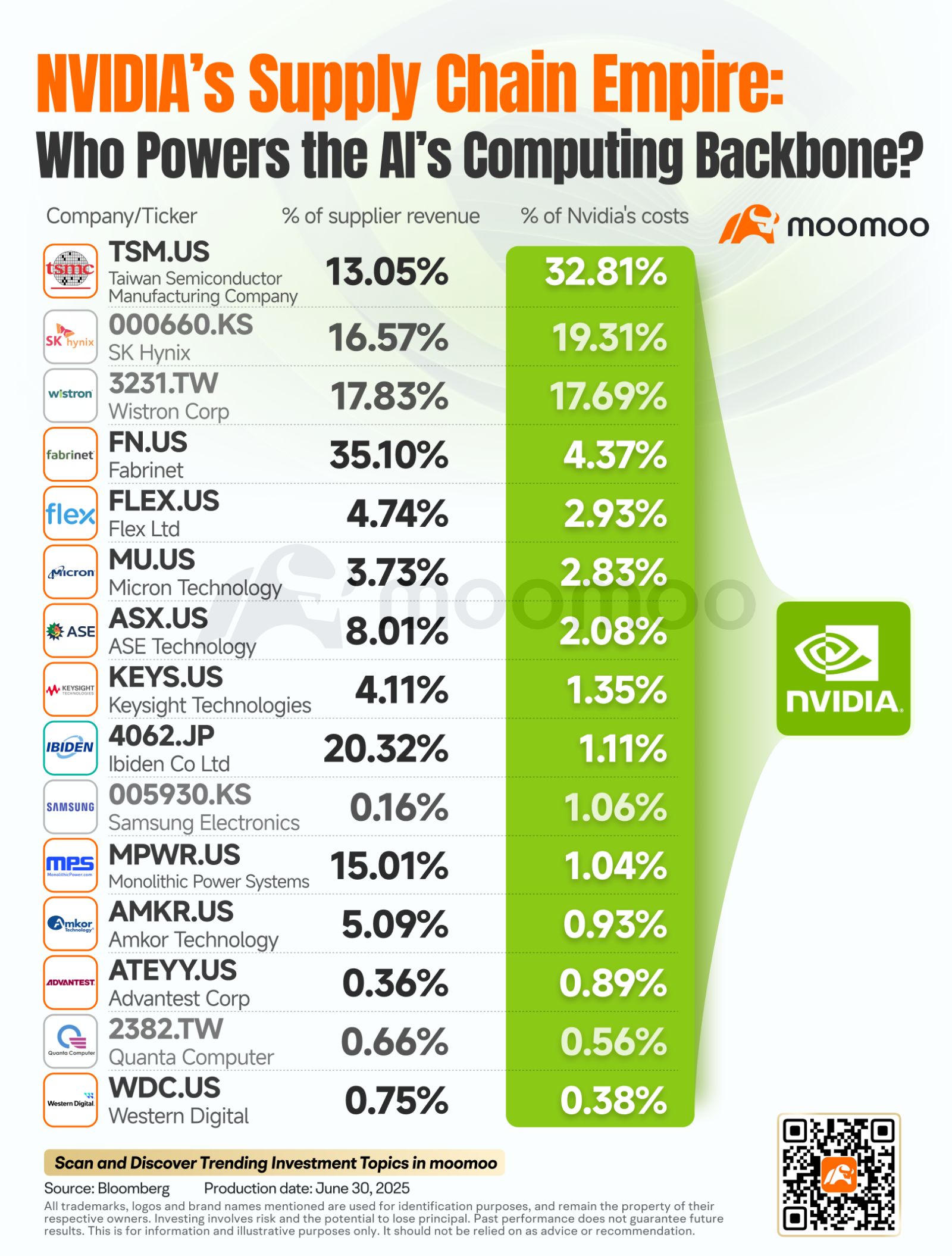

NVIDIA reportedly told suppliers to suspend production of its H20 chips, the export-compliant GPUs built specifically for China. $AMD ( ▼ 1.7% ) may follow with its MI308 series, and this ripples directly into suppliers:

$ALAB ( ▼ 4.68% ) Astera Labs and $MU ( ▼ 0.77% ) Micron, who provide connectivity and HBM3E memory components

Other partners tied to the H20 supply chain

China was expected to represent nearly $20B in revenue for these chips, meaning this halt has implications beyond NVIDIA itself. For now, the market will be watching how quickly supply resumes and whether AMD’s roadmap adjusts.

JACKSON HOLE AND A PULLBACK?

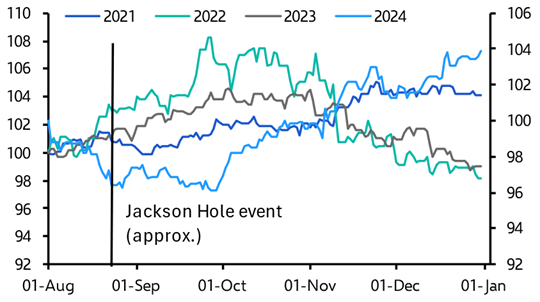

The timing adds fuel to market nerves. Chair Powell speaks at Jackson Hole tomorrow, and historically the last four speeches were followed by 10% drawdowns or corrections.

We doubt history repeats exactly, but a pause or rotation wouldn’t be shocking. The market already priced in softness around U.S.-China chip dynamics, and indices are circling the 20-day moving average. We see more sideways chop than a steep correction, but sentiment could swing fast depending on Powell’s tone.

While the headlines dominate around chips and Jackson Hole, execution in our own trades matters just as much.

That’s why I use TradePath, a platform that makes it simple to track positions, journal trades, and analyze results… the same way we manage entries and exits here.

If you want to sharpen your own process, check them out.

Now, in today’s Premium Section, we’re locking in profits on two big winners and resetting our playbook as the market tests key levels.

Weekly stock deep dives, market breakdowns, and financial tips, just $9/month.

Join hundreds of subscribers leveling up in 2025.

I want to be Financially Literate.