In partnership with

Hey everyone! Sam here (AKA @SamSolid57 on X)

I drop into your inbox a few times a week, breaking down the biggest stories in finance and the moves that matter most.

Let’s get into it

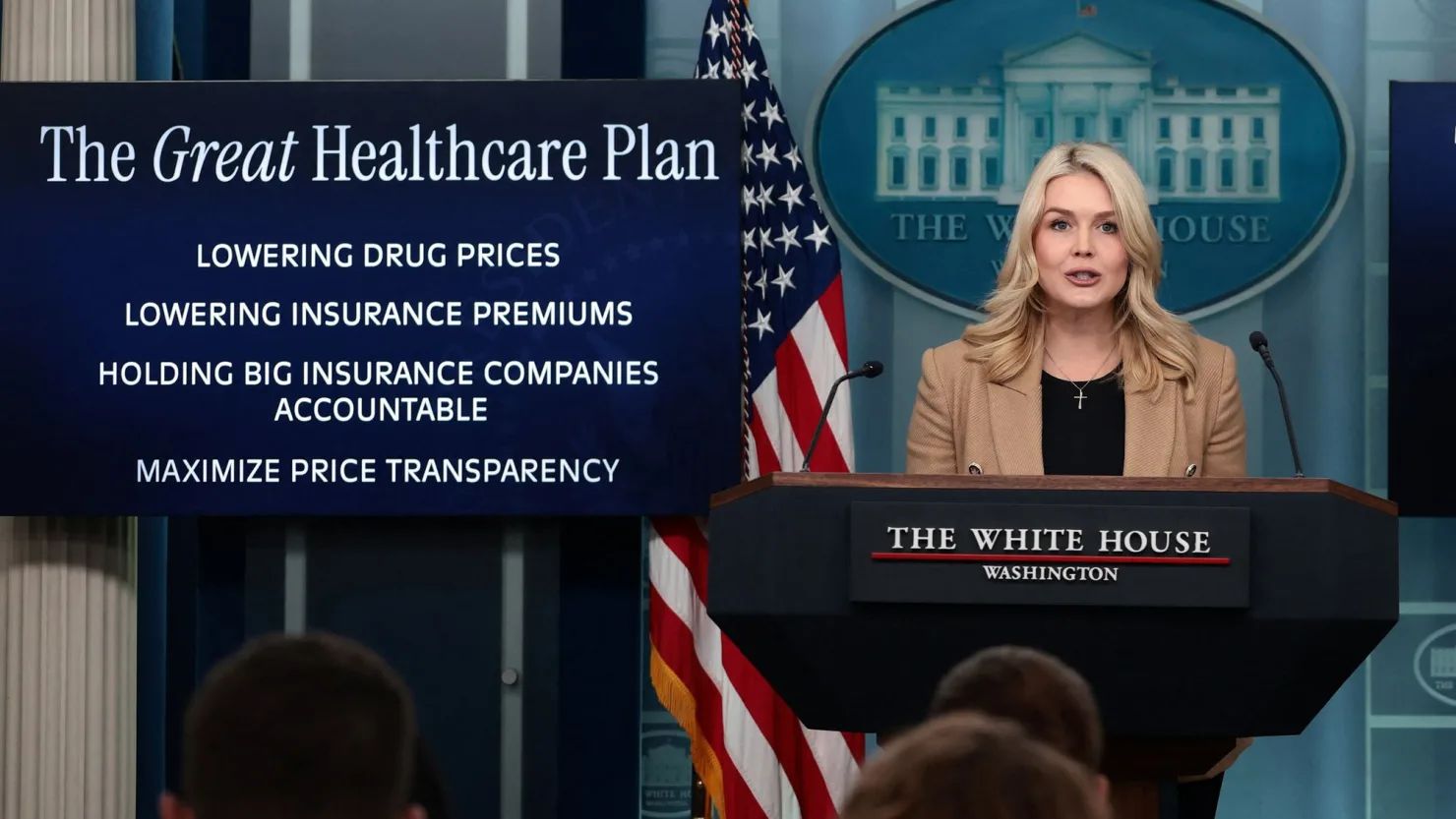

A New Healthcare Framework Takes Shape

Donald Trump outlined a new healthcare framework called the “Great Healthcare Plan,” aimed at lowering prescription drug prices and insurance premiums. The proposal comes as efforts to extend key Affordable Care Act tax credits stall in the Senate, raising the risk of higher premiums. The White House positions the plan as cost relief rather than expanded insurer subsidies.

The framework would lock in most-favored-nation drug pricing, expand direct-to-consumer discounted drug sales, and redirect insurance funding to individuals instead of insurers. It also includes cost-sharing reductions that could lower common Obamacare plan premiums by over 10%, plus broader price-transparency rules. The political appeal is clear, even if execution remains uncertain.

Seek Weekly Income. Maintain Equity Exposure.

YieldMax® Option Income ETFs are designed to generate income by selling call options or call spreads and distributing the premium generation back to shareholders, offering an alternative income source alongside traditional equity exposure.

YieldMax® ETFs offer a family of option income strategies designed to generate attractive weekly income while maintaining exposure to individual stocks or diversified portfolios. By selling call options or call spreads, YieldMax® ETFs distribute premium income back to shareholders, providing an income focused approach for investors seeking yield potential without stepping away from equity exposure.

With both single stock and thematic portfolio offerings, YieldMax® provides option income strategies that may complement traditional equity allocations in today’s evolving market environment.

Explore the full ETF lineup at YieldMaxETFs.com

The U.S.-Taiwan Chip Deal Resets the Trade Narrative

The U.S. and Taiwan reached a trade agreement to expand semiconductor manufacturing in America. Taiwanese chip firms committed at least $250B in U.S. investment, backed by $250B in credit guarantees. In exchange, the U.S. will cap tariffs at 15%, remove some duties, and grant Section 232 exemptions for U.S.-based fabs.

TSMC has already purchased land and may further expand in Arizona, with added flexibility to import equipment tariff-free during construction. The deal reduces supply-chain friction and aligns industrial policy with long-term capacity goals. For markets, it removes a layer of uncertainty around large-scale capex.

TSMC Earnings Confirm AI Capex Is Structural

TSMC beat fourth-quarter expectations, posting NT$505.7B in net profit, up 35% year over year on strong AI demand. The key takeaway was a $52-56B capex forecast, well above expectations and a clear signal that AI investment is durable. Semiconductor equipment names like ASML rallied in response.

Management guided to roughly 30% revenue growth and reaffirmed its role as the primary chip supplier to NVIDIA. Combined with expanding U.S. operations, the message is simple, AI infrastructure spending is becoming embedded, not cyclical.

Thanks for reading! Catch you in the next one!

For more updates throughout the week, follow @WOLF_Financial and @SamSolid57 on X.

Disclosure: Before investing you should carefully consider the Funds’ investment objectives, risks, charges and expenses. This and other information are in each Fund’s prospectus and summary prospectus, which can be obtained at https://yieldmaxetfs.com/. Please read the prospectuses carefully before you invest.

An investment in YieldMax ETFs involves risk, including possible loss of principal.

Distributions are not guaranteed.

YieldMax ETFs are distributed by Foreside Fund Services, LLC.