Welcome to the WOLF Financial Newsletter.

Join over 18,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

$COST ( ▲ 1.26% ) Costco shows why long-term compounding trumps short-term noise, Powell steadies the Fed’s message, and $ORCL ( ▲ 3.42% ) Oracle, OpenAI, and $NVDA ( ▲ 0.68% ) NVIDIA map out the next phase of AI infrastructure.

Costco Resilience in a Downtrend

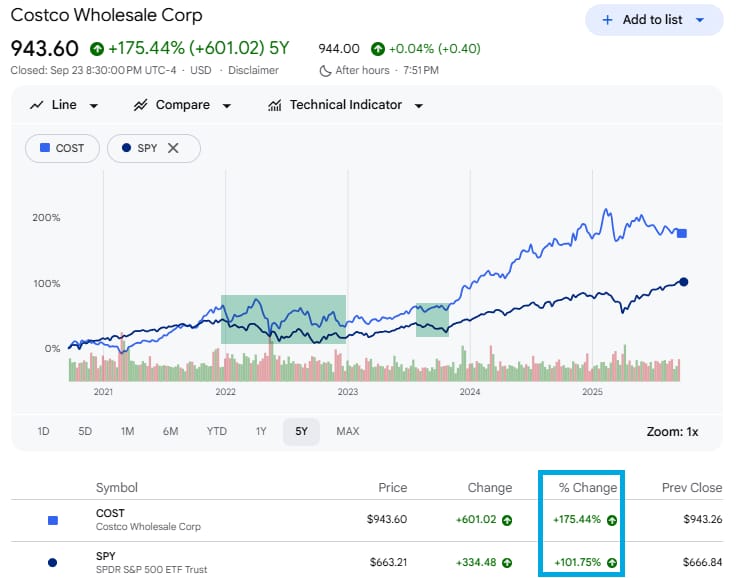

$COST ( ▲ 1.26% ) Costco reports earnings on Thursday and shares have been drifting lower. But zoom out, and the story looks very different: Costco has outperformed the market over the past five years with a steady compounding engine built on membership fees, traffic growth, and operational consistency.

For those looking for higher leverage on the trend, Leverage Shares offers $COTG ( ▲ 2.77% ), a 2x COST ETF. It’s a way to amplify exposure to Costco’s long-term compounding story without stock picking. The short-term pullback may be noise, but the long-term resilience remains.

Powell Signals Caution But Keeps the Door Open

Speaking in Rhode Island, Powell said the Fed must tread carefully: too aggressive cuts could undo inflation progress, while lingering high rates risk hurting jobs. He described the rate stance as “modestly restrictive” and noted that inflation and employment risks are two-sided in nature.

Markets took the tone as moderately dovish. The S&P fell 0.6% after his remarks, yields dipped, and sentiment softened.

Still, this doesn’t flip the long game. The Fed is sending a signal… not a shift. Powell emphasized that policy is data dependent, and that the recent cut was a “risk management” move… not a prelude to aggressive easing.

Oracle, OpenAI, NVIDIA: $1T Computing Build

Tech’s next phase is infrastructure. Oracle, OpenAI, and NVIDIA are reportedly committing to $1 trillion+ in global datacenter investments over time. These aren’t small expansions… they’re structural bets on compute as a utility.

The real leverage won’t just be in GPU makers. Networking, memory, silicon, cooling, and latency optimization will become battlegrounds for the next wind. Even as Powell slows the rate narrative, this tech investment wave gives the equity cycle fuel.

Thanks for reading! Check out more content like this over on my X account.

Have a safe weekend!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.