PRESENTED BY:

No one likes to talk about retirement.

It’s boring, and won’t matter for decades, right?

At least that’s what most people think.

And that’s why most people don’t have enough money to retire.

But what if I told you there was a simple way to retire a millionaire?

What if I said you could do it without paying taxes?

Do I have your attention now?

Good.

I’ll explain after a word from this week’s sponsor:

Pay no interest until nearly 2025.

If you have outstanding credit card debt and large monthly payments, getting a new 0% intro APR credit card could help ease the pressure while you pay down your balances.

Our credit card experts put together a list of the top cards offering extended periods of 0% intro APR on balance transfers and purchases. Apply today to take advantage of these special rates before they're gone.

Now back to today’s email 🤝

The Roth IRA is one of the greatest investment accounts you can open.

But over 90% of people still don’t have one.

So here’s a breakdown of the Roth IRA:

(and why you should open one)

What is a Roth IRA?

Roth IRA stands for Roth Individual Retirement Account.

They’re called retirement accounts because they’re tax-advantaged.

Meaning they provide favorable tax treatment, which I’ll get into later.

But because they’re so powerful, you need to open them up yourself.

Here’s how to do that…

How to open a Roth IRA:

Roth IRAs aren’t accounts you get to opt in to like your 401k.

No one will do it for you.

But opening a Roth IRA isn’t difficult.

In fact, it’s as easy as opening a bank account.

Especially if you use any of these brokerages:

Fidelity

Vanguard

Betterment

M1 Finance

Charles Schwab

There are more brokerages that offer Roth IRAs, but these are the one’s I like best.

How do Roth IRAs work?

Unlike your 401k where pre-tax money gets invested, the Roth IRA uses post-tax money.

Which is fancy talk for money you already paid taxes on.

If you’re employed by someone else, this is the money that enters your bank account.

If you’re self-employed, this is your net earned income.

And because you already paid taxes on the money, the government says you don’t have to pay taxes when you take it out.

So if your investments grow to $1,000,000 the entire amount will be tax-free.

But there’s a catch…

Roth IRAs come with a set of rules related to:

Income

Withdrawals

Contributions

I’ll break down each…

Income:

To contribute to a Roth IRA, you must have earned income.

Earned income is money you made from:

Tips

Salary

Wages

Commissions

Net earnings (self-employment)

But that’s not all…

You can also make too much money.

Here’s what I mean…

Making too much money:

There are income limits for Roth IRA contributions.

Here’s a chart from the IRS that explains:

Boring, I know.

Basically, if you’re single and make more then $144,000 you can’t contribute to a Roth IRA at all.

And the same applies if you’re married and make more than $214,000.

Lucky for you there’s a way around that…

My friend Brennan explains it perfectly in this thread here:

Anyways, notice how the IRS says “up to the limit.”

That’s because you can’t contribute an infinite amount of money to a Roth IRA.

Here’s what I mean…

Contribution limits:

For 2023 the maximum contribution to a Roth IRA is $6,500.

If you’re age 50 or older, you can contribute up to $7,500.

These amounts phase out the more money you make.

Refer to the chart above to see when that happens.

Withdrawals:

There are some other limitations to Roth IRAs too.

Specifically, with when you can take out your money.

For your money to be tax-free, you must wait until your account is at least 5 years old and you’re age 59 ½.

If you withdraw early there are penalties…

Early withdrawal penalties:

If you withdraw from a Roth IRA before age 59 ½ and before the account is 5 years old you must pay a 10% penalty + income taxes on the withdrawal.

But does this mean you can’t withdraw ANY money at all?

No.

Like al things in finance, there are exceptions…

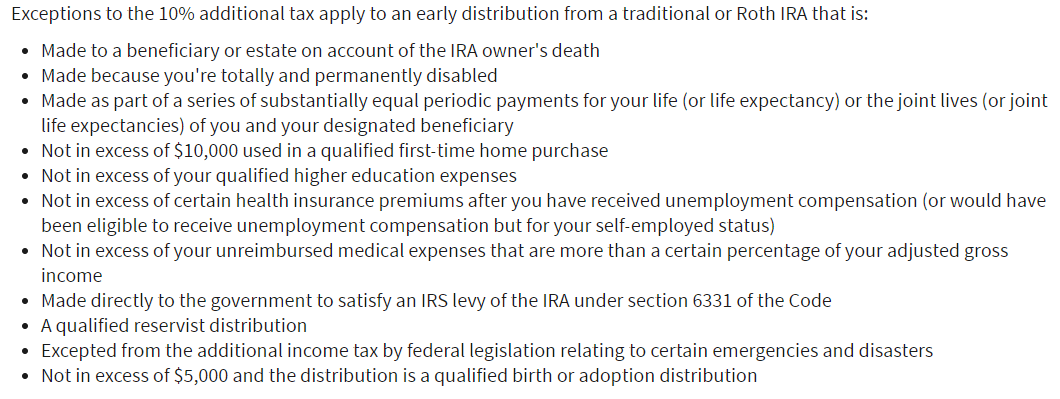

Withdrawal exceptions:

You can withdraw Roth IRA contributions at any time.

Meaning you can withdraw up to the total amount of deposits you’ve made.

Penalties and taxes come into play when you withdraw earnings.

But that’s not all…

There are more exceptions.

But these exceptions only apply to the 10% penalty, not the income taxes on the early withdrawal.

Here’s a list from the IRS:

Now I don’t expect you to read all that.

So here are the ones I think are most important:

$10,000 towards your first home purchase

Withdrawals from your beneficiary if you die

Total and permanent disability

Qualified higher education expenses

Obviously, they’re ALL important, but I think these would apply to most people.

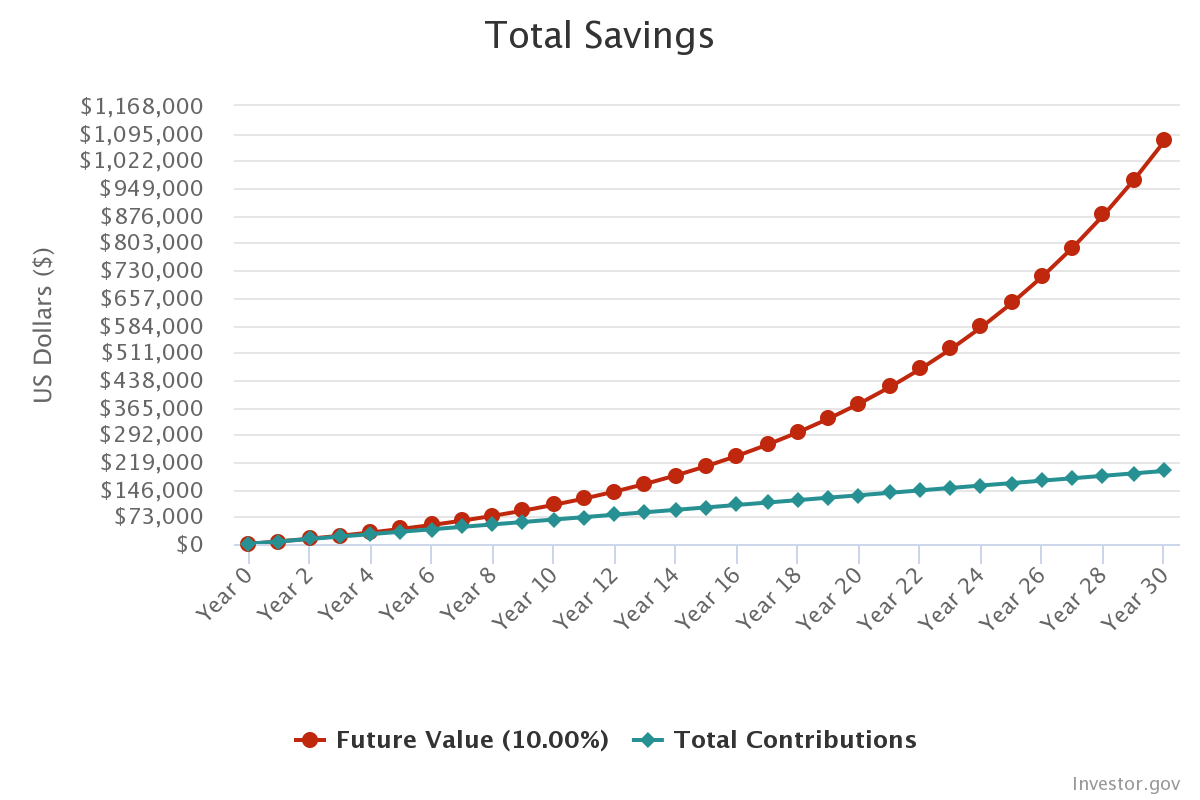

But despite all the rules, the Roth IRA is still the easiest way for you to retire a tax-free millionaire.

Here’s how:

Invest $540 a month for 30 years and you’ll have $1.1 million free and clear.

That’s the power of the Roth IRA.

That’s it for today’s email.

See you in the next one.

Wolf.