Welcome to the WOLF Financial Newsletter.

Join over 18,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

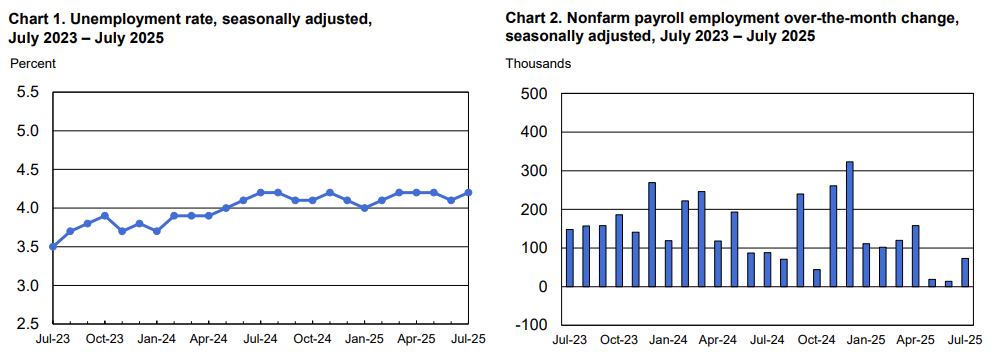

MARKETS RESET ON JOBS DATA

Last Friday blindsided the market... not earnings, not the FOMC... but a massive revision to U.S. job data.

According to the latest update, non-farm payrolls for May were revised down by 125,000 (from +144,000 to +19,000), and June was revised down by 133,000 (from +147,000 to +14,000). In total, May and June payrolls were overstated by 258,000 jobs.

This wasn’t just noise, it reshaped the narrative around labor strength, wage pressure, and Fed policy. Decisions made on top of inflated data now appear far less grounded.

The market sold off on the headline... but quickly reversed and recovered into Monday. This wasn’t a signal of new weakness, it was a reset of outdated assumptions. And for risk assets, that reset might’ve been exactly what was needed.

PALANTIR: TRANSITIONING FROM HYPE TO INFRASTRUCTURE

Palantir delivered a standout quarter, and not just in the top line.

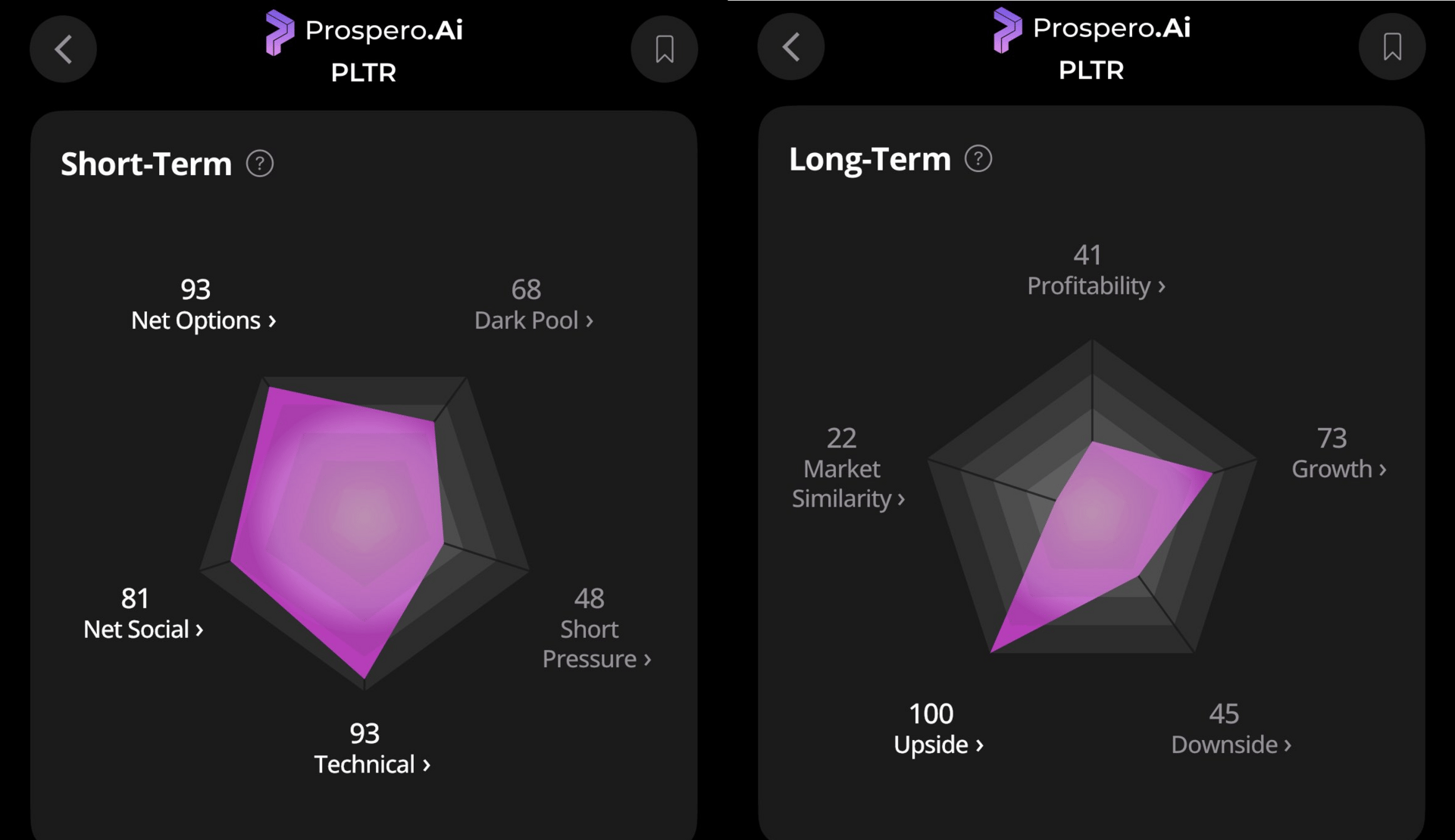

The best part? Our favorite tool, Prospero.ai, gave it a perfect 100 score on Long-Term Upside. If you’re not using this tool, you’re seriously missing out. $PLTR ( ▲ 0.92% ) jumped 7% after earnings!

Revenue surpassed $1 billion, up 48% YoY, marking its first billion-dollar quarter

U.S. commercial revenue soared 93% YoY, with government sales also showing strong growth

Solid GAAP operating income and continued profitability

But more important than the numbers, Palantir is becoming a core part of enterprise and government AI workflows. Companies are embedding its platform across operations, automating insights, and reducing time-to-value. In many cases, the cost of not using Palantir is higher than sticking with it.

This isn’t speculative AI... it’s operationalized intelligence.

INFRASTRUCTURE BENEFICIARIES: ALAB & ANET

Under the radar, two companies posted results that signal real momentum in AI infrastructure adoption:

Astera Labs $ALAB ( ▼ 4.68% ) reported $191.9M in revenue, up 150% YoY, crushing expectations

Arista Networks $ANET ( ▲ 2.5% ) continued to show robust growth in 400G and 800G switching, tied directly to AI bandwidth needs

These aren’t just momentum names. They’re providing the backbone for hyperscaler data center expansion. As GPU clusters scale and inference loads multiply, companies like ALAB and ANET are at the center of it.

And now onto the PREMIUM SECTION!

As a preface, we just hit a monster gain on $BTCL ( ▼ 5.44% ) as our first play and have locked in 40% gain on our recent China positions. Subscribe now!

Weekly stock deep dives, market breakdowns, and financial tips, just $9/month.

Join hundreds of subscribers leveling up in 2025.

I want to be Financially Literate.