Welcome to the WOLF Financial Newsletter.

Join over 18,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

Inflation isn’t cooling fast enough to relax Fed fears, housing may be stirring from its slump, and $OPEN ( ▼ 0.28% ) dramatic stock reversal reminds us this cycle is built for volatility.

Inflation Slightly Warmer… Cutting Rates Isn’t Debated, It’s Quantified

August’s CPI report showed inflation climbing to 2.9% YoY, up from 2.7% in July, with core inflation steady at 3.1% . Monthly inflation also rose around +0.4% seasonally adjusted… enough to stoke the embers of rate-cut caution, but not pull the emergency brake.

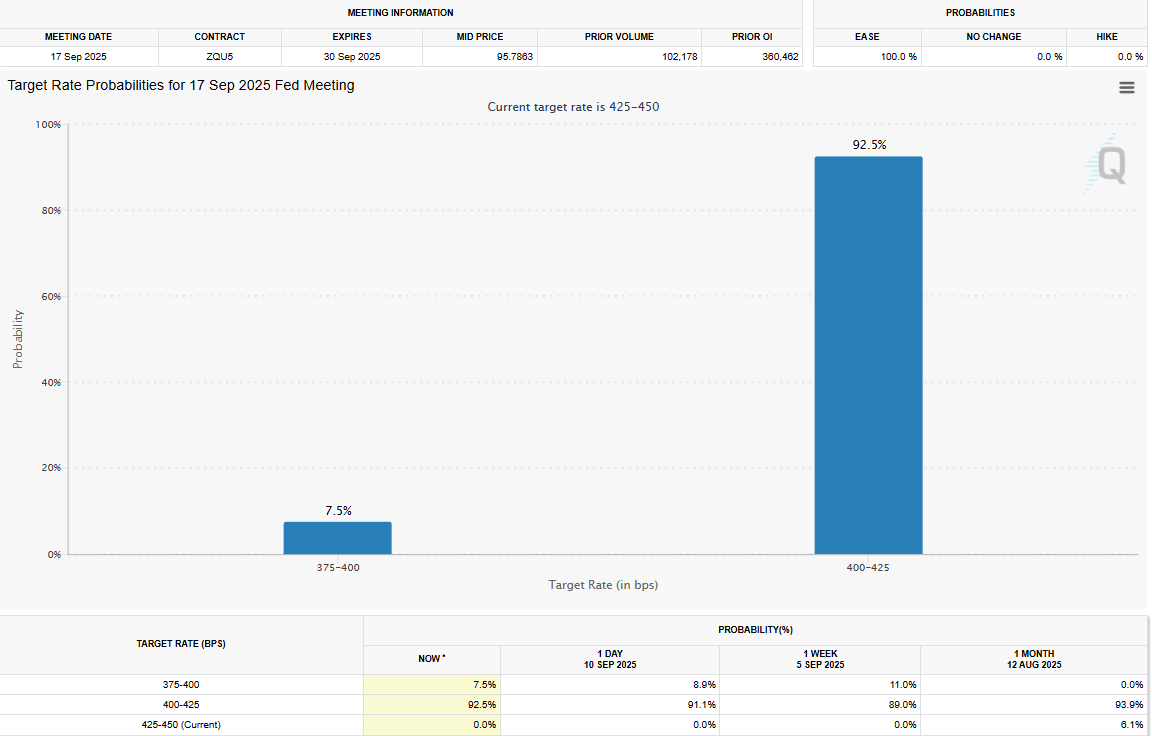

100% chance of a Fed Cut next week… but 7.5% chance of 50bps vs 25bps.

What this means: the Fed has essentially told the market that a cut in September is almost baked in… the question no longer is if, but how much and how confident they are going forward. With inflation sticky in certain sectors like food and shelter, there’s enough discomfort that the Fed can’t fire off aggressive cuts, but the easing undercurrent is clearly gaining momentum. FOMC is next week!

With that being said, there are some notable gainers this year. $PLTR ( ▼ 0.5% ) is up 117% YTD, but more importantly… GraniteShares 2x Long PLTR ETF $PTIR ( ▲ 1.85% ) is up an INSANE 205% YTD!

Is Housing Coming Back? Did We Bottom?

There are signs that housing may be waking up. The 30-year fixed mortgage rate dropped to 6.27%, the lowest in nearly a year, down from 7.25% just months ago, as Treasury yields eased and Fed dovish expectations firmed up. As borrowing costs ease, affordability ticks up, and mortgage application activity, especially refinancing, has seen a noticeable bump… one of the first responses from buyers who have been sitting on the sidelines.

Mortgage rates are falling!

That said, this feels like the market is front-running the housing comeback. Inventory remains tight in many key metros, prices are still high, and buyers remain wary. The drop in rates gives hope, but a real bottom may require sustained improvement in employment, incomes, and perhaps a few more weeks of favorable rate headlines.

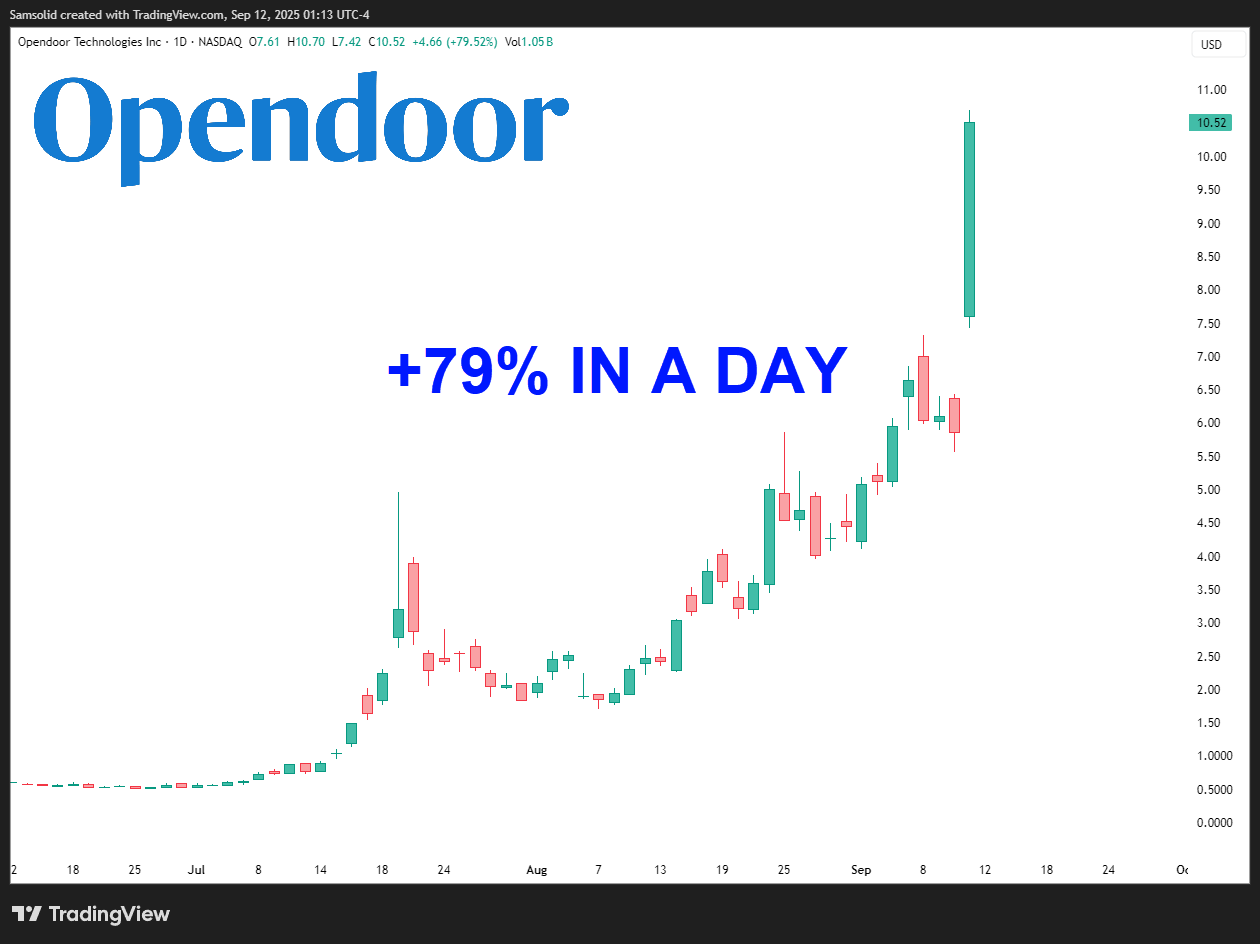

Opendoor Madness… A Shot of Hope or Just Hype?

$OPEN ( ▼ 0.28% ) stock exploded after the company appointed Kaz Nejatian, formerly $SHOP ( ▼ 4.55% ) Shopify COO, as CEO, while reinstating co-founders Keith Rabois and Eric Wu to the board. Shares soared 80% in a day, with the “Open Army” of retail investors fueling much of the momentum.

The company remains loss-making, and its housing model still faces challenges from macro headwinds, inventory constraints, and rate sensitivity. But this move is bullish in that it demonstrates investor appetite for narrative, turnaround, and leadership with product/AI bent. In this bull cycle, stories like Opendoor work… they can rally hard on momentum and expectation. Just remember: with high reward comes high risk.

Thanks for reading! Check out more content like this over on my X account.

Have a safe weekend!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.