In partnership with

Hey everyone! Sam here (AKA @SamSolid57 on X)

I drop into your inbox a few times a week, breaking down the biggest stories in finance and the moves that matter most.

Let’s get into it

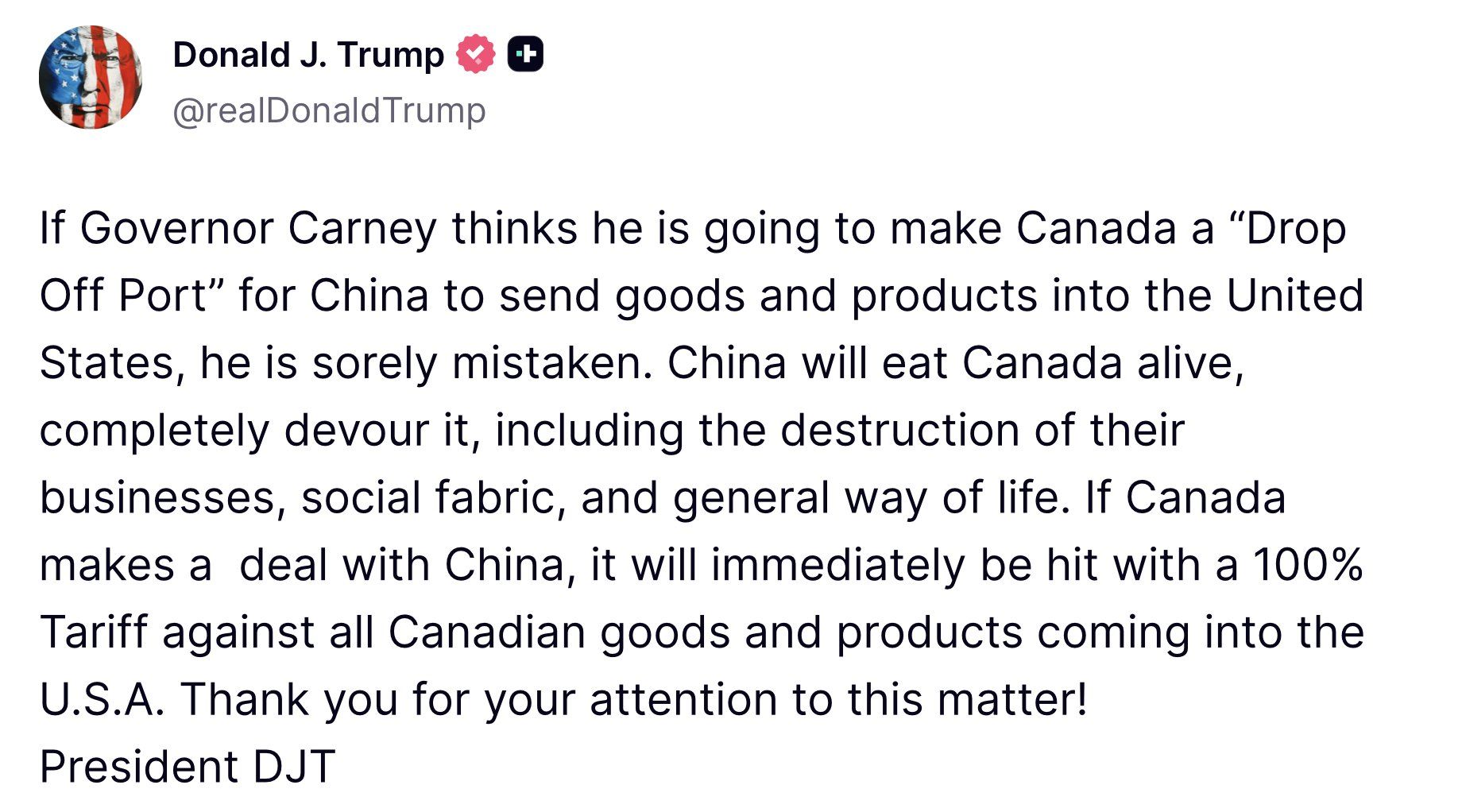

Tariff Anxiety Returns to the Tape

Renewed fears around a potential Canada-China deal are reviving concerns about additional U.S. tariffs. The issue is not confirmed policy, but positioning, markets remain sensitive to anything that reopens the trade front just as growth expectations stabilize. Even incremental headlines are enough to reprice risk across globally exposed sectors.

The sequencing matters. Trade narratives tend to surface when markets are extended, forcing fast adjustments across equities, FX, and rates. For now, this sits firmly in headline risk territory, but it is enough to cap near-term enthusiasm.

ClearEdge is an automated trading platform built for traders who want systematic execution without emotional decision-making. The platform focuses on rule-based strategies, automation, and risk controls designed to help traders stay consistent across different market conditions.

Rather than relying on discretionary trades, ClearEdge emphasizes predefined logic, backtesting, and disciplined deployment. This allows users to scale strategies based on performance while maintaining strict risk parameters and execution consistency.

For traders interested in automation-driven approaches, ClearEdge represents a modern alternative in the evolving algorithmic and systematic trading landscape.

Explore the automation at https://clearedge.trading/

Bitcoin Slides Back to 86k as the Yen Firms

Bitcoin has pulled back to roughly 86k after trading near 96k, keeping the broader downtrend intact. Part of the pressure coincides with renewed strength in the Japanese yen, a classic signal of tighter global financial conditions and reduced leverage appetite. High-beta assets tend to feel this first.

Crypto continues to trade as a liquidity proxy. Until currency volatility eases and risk appetite improves, Bitcoin is likely to remain range-bound with sensitivity to macro shifts rather than narrative catalysts.

Earnings Week for Tesla, Microsoft, Meta, and Apple

This earnings week carries outsized weight with reports from Tesla, Microsoft, Meta, and Apple. Expectations are high, not just on results, but on forward commentary around AI spending, margins, and consumer demand. Guidance, not beats, will likely drive the market reaction.

The broader setup is fragile. With macro uncertainty still elevated, strong execution can stabilize sentiment, while cautious outlooks could amplify volatility. This week is less about one quarter and more about confidence in 2026 trajectories.

Thanks for reading! Catch you in the next one!

For more updates throughout the week, follow @WOLF_Financial and @SamSolid57 on X.