Before we dive in, here’s what stood out today: volatility is back, the first big bank earnings are in, and speculative names are running hot again.

Before we dive in, here’s what stood out today: sentiment indicators are flashing panic while price action sits near record levels, regional banks made headlines again, and next week’s earnings may set the tone for Q4.

The Fear & Greed Index is broken

We’re in Extreme Fear territory, yet $SPY ( ▼ 0.47% ) is only 2% from all-time highs… a disconnect that shows why this isn’t a clean “buy the dip” moment. The market’s been stretched far above its 125-day moving average, and when stocks hover near 52-week highs, even a 2–3% pullback can look worse than it is.

The Put/Call Ratio remains low, so any uptick in hedging reads like panic, and the $VIX above 20 simply signals institutional protection, not a true sentiment collapse. With the 10Y yield dipping below 4%, the index flashes fear even as trends stay bullish. $SPY remains above both the 50MA and 200MA… a reminder that technicals, not sentiment gauges, are what matter most.

Companies like Aduro Clean Technologies are a reminder of the kind of innovation investors overlook in volatile markets, the firm is developing chemical recycling systems to convert waste plastics and bio-oils into high-value renewable fuels. Learn more on their Investor Relations page here.

Zions and the Regional Bank Ripple

Zions Bancorporation $ZION ( ▼ 8.01% ) reignited bank stress after revealing new unrealized bond losses, pulling other regionals like $CFG ( ▼ 6.66% ) and $KEY ( ▼ 5.99% ) lower. The update revived concerns about deposit flight and duration risk, especially among smaller lenders.

Large banks are better positioned, but the sector remains fragile. One more stumble here and investors could start questioning financial stability again just as earnings begin.

Earnings Season: The Next Catalyst

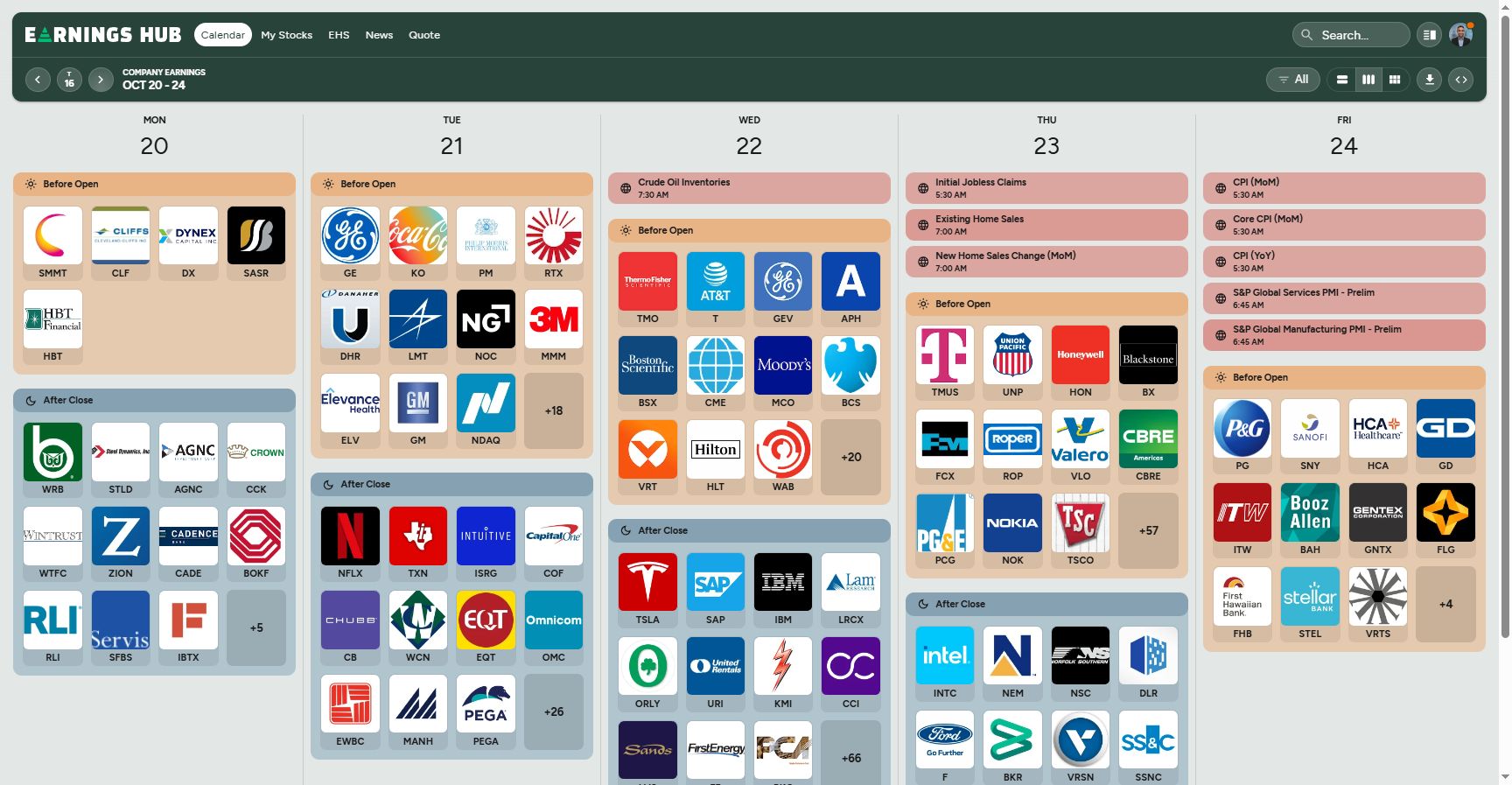

All eyes turn to next week, when the market’s next catalysts arrive: Netflix $NFLX, Tesla $TSLA, Intel $INTC, and IBM $IBM are all set to report.

Expectations are high across sectors, streaming and AI will dominate the headlines. Analysts are looking for modest EPS growth from $NFLX, mixed margins from $TSLA as pricing pressures linger, and continued AI momentum from $INTC and $IBM.

After weeks of macro-driven volatility, next week’s results could finally anchor direction… and decide whether this pullback becomes consolidation or a breakout setup into year-end.

Thanks for reading! Check out more content like this over on my X account.

Enjoy the weekend!

Disclaimer:

Investors should carefully consider the investment objectives, risks, charges and expenses of Exchange Traded Funds (ETFs) before investing. To obtain an ETF's prospectus containing this and other important information, please call (866)498-5677 or view/download a prospectus here: SPYI | QQQI | | CSHI | BNDI | IWMI | BTCI | IYRI. Please read the prospectus carefully before you invest.An investment in NEOS ETFs involves risk, including possible loss of principal. The equity securities purchased by the Funds may involve large price swings and potential for loss.

The use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include (i) the risk that the counterparty to a derivative transaction may not fulfill its contractual obligations; (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. Derivative prices are highly volatile and may fluctuate substantially during a short period of time. The use of leverage by the Fund, such as borrowing money to purchase securities or the use of options, will cause the Fund to incur additional expenses and magnify the Fund’s gains or losses. The earnings and prospects of small and medium sized companies are more volatile than larger companies and may experience higher failure rates than larger companies. Small and medium sized companies normally have a lower trading volume than larger companies, which may tend to make their market price fall more disproportionately than larger companies in response to selling pressures and may have limited markets, product lines, or financial resources and lack management experience. The funds are new with a limited operating history.

Investments in smaller companies typically exhibit higher volatility. Investors in NEOS ETFs should be willing to accept a high degree of volatility in the price of each fund’s shares and the possibility of significant losses.

Bitcoin Risk: Bitcoin is a relatively new innovation and the market for bitcoin is subject to rapid price swings, changes and uncertainty. The further development of the Bitcoin network and the acceptance and use of bitcoin are subject to a variety of factors that are difficult to evaluate. The slowing, stopping or reversing of the development of the Bitcoin network or the acceptance of bitcoin may adversely affect the price of bitcoin. Bitcoin is subject to the risk of fraud, theft, manipulation or security failures, operational or other problems that impact the digital asset trading venues on which bitcoin trades. The Bitcoin blockchain may contain flaws that can be exploited by hackers. A significant portion of bitcoin is held by a small number of holders sometimes referred to as “whales.” Transactions of these holders may influence the price of bitcoin. NEOS ETFs are distributed by Foreside Fund Services, LLC.