Welcome to the WOLF Financial Newsletter.

Join over 13,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

STREAMLINE YOUR DIGITAL LIFE WITH BLOCX

Discover BLOCX—the ultimate all-in-one platform designed to simplify and secure your digital experience. From desktop management to secure messaging, we've got you covered.

BLOCX provides everything you need: B. Desktop serves as your all-in-one computer manager, B.TXT offers a decentralized messenger for private, secure communication, B. Marketplace brings a distributed computing marketplace at your fingertips, and B. GUARD acts as a mobile safety suit for comprehensive protection.

Revolutionize your workflow with a safety layer of DePIN, ensuring your security is always prioritized.

Ready to experience seamless digital efficiency? Click the link below to start your journey with BLOCX today:

This Week’s Market Forecast… 📊

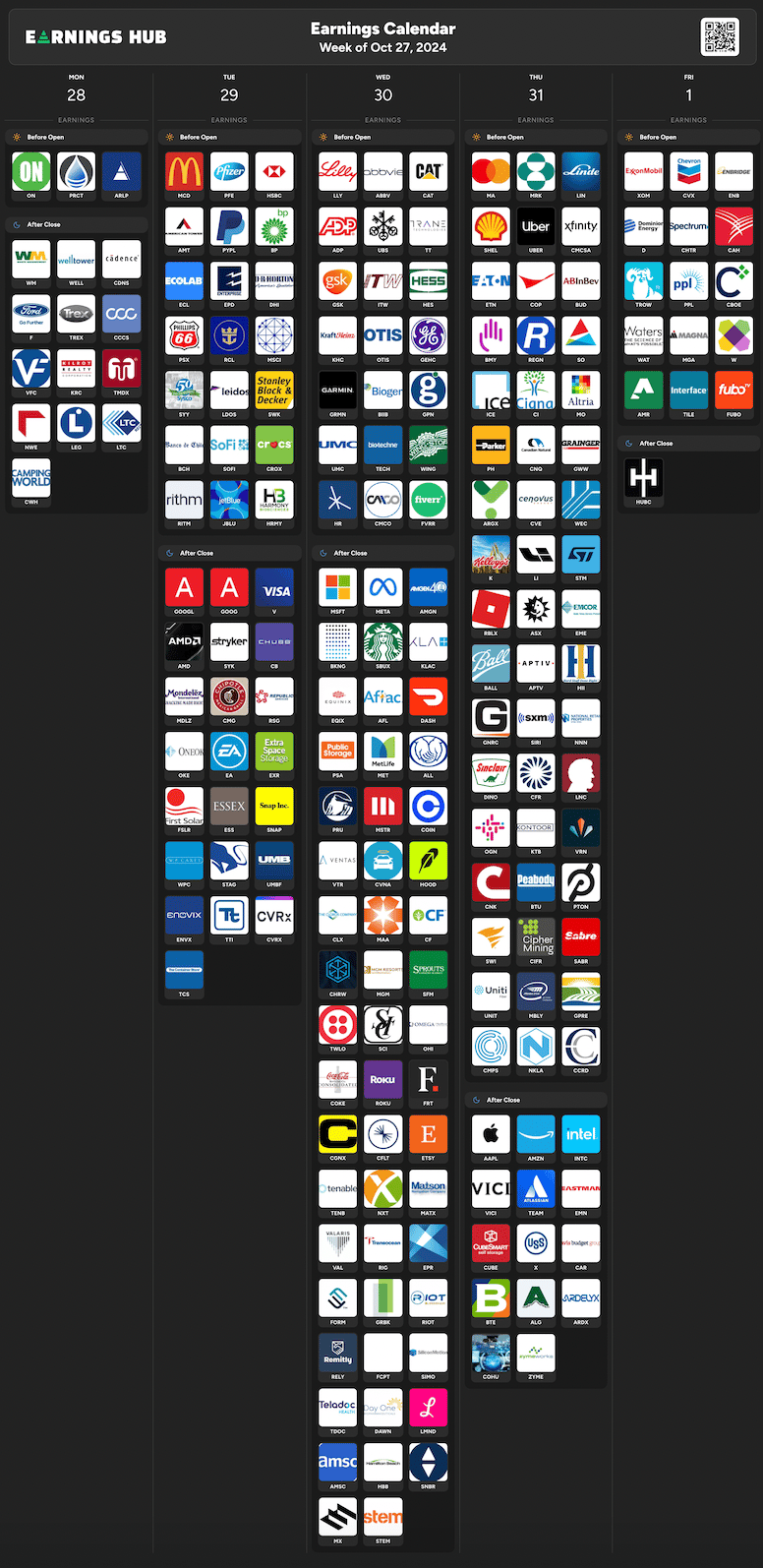

This week is shaping up to be one of the most pivotal for the markets this year—prepare for potential volatility. Major earnings releases are underway, with tech giants Apple, Google, Microsoft, Amazon, and Meta all set to report. These five companies alone have driven much of the stock market’s growth over the past year.

Investors are hopeful that big tech will continue to deliver strong results, extending the positive momentum from earlier earnings reports. Last week, Tesla made waves with its own earnings, jumping 20% on the back of an EPS beat and promising forward guidance.

Adding to this, a slew of macroeconomic data is expected this week, including GDP, PCE, and the Non-Farm Payrolls report. These figures are particularly significant as they’re the last key indicators on inflation and employment before the Federal Reserve’s meeting on November 6–7. While a 25 BPS rate cut seems likely, any surprises this week could alter expectations.

And with the U.S. Presidential Election around the corner on November 5, this week’s news cycle could further influence market volatility. Keep your eye on the prize, stay informed, and think strategically!

🚨Top Stocks on our Radar…

Apple 5th Avenue NYC

Apple ($AAPL) will report earnings on Thursday after the close, with an EPS consensus estimate of $1.54 for the recent quarter. This will also give us our first insights into iPhone 16 sales—one of Apple’s key growth drivers.

Thanks for reading, and here’s to a productive week!

– Ryan

In case you wanted to check out our schedule, I layed it out below! 👇

My Schedule This Week:

Monday:

9:20 AM EST - Good Morning FinTwit

3 PM EST - Stock Market Analysis

Tuesday:

8 AM EST - Futures Education & Trading

9:15 AM EST - LIVE Trading

11 AM EST - Mega Cap Tech Earnings Analysis

12 PM EST - Tesla Deep Dive

1 PM EST - Q4 Investing Competition

2 PM EST - Gold & Bitcoin Deep Dive | $BTGD

3 PM EST - $GOOGL & $AMD Earnings

6:30 PM EST - Passive Income Strategies - Done For You

7:30 PM EST - How To Boost Your Portfolio Income & Reduce Risk

Wednesday:

9:15 AM EST - LIVE Trading

11 AM EST - Web3 Gaming | Lizard Labs | TGE & Listing

2 PM EST - Earnings Analysis W/ EarningsHub.com

3 PM EST - $MSFT & $META Earnings

Thursday:

12 PM EST - The X Spaces Crew

3 PM EST - $AAPL & $AMZN Earnings

Friday:

12 PM EST - The Crypto Pulse

Have a Blessed Weekend!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.