Presented By:

1,000,000s of people started trading options between 2020 - 2023.

But 98% don't know how to pick the right strike date.

There are 5 steps to successfully choosing strike dates.

I’ll break down each after a word from this week’s sponsor.

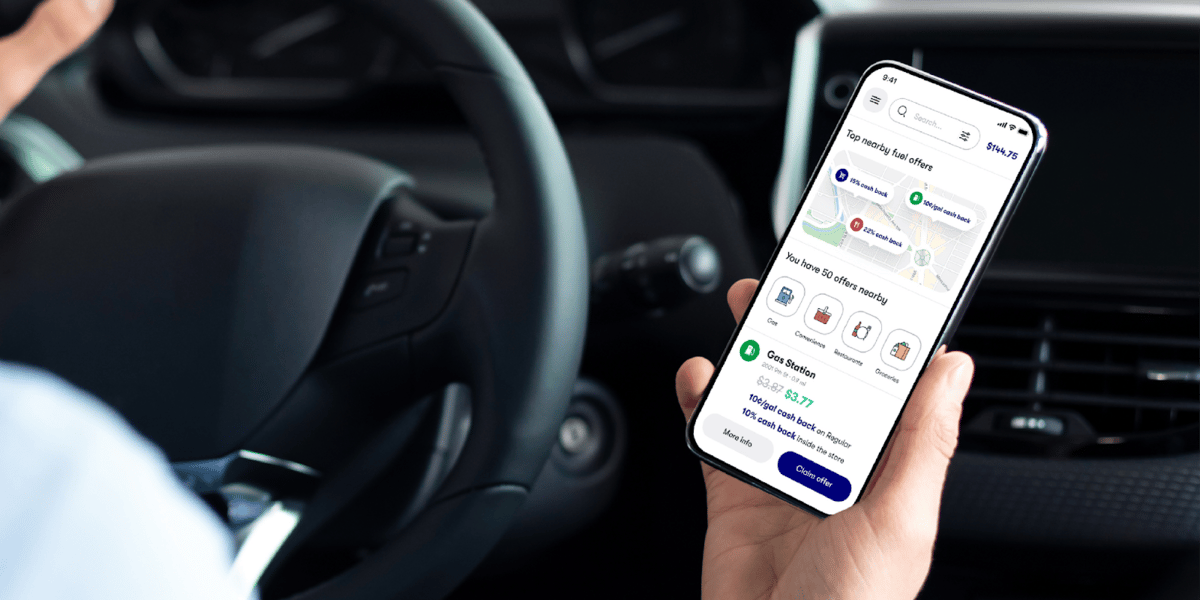

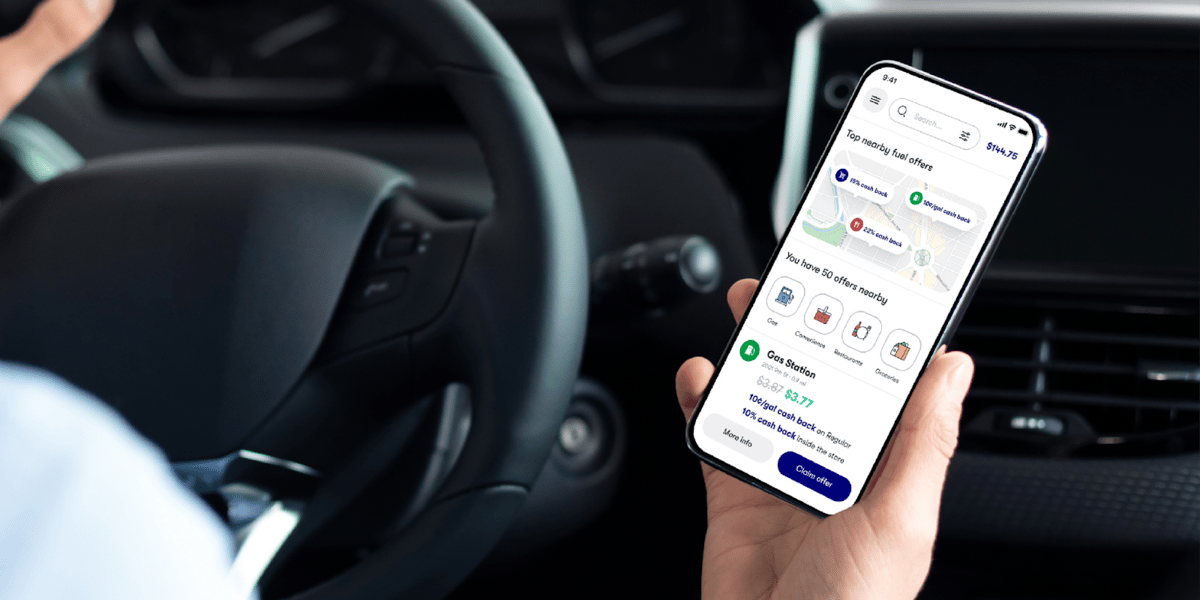

Don’t cut back, get cash back

The cost of eggs has risen 190.9% since 2020. And with costs continuing to rise, we’re all trying to figure out where we can cut back a little bit.

That’s where Upside comes in. It’s a free app that gets you cash back on everyday items, like groceries, gas, and at restaurants. You get to go about your normal business while Upside earns a little bit of cash back here and there along the way.

Upside users earn 3x more cash back than other apps and rewards programs. On average, frequent users earn $340 a year.

Get an extra 25¢/gal cash back on your first tank of gas. Download the free Upside app and use code: “BHBusiness25”.

1. Find tools that work

For me, this starts with removing the option chain.

Instead, I use the Optionality app which offers pre-packaged option trades showing:

Max loss/gain

Breakeven price

% move required

Optionality makes the research and execution aspect of trading options easy.

Here’s what it looks like

2. Choose to be a day or swing trader

Day traders/scalpers are in and out.

Swing traders buy & sell over the course of weeks or months.

Buying yourself extra time in a trade often works best for beginners.

As you become more confident in your craft you can adjust.

3. Know your strategy

Tech stocks

Commodities

Industry specific funds

Dividend stocks

Options can be traded on all of these but each acts differently.

But Optionality lays out high/low confidence plays across different stocks and packages them for you.

4. Know your risk tolerance

Options are generally more volatile than common stock.

Bigger risk = bigger reward.

Optionality ranks trades into risk buckets of low, medium, or high & provides insights on upside/downside. This allows me to pick trades that match my tolerance.

5. Use data (not emotions)

The market is volatile.

Too many people rely on feelings.

Emotions drive bad investing habits.

Optionality gives many indicators, packages, and analyses you can use without letting your emotions win.

6. Bonus Action:

Use Spreads I know I said 5 actions but using spreads can significantly reduce risk and exposure.

Don't know how to use them?

Optionality packages the spreads for you AND explains how they work.

But that’s not all the good news…

The best part is Optionality is free.

Try it out today: https://app.adjust.com/n978vcc

Note: The Optionality brokerage is only for US customers on mobile devices at the moment.