I’ve been trading stocks for years and have spent thousands of hours on Twitter discussing stock trading.

If I were starting from scratch, I wouldn’t trade stocks until I knew these 10 chart patterns like the back of my hand:

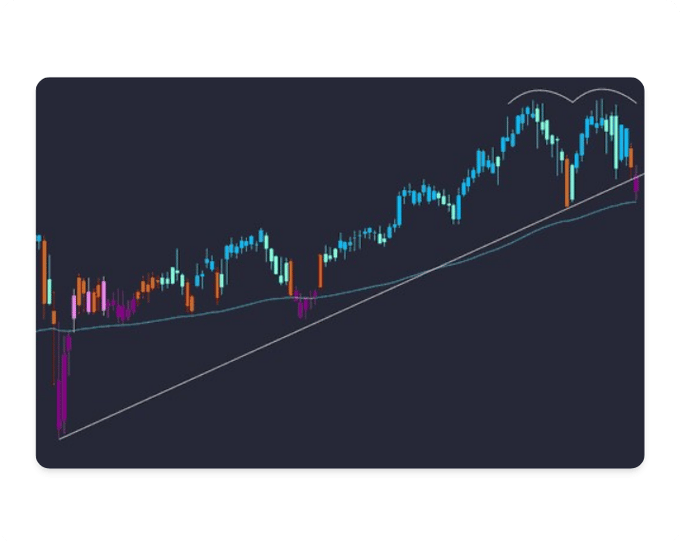

1. Head and Shoulders

This chart pattern has 3 peaks. As you might be able to tell from the name, it has a:

Left shoulder

Head

Right shoulder

The left and right shoulders should have similar heights and the head should be the highest peak and in the middle.

This pattern may indicate a bullish trend is turning into a bearish one.

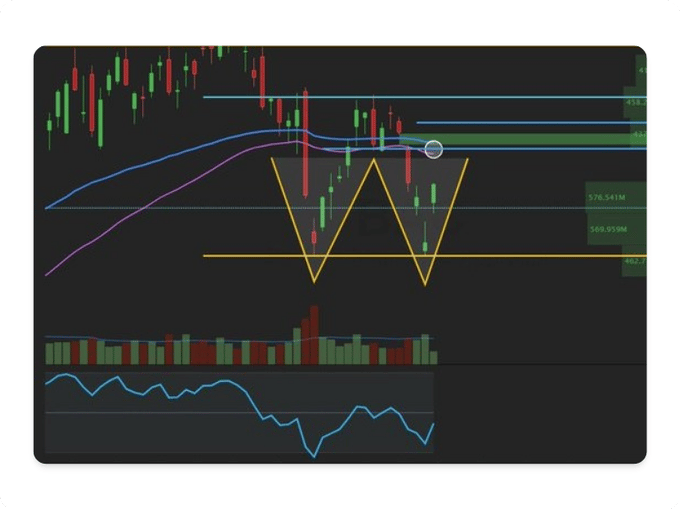

2. Double Top

A double top is a bearish pattern that forms when the price reaches 2 consecutive highs, has a moderate drop in the middle, and the price drops below the support (the straight line in the graph).

If the price doesn't drop below the support it's a failed double-top pattern.

3. Double Bottom

This pattern is shaped like a "W" where the 2 bottoms are the support level.

Double bottoms usually happen after downtrends and signal a potential uptrend.

This chart pattern works best when analyzing medium to long-term market movements.

4. Wedge

There are 2 types of wedges: 1) Rising Wedges and 2) Falling Wedges.

Prices tend to break out in the opposite direction of the wedge pattern.

So a rising wedge pattern signals a bearish trend, and a falling wedge pattern signals a bullish one.

These patterns are short-term formations and usually occur over 1-7 weeks.

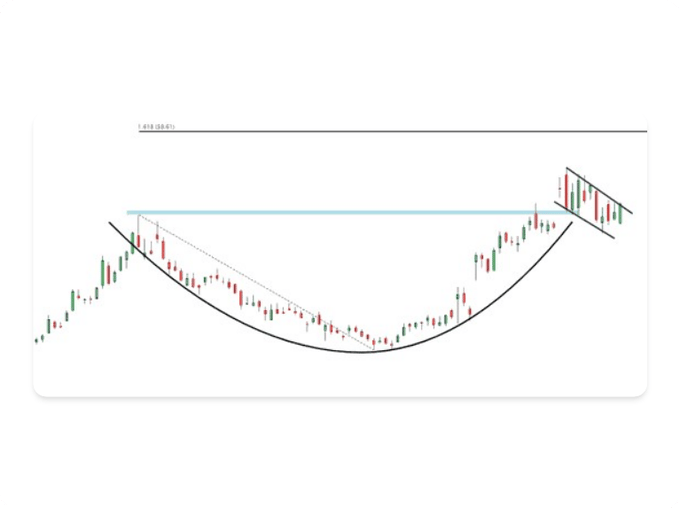

5. Cup and Handle

The part shaped like a "U" is the cup and the slight downward drift is the handle.

Not all “cups” look the same though. Cups with wider "U" shapes are more reliable than sharper "V" shapes.

This pattern can take place anywhere from medium-term lengths to long-term ones (think 2-12 months to form).

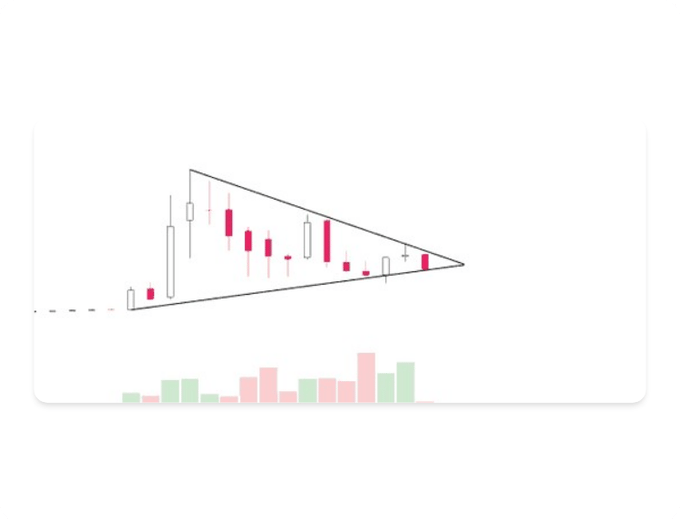

6. Pennant

This pattern occurs when a price consolidates (fluctuates less) before a breakout.

They tend to start with a large trading volume (which creates the run up called the “flagpole”) and are followed by decreasing volume (the consolidation/flag).

Try not to use this pattern alone. It’s best used in conjunction with other chart patterns.

7. Rounding Bottom

This is a rare pattern that looks like a cup and handle but without a handle.

It's made of 3 parts: the decline, the bottom, and the incline.

This is a bullish trend and usually takes 2 weeks to 3 months to form.

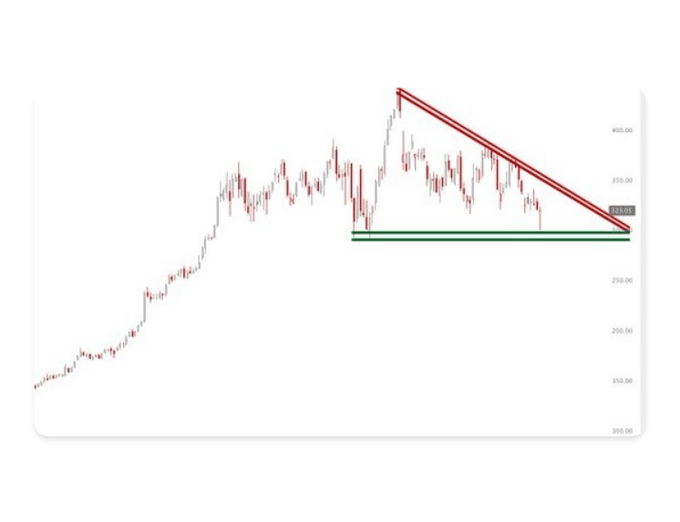

8. Descending Triangle

There are a lot of moving parts to this chart pattern.

The top trend line that creates the downward slope of the triangle should be formed alone a series of falling highs.

The base of the triangle should be formed along a series of relatively even lows.

If the price falls under the lower trend line, this could be an indication that the price will continue to fall.

When this happens, traders usually open short positions.

9. Ascending Triangle

This pattern is a flipped version of the descending triangle.

Instead of a flat trend line at the bottom, the flat trend line goes on top.

And instead of a downward slope, this triangle slopes upward.

If the price goes above the flat trend line, it's a bullish signal.

If the price falls below the diagonal line, it's a bearish one.

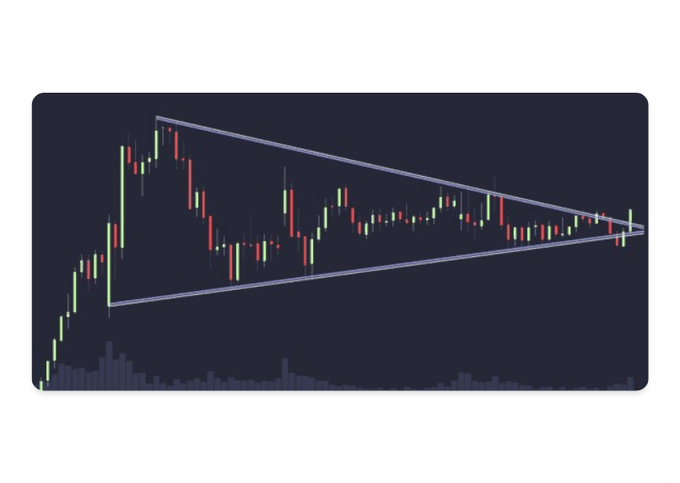

10. Symmetrical Triangle

This pattern is almost like a pennant except the trend lines have an equal slope and there's no "flag pole" present.

If the price rises above the top trendline, a breakout will occur.

If the price falls below the trendline, a breakdown will occur.

These are 10 chart patterns I would never trade without knowing to a “T”.

But these aren’t the only important ones…just the basics every trader needs to understand.

Do you know of any other chart patterns that are crucial to trade with?

Reply to this email and let me know!