Hey there! My name is Nate and I write about trading for the WOLF Financial newsletter. If you are looking for more trading tips and tricks, I guarantee you’ll enjoy my content on 𝕏, @tradernatehere. Thanks for reading!

This service is for general informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice. These are my opinions and observations only. I am not a financial advisor.

The world of trading options is full of lingo that can be hard to understand and also a little intimidating.

If you take time to learn and understand a few basic concepts you quickly realize options can be used to minimize risk while providing outsized gains.

These are not things to fear but instead embrace as a trader.

And that is exactly why we are taking a look at the debit spread strategy this week.

This strategy can provide you with lower cost entries into trades with clearly defined risk and upside potential.

Let’s dive in!

What Are Debit Spreads?

In options trading, a debit spread is a strategy involves simultaneously buying and selling options of the same class (calls or puts), but with different strike prices and/or expiration dates.

The goal is to enter the trade for a "debit," meaning the premium paid for the long option is more than the premium received from the short option.

There are two types of debit spreads: the Bull Call Spread and the Bear Put Spread.

Bull Call Spread

This strategy involves buying a call option (the lower strike) and selling another call option (the higher strike) on the same underlying asset.

The options contracts for this strategy will have the same expiration date.

A bull call spread is often used when you have a moderately bullish stance on a stock price.

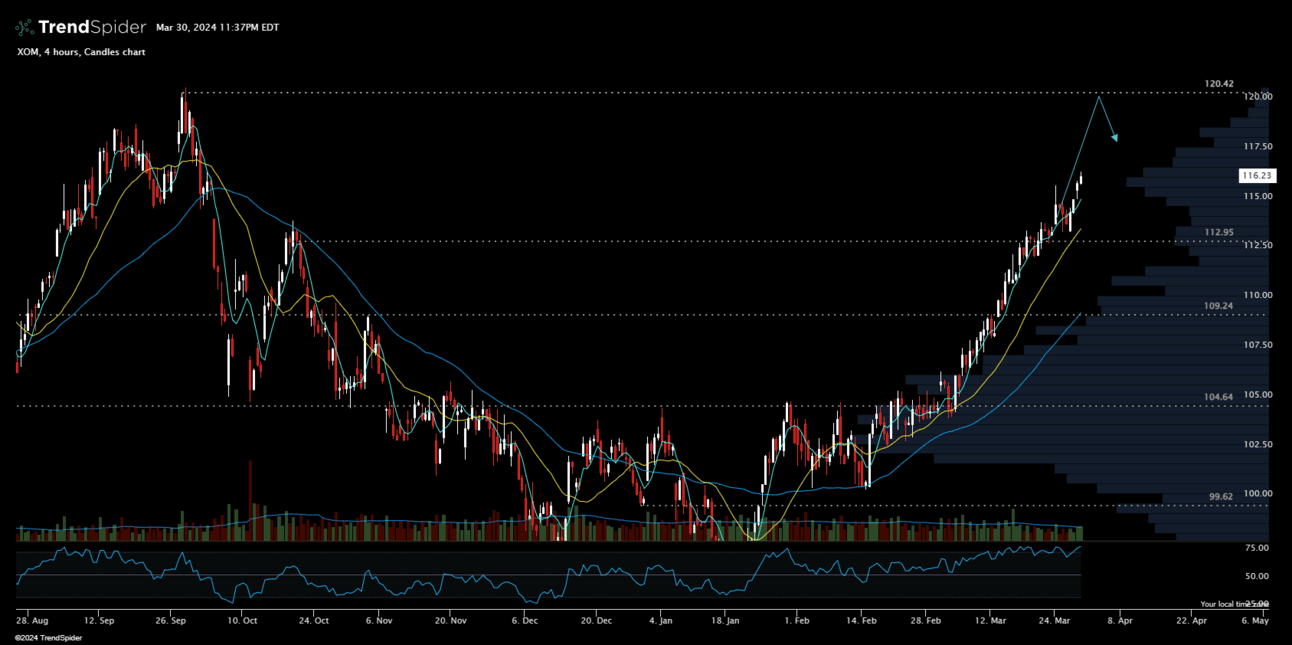

For example, you may expect XOM to push up to $120 but also believe that to be the top of the move.

You could consider a bull call spread, buying the $116 strike call option and selling the $120, putting less at risk than if you simply buy a call option.

XOM 4-hour candles

The money you collect by selling the higher strike call option offsets some of the cost of buying the lower strike, thereby reducing how much you put at risk.

The tradeoff is you will not participate in the upside beyond $120 per share if XOM continues to move up.

Bear Put Spread

This strategy involves buying a put option (the higher strike) and selling another put option (the lower strike) on the same underlying asset, again with the same expiration date.

This strategy is used when you are moderately bearish on a stock’s price.

Using SHOP as the example, you might expect shares to find their way lower but also believe they will find support at $70.

SHOP daily candles.

You could consider buying the $75 strike put and sell the $70 strike put, both expiring on the same date.

Selling the lower strike put caps your gains but also reduces the amount you have to put into the trade, similar to the bull call spread.

This also means a lower breakeven point as well.

Advantages and Disadvantages of Debit Spreads

First up, the advantages:

1. Defined Risk and Reward: The max you can lose is the amount you put into the trade and the max you can make is defined by the strike prices you choose.

2. Lower Cost: Compared to buying a single option, a debit spread usually costs less because you're offsetting the costs by selling in addition to buying.

3. Profit in Various Market Conditions: Debit spreads can generate profit in a variety of market conditions, even when markets are moving sideways.

The disadvantages:

1. Limited Profit Potential: While the risk is defined with debit spreads, so is the profit. The maximum profit you can make is capped.

2. Requires Directional Bias: Unlike some other strategies, debit spreads require a directional bias. You need the underlying asset's price to move in a certain direction to profit.

3. Time Decay: The option you bought can lose value over time due to time decay, especially as it gets closer to expiration. This can eat into your potential profits.

Debit spreads can be a valuable tool in your trading toolbox. They offer defined risk and reward, lower cost, and the ability to profit in various market conditions.

However, they also come with limitations, including capped profits and the effects of time decay.

As with any trading strategy, it's crucial to understand how debit spreads work and to use them in the right market conditions.

Always remember, the key to successful trading is not just about the strategy you use, but also about your discipline, risk management, and consistency.

Have a great week of trading ahead!

-Nate