Welcome to the WOLF Financial Newsletter.

Join over 13,000 savvy investors building wealth and mastering advanced investing

strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

For years, passive was king. Just buy the index and let tech do the work. But in today’s market, predictability wins — and income matters.

Meet $OMAH.

Inspired by Buffett’s best — $BRK.B, $AAPL, $KO — but engineered for monthly income. It’s not just value investing. It’s value, weaponized.

Fortress balance sheets. Real cash flow. Active management. Monthly yield.

$OMAH doesn’t just protect capital. It puts it to work.

COMMUNICATED DISCLAIMER

This Week’s Market Forecast… 📊

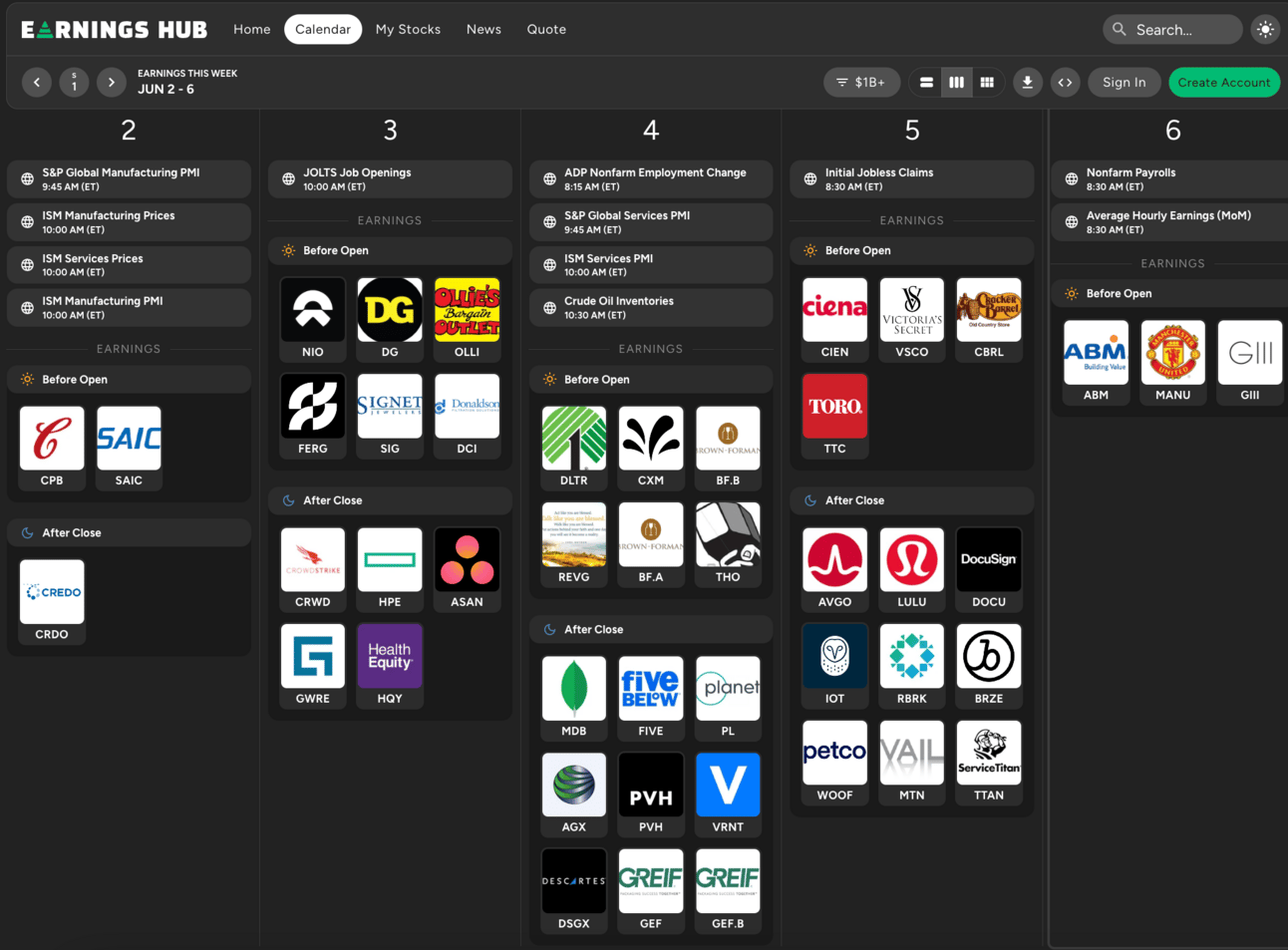

Markets enter the new week with a steady tone as investors shift their attention from earnings season toward key economic updates. While most first quarter results are behind us, a few notable companies are still set to report and could offer valuable insight into the health of the consumer.

Among the most anticipated earnings this week are reports from CrowdStrike, Five Below, and Lululemon. These companies span different corners of the retail and technology landscape. Five Below will help paint a picture of how lower-income consumers are spending, while Lululemon will offer a view into higher-end retail demand. CrowdStrike’s results will give us a read on corporate tech spending and security budgets.

Expectations heading into earnings season were muted, yet many companies managed to exceed forecasts. That has helped support equity markets over the past few weeks. Underpinning that resilience has been continued strength in the labor market. Despite tighter financial conditions, employment trends remain strong, and layoffs have stayed relatively low.

This week brings more clarity on that front. The labor market will be in focus with Thursday’s jobless claims report and Friday’s Non-Farm Payrolls release. Together, they will give us a timely look at both short-term and longer-term employment conditions.

From a market perspective, the current environment feels stable but cautious. With earnings season winding down and no immediate signs of a change in policy from the Federal Reserve, investors may wait for a clearer direction before making bold moves. While upside in the near term might be limited, the backdrop for the second half of the year looks positive.

Keep an eye on the data, stay focused, and maintain a long-term perspective. There is still plenty of opportunity ahead.

My advice? Focus on the positive and keep an optimistic outlook.

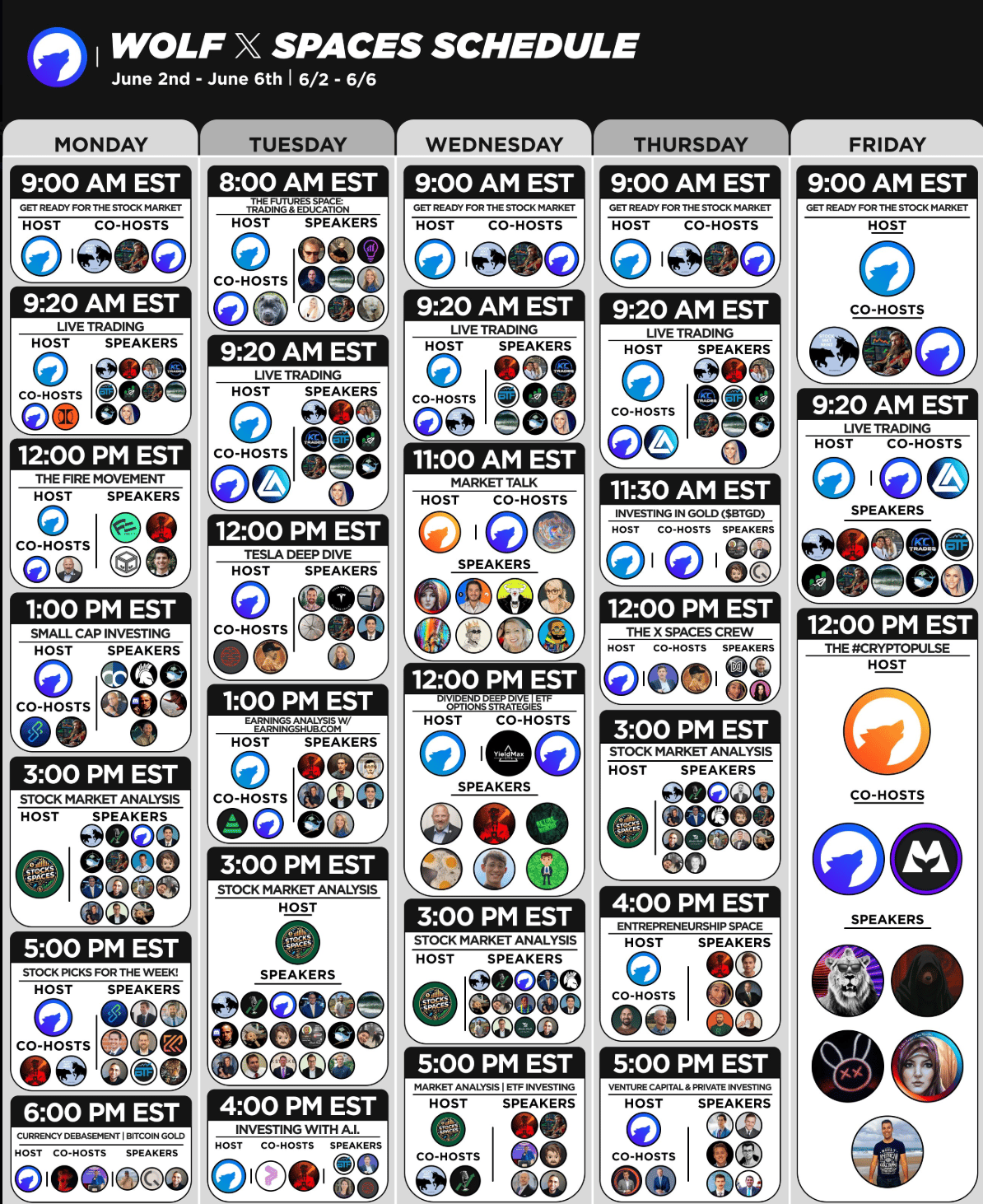

My Schedule This Week!

Have a Blessed Weekend!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.