Welcome to the WOLF Financial Newsletter.

Join over 13,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

VISTASHARES $AIS

Technology is evolving fast, and artificial intelligence is at the center of it all. VistaShares Artificial Intelligence Supercycle ETF ($AIS) gives investors an easy way to tap into the companies driving this transformation.

$AIS invests in a diverse mix of businesses shaping the future, ranging from chipmakers and software firms to automation leaders. With a rules-based strategy, the fund focuses on established industry players and rising innovators positioned for long-term growth.

As AI continues to reshape industries, AIS helps investors stay ahead of the curve.

COMMUNICATED - DISCLAIMER

The Soft Data Correction… 📊

Entering 2025, markets were optimistic about tax cuts and deregulation under Trump. However, within a week, he raised the topic of tariffs.

Initially, markets shrugged off the tariff talk, hitting new highs. Many believed Trump was using tariffs as a negotiation tool rather than a real policy shift. But as discussions persisted, uncertainty grew. Then, on February 20th, a negative consumer sentiment report signaled inflation fears, triggering a 10% market correction.

Consumer sentiment is a “leading economic indicator” but is considered “soft data” since it’s survey-based. Today’s political polarization skews its reliability—Republicans expected 0% inflation, Democrats 7%, heavily tilting the survey.

Despite market reactions, hard economic data hasn’t shown drastic weakness. While tariffs may slow the economy, I don’t expect inflation or market declines at the levels suggested by soft data. For now, we remain in a “wait and see” economy.

My advice? Focus on the positive and keep an optimistic outlook.

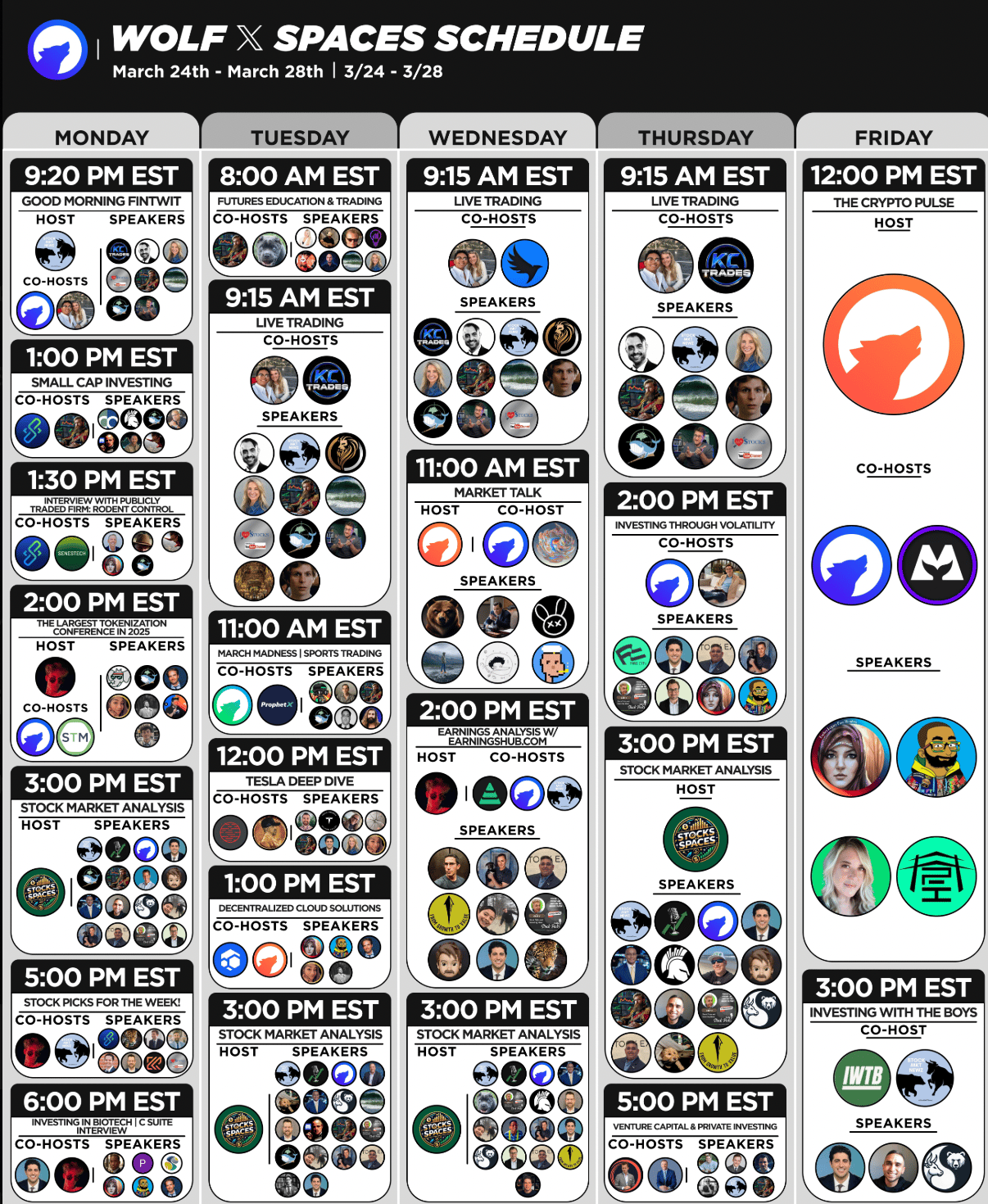

My Schedule This Week!

Have a Blessed Week!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.