Welcome to the WOLF Financial Newsletter.

Join over 13,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

I’m excited to introduce today's sponsor - OS Therapies Inc. (NYSE: OSTX)—a clinical-stage biopharmaceutical company focused on developing treatments for osteosarcoma and other solid tumors.

With a promising pipeline targeting these critical conditions, OS Therapies is leading the charge in oncology innovation. As the fiscal year ends, now could be an ideal time to explore this potential investment.

Whether you’re seeking new opportunities or diversifying your portfolio, OS Therapies offers a chance to invest in groundbreaking cancer treatments.

Do your due diligence and consider adding OS Therapies to your watchlist.

COMMUNICATED - DISCLAIMER

In financial media, certain phrases often capture attention, such as "sell in May and go away" or "September seasonality." Lately, two recurring themes have dominated headlines: the "Santa Claus Rally" and the "January Barometer."

The Santa Claus Rally refers to a historical trend where markets rise during the last five trading days of the year and the first two of the new year. This year, however, the rally hasn’t lived up to expectations—though there’s still time for a turnaround.

Meanwhile, the January Barometer suggests that January's performance predicts whether the market will finish the year up or down. Despite its popularity, many overlook its lack of consistency in delivering accurate forecasts.

The data tells the story. Over the past seven years, both indicators have been wrong 3 out of 7 times, giving them no better predictive power than a coin flip. Their correlation with annual market returns is minimal at best.

While these phrases make for great conversation starters, investors should treat them as market trends to watch rather than reliable tools for forecasting. Solid investment strategies require deeper insights, not catchy slogans.

Have a great rest of your Holidays and Happy New Year!!

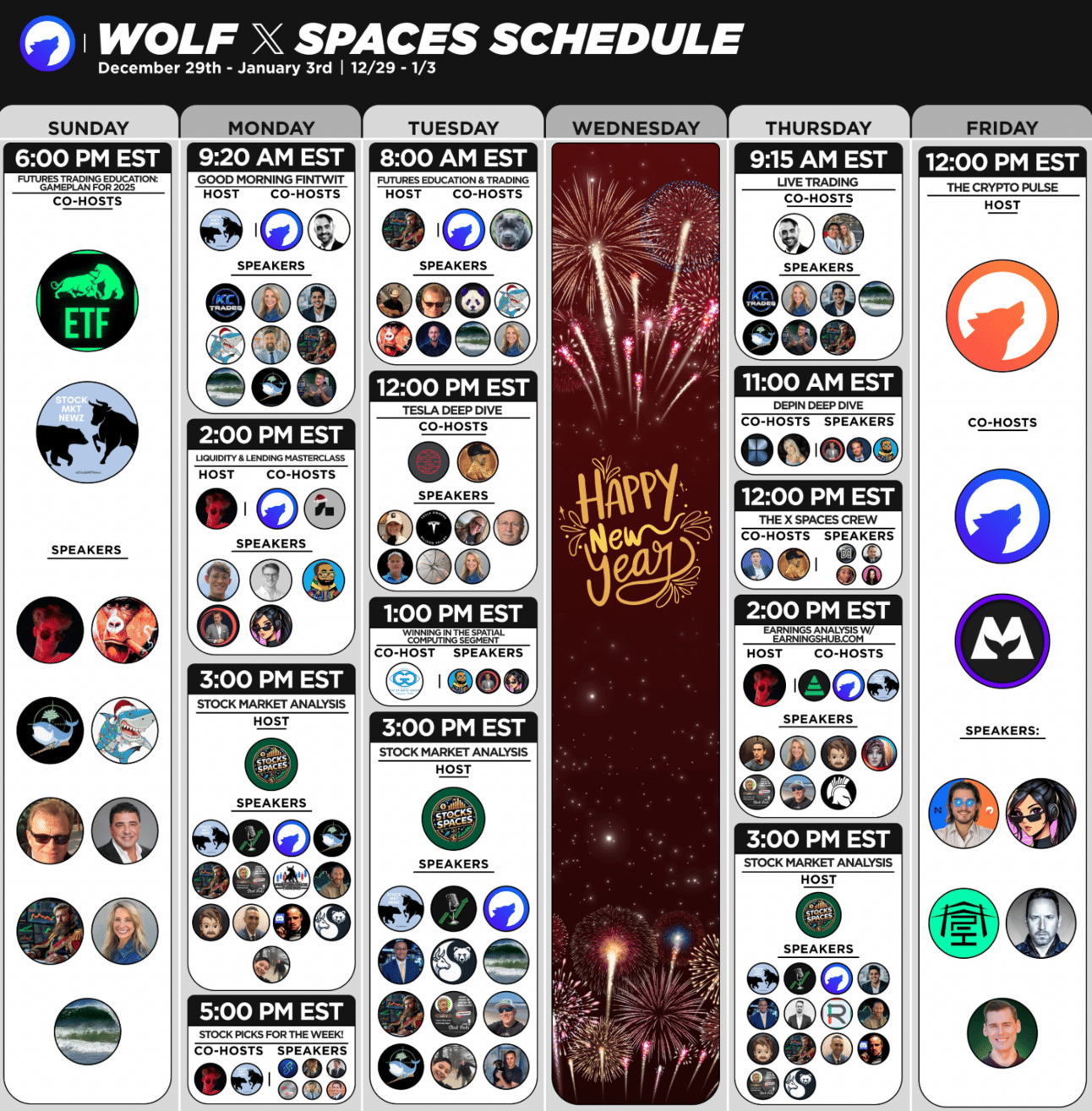

My Schedule This Week!

Have a Blessed Weekend!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.