Welcome to the WOLF Financial Newsletter.

Join over 13,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

This Week’s Market Forecast… 📊

This marks the first shortened trading week since the holidays, with markets closed today, Monday the 17th, in observance of Presidents’ Day. After a fast-paced, news-heavy start to the year, a brief break for investors isn’t the worst thing.

This week’s market calendar is relatively light. If we see any notable volatility, it will likely stem from developments in Washington. Given the choppiness we’ve already seen to start the year, we continue to believe more volatility is ahead.

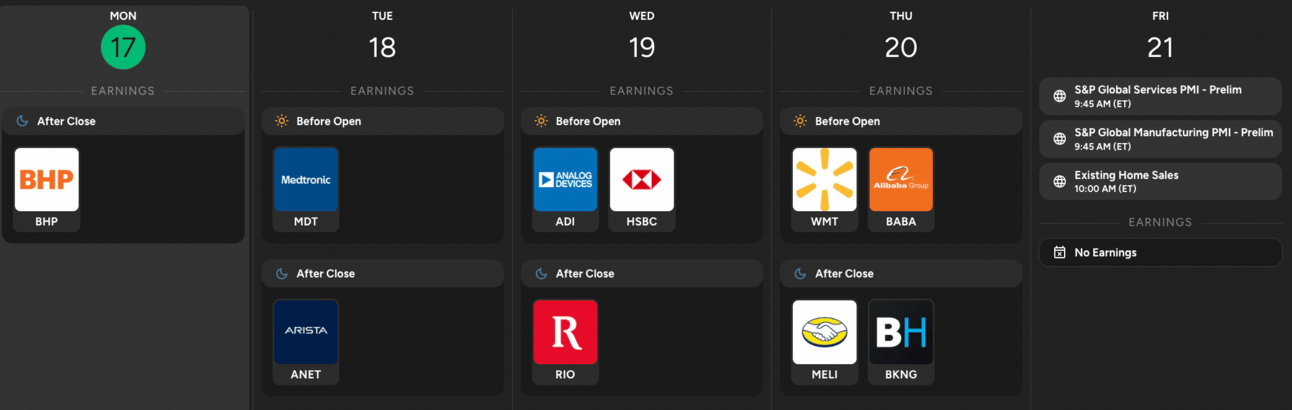

Earnings season is winding down, and overall, it has exceeded expectations. As of last week, 77% of companies that reported earnings have beaten estimates. I still believe earnings growth will be the primary driver of stock market performance in 2024.

One key earnings report to watch this week is Walmart, which announces results Thursday before the market opens. As the world’s largest retailer, Walmart’s earnings will offer important insight into consumer spending trends.

For much of the past few months, economic data painted a strong and steady picture of the economy, fueling a "Goldilocks" narrative. But in the last two weeks, that story has flipped. A weaker-than-expected jobs report was followed by a hotter-than-expected inflation data. However the market barely blinked, pushing to fresh all-time highs last week.

This week’s economic calendar is quiet, with no major releases until Friday when we’ll get Services PMI and Manufacturing PMI. These reports will provide a closer look at the strength of both the services and manufacturing sectors.

My advice? Focus on the positive and keep an optimistic outlook.

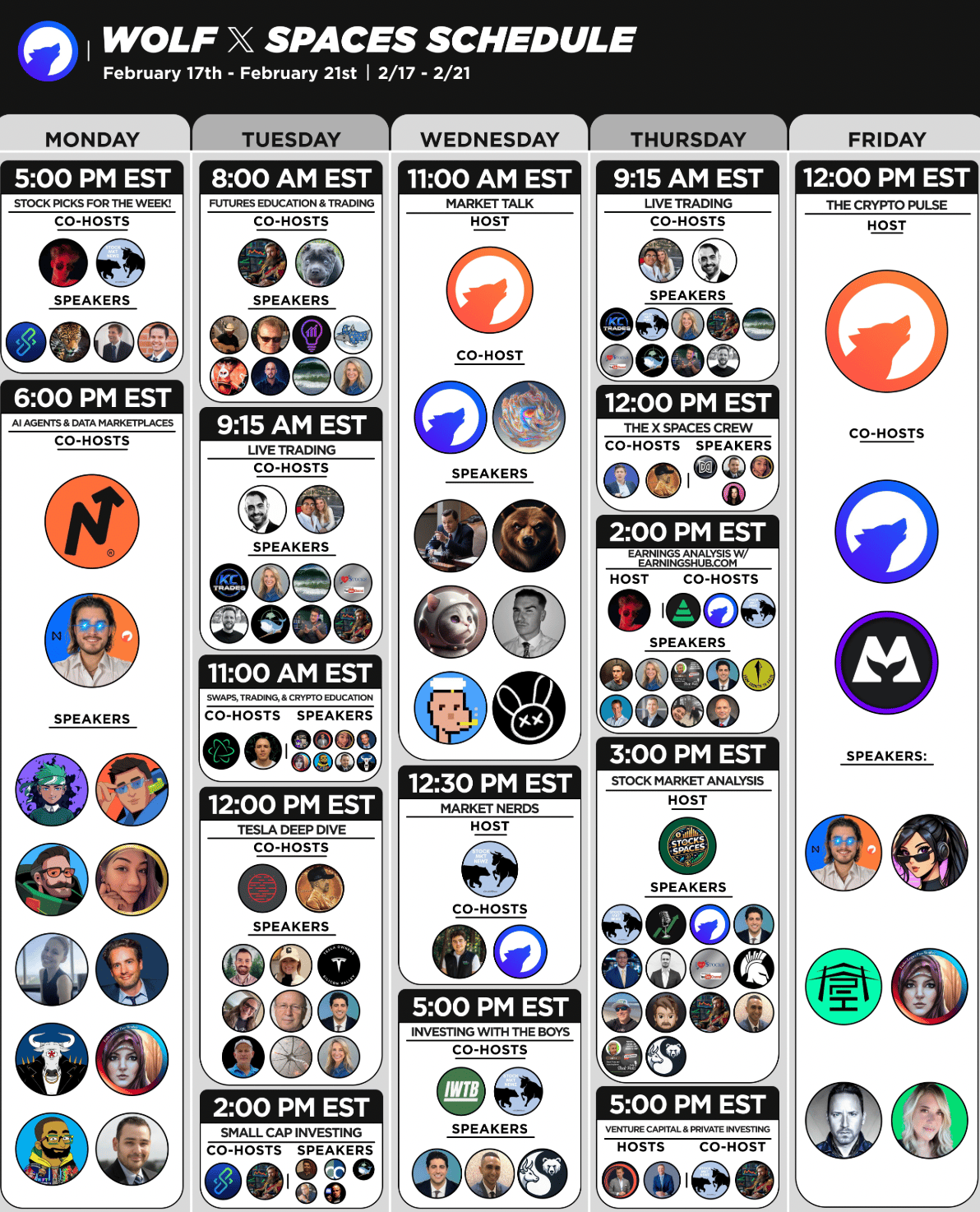

My Schedule This Week!

Have a Blessed Weekend!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.