Welcome to the WOLF Financial Newsletter.

Join over 14,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

🚨Top Tweet of the Week!🚨

The biggest story of the week: The rise of AI is here, and it’s impact is becoming increasingly evident.

Before we dive in, I’m excited to share something new with you all.

Introducing the Peerless Option Income Wheel ETF ($WEEL)—the first-ever ETF that provides turnkey access to the popular Option Wheel strategy.

$WEEL is an actively managed ETF designed with one clear objective: to generate current income. Through a dynamic combination of secured put writing and covered-call writing, this fund aims to deliver equity-like returns with less volatility than the major equity indexes.

Whether you’re looking to diversify your portfolio or seeking a stable income stream, $WEEL offers a unique alternative income solution tailored for today's market.

Don’t miss out on this innovative approach to income generation—check it out here!

COMMUNICATED - DISCLAIMER:

This Week’s Market Recap… 📊

Happy Thanksgiving!

I hope you had a wonderful time celebrating with family and friends. Thanksgiving is a great reminder to pause, reflect, and express gratitude for the people and opportunities in our lives.

This week has been relatively quiet, with many focused on the holiday. The markets have remained mostly unchanged since Monday, and Friday is expected to be uneventful as well.

One key economic update this week was the release of the Fed’s preferred inflation measure, PCE. The data met expectations and showed inflation at its lowest level since March 2021.

As new economic data rolls in and Fed officials continue to share their views, I’m leaning toward the Fed holding rates steady at their December meeting, a move I think is appropriate given current conditions.

Another notable development came from President-Elect Trump, who proposed new tariffs: a 25% tariff on Canadian imports and an additional 10% on Chinese imports. The markets took this news in stride, with the dollar showing strength.

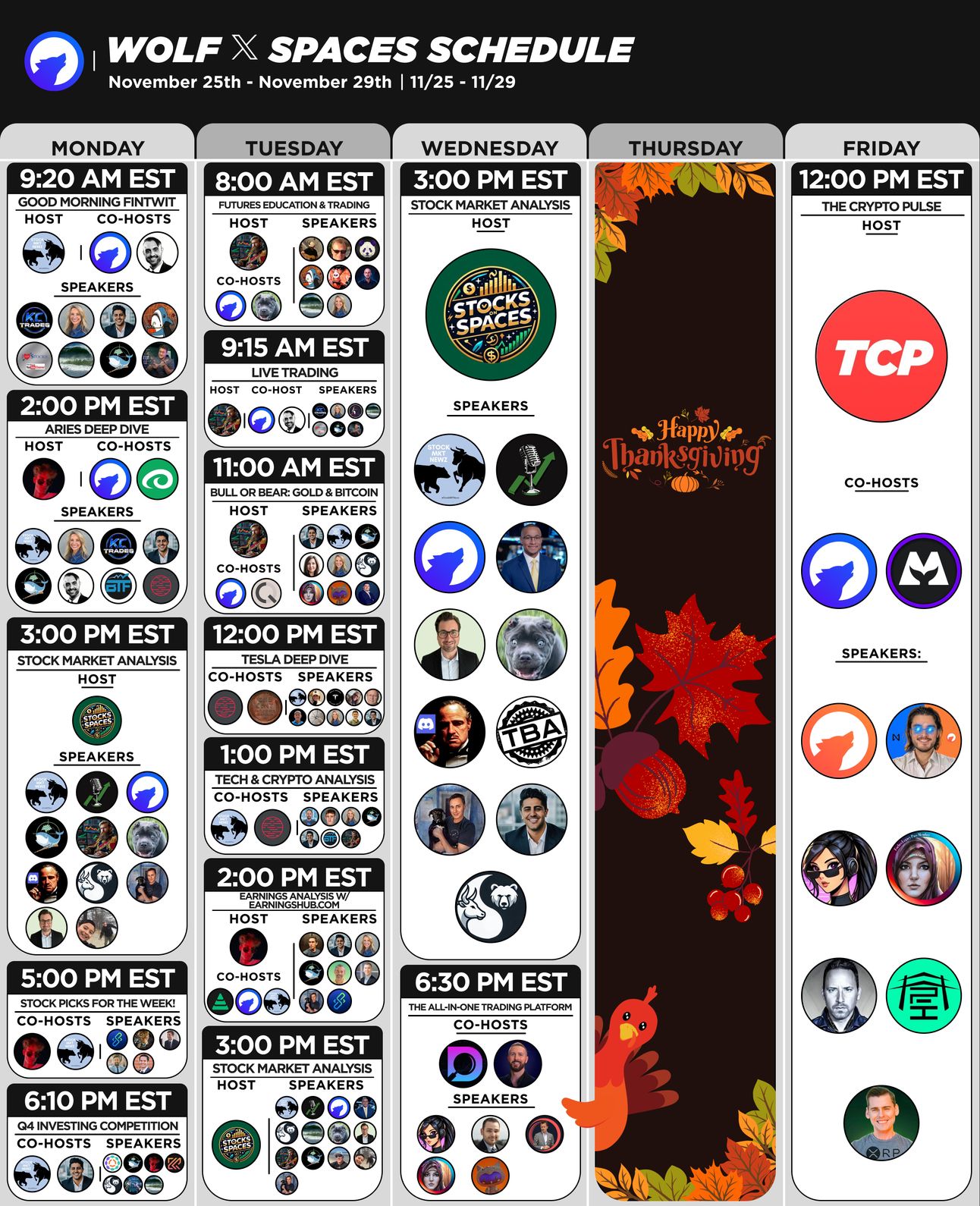

My Schedule This Week!

Have a Blessed Weekend!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.