Welcome to the WOLF Financial Newsletter.

Join over 14,000 savvy investors building wealth and mastering advanced investing strategies live on Twitter Spaces. Subscribe below to be part of the action:

WOLF Financial has driven liquidity, user growth, and brand awareness across TradFi and Crypto through marketing, advisory, and partnership services. See more Here.

🚨Top Tweet of the Week!🚨

This Week’s Market Recap… 📊

The Federal Reserve took center stage this week during its final meeting of the year, delivering a widely expected 25 basis point (0.25%) rate cut. This adjustment lowered the federal funds rate to a range of 4.25%–4.50%.

While rate cuts often boost market sentiment, this time the reaction was starkly negative. Wednesday’s sell-off was the steepest since March 2020, driven not by the rate decision itself but by the Fed’s updated Summary of Economic Projections.

The “dot plot” in this report showed a significant shift in outlook: instead of the previously expected four rate cuts in 2025, the Fed now projects only two. This caught markets off guard, leading to a broad sell-off. All major indices tumbled more than 2%, with the S&P 500 and Nasdaq each shedding over 3%, marking one of the most challenging trading days in two years.

The sharp reaction surprised me, especially since many economists and strategists had already anticipated a hawkish tone from the Fed. Yet, this didn’t soften the blow, as rates rose and equities fell.

That said, I see this pullback as potentially constructive for the market. After months of steady gains, a correction like this can recalibrate expectations and set the stage for more sustainable growth. Despite the volatility, I remain optimistic that the market will end the year higher than current levels.

As always, stay focused on your long-term goals, remain invested, and maintain a positive outlook.

Have a great weekend!

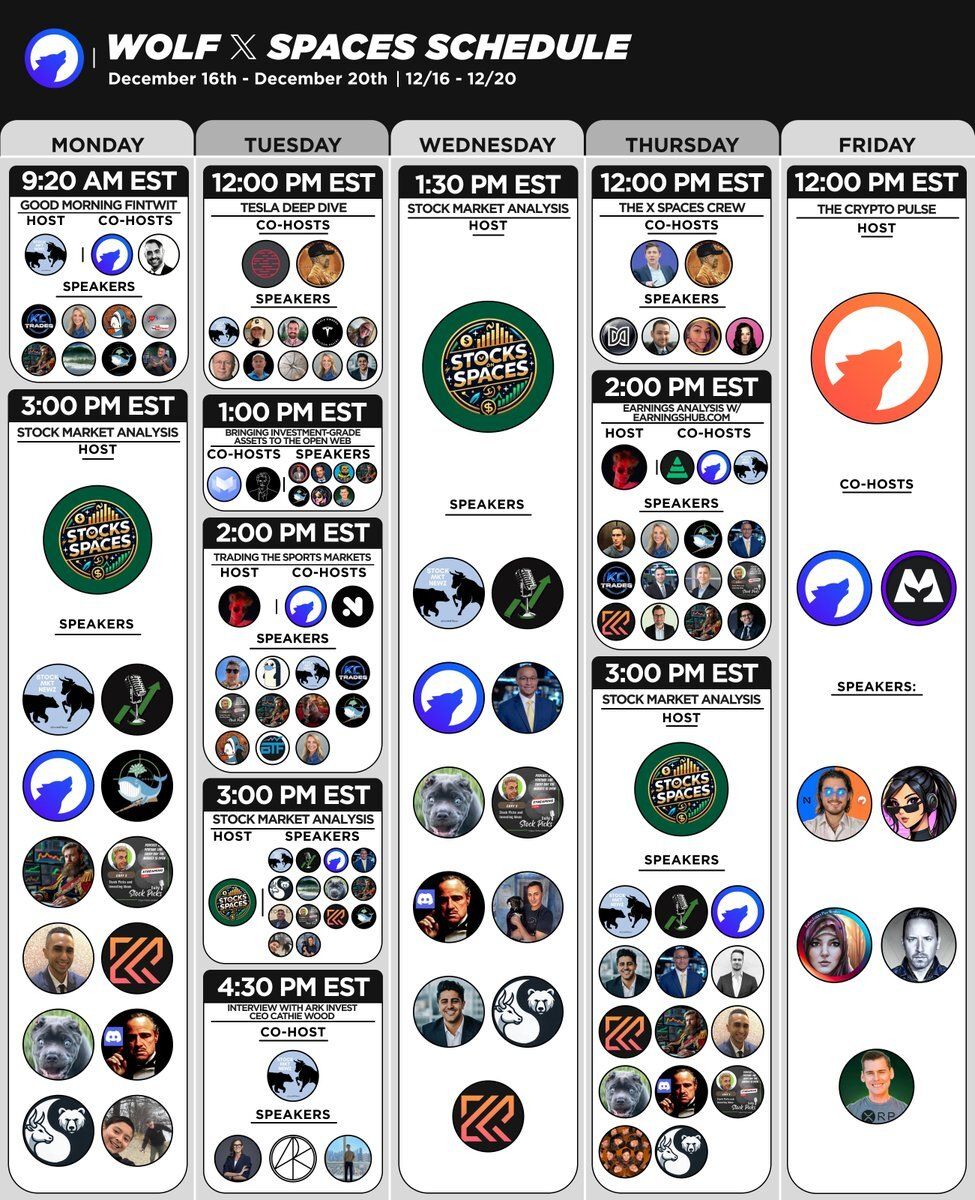

My Schedule This Week!

Have a Blessed Weekend!

Disclaimer: Wolf Financial does NOT offer financial advice. All content provided is strictly for informational purposes. Wolf Financial is not registered as an investment, legal, or tax advisor, nor as a broker/dealer. Please be aware that trading any stock or crypto-related asset carries inherent risks and may lead to substantial capital losses.